Litecoin price rises amid optimism for EFF approval.

IFF analyst James Seifert shared that Canary Capital has updated its S-1 filing for the Litecoin ETF, a move that indicates greater involvement from the US Securities and Exchange Commission (SEC).

Recent developments regarding the proposed Litecoin ETF have created optimism in the market.

Litecoin may be the next Crypto ETF to receive SEC approval.

Although Seifert stated that there are “no guarantees”, the updated filing may indicate that the SEC is beginning to closely evaluate the proposal.

“CanaryFunds filed an amended S-1 for the Litecoin ETF. There are no guarantees – but this may indicate SEC involvement on the filing. No 19b-4 filing yet. (A 19b-4 actually starts the approval/denial clock) h/t,” Seifert tweeted on Jan. 16.

For context, an S-1 filing is a critical step in the SEC approval process for any new investment product. While the amendment itself does not confirm approval, it does indicate that the SEC is paying attention to the decision.

However, as Seifert pointed out, the 19b-4 filing has not yet been filed. It is a formal requirement to list and trade an ETF on a national securities exchange.

This filing is necessary to start the official clock for the SEC's potential approval or rejection of the ETF, which means the process could still take some time.

Canary Capital filed for the Litecoin ETF in October last year, less than a month after filing for the XRP ETF.

Eric Balchunas, another Bloomberg analyst, further supported the idea that the SEC is getting involved with the Litecoin ETF filing. Balchunas cites “Chatter” and points to the SEC's feedback on the S-1, which he believes strengthens the case for Litecoin to be the next crypto to receive ETF certification.

Both Balchunas and Seifert believe approval of the Litecoin ETF is imminent. However, they caution that the appointment of a new SEC chairman is a significant variable that could affect the timetable. To date, the SEC has been cautious in approving cryptocurrency ETFs, with Bitcoin and Ethereum ETFs receiving some notable scrutiny.

At press time, LTC was trading at $119.22. The price of the crypto increased by 16.8% in the last 24 hours.

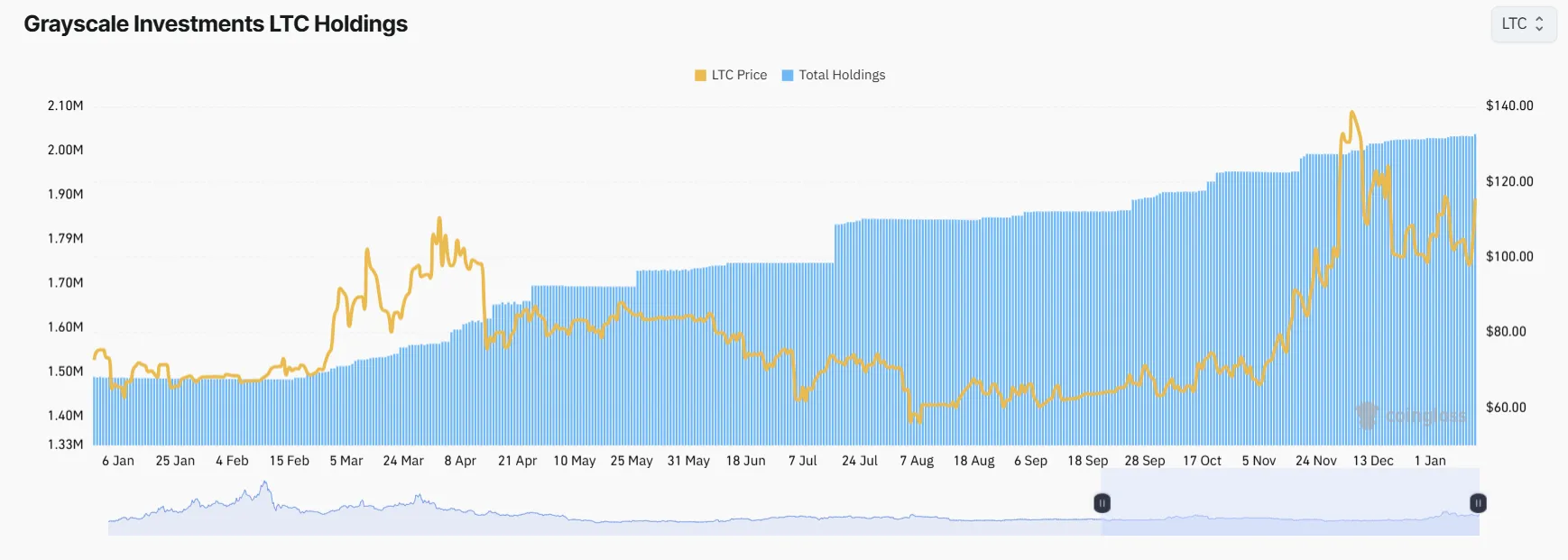

Additionally, Greyscale's Litecoin Investment Trust already offers US investors exposure to LTC through an ETP. It looks like the Greyscale Trust has quietly collected over 500,000 LTC by 2024.

Based on Coinglass data, the Trust will hold over 1.5 million LTC coins in January 2024. A year later, the giant's investment holdings had grown to over 2 million. Greyscale's move suggests the company expects strong investor interest in Litecoin.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.