Litecoin’s (LTC) make or break moment, complete insights

Ahead of the US election, volatility in the cryptocurrency landscape has increased. Meanwhile, Litecoin (LTC) has reached a make-or-break point that could lead to the loss of millions of dollars in traders' positions.

Litecoin (LTC) technical analysis and upcoming level

According to expert technical analysis, Litecoin (LTC) is trading in an upper channel pattern and is currently at the lower border, which acts as a support level. Historically, whenever the LTC price reaches this level, it experiences buying pressure and an upward rally. But this time, traders and investors are waiting for the same reverse movement.

Based on the recent price action, if LTC holds itself above the $64.5 level, there is a strong possibility that the asset can rally by 16% to reach the $77 level in the coming days.

On the other hand, some believe that LTC cannot hold this level of support due to the strong volatility in the cryptocurrency market. If this happens, the property may experience a 15% drop in price, which will reach the $55 level in the coming days.

As of now, LTC is trading below the 200 exponential moving average (EMA) on a daily time frame, indicating a bearish trend. Meanwhile, the Relative Strength Index (RSI) is currently in the oversold zone, suggesting an upside trend in the coming days.

Measurements on the chain

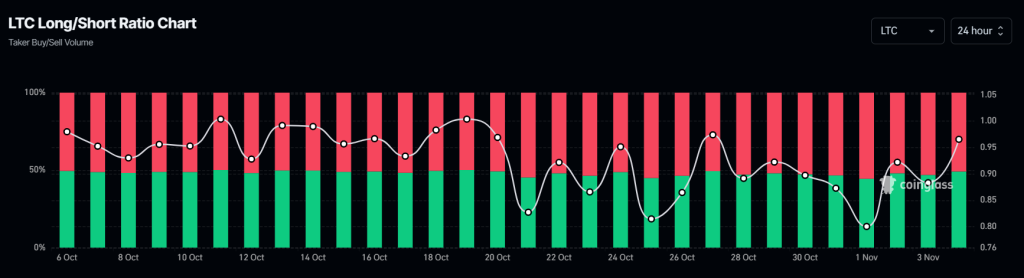

LTC's mixed feel is further supported by chain gauges. According to on-chain analytics firm Coinglass, LTC's long/short ratio currently stands at 1.001, indicating equal participation from both bulls and bears over the past 24 hours.

Additionally, open demand for LTC has remained unchanged over the past 24 hours, indicating that traders' positions are still safe as the price falls to critical levels. Currently, 50.01% of top traders hold long positions while 49.95% hold short positions.

Current price momentum

At press time, LTC is trading around $66 and has experienced a modest price increase of 0.55% in the last 24 hours. At the same time, the trading volume decreased by 10 percent, which shows that the participation of traders and investors is lower compared to the previous day.