Mantle (MNT) price hit hard after falling from all-time high TVL

Mantle (MNT), Ethereum's Layer-2 (L2) project, has recently received widespread attention.

MNT, a native cryptocurrency, has outperformed other blockchains tokens in the same category. However, this analysis focuses on recent change.

The failure of Mantle TVL activates Ripple Effects on the network

According to DeFillama, Mantle's Total Value Locked (TVL) hit an all-time high of $636.50 million on July 24. TVL, as it is commonly called, measures the value of assets locked or held in a protocol.

The higher the TVL, the more reliable the network is considered to be profitable. However, if the TVL decreases, it indicates that market participants are withdrawing the previously locked tokens.

Seven days after peaking, Mantle's TVL dropped to 589.13 million. The reduction reflects the growing underlying benefits and earnings on the credit, equity and cross-chain protocols developed under Mantle.

Read more: What is Mantle Network? Ethereum Layer 2 solution manual

The cuts also seem to have affected MNT prices. A few days ago, the price of cryptocurrency increased by double digits. But later profitability increased the turnover. Since then, MNT has struggled to recover, trading at $0.75 at press time.

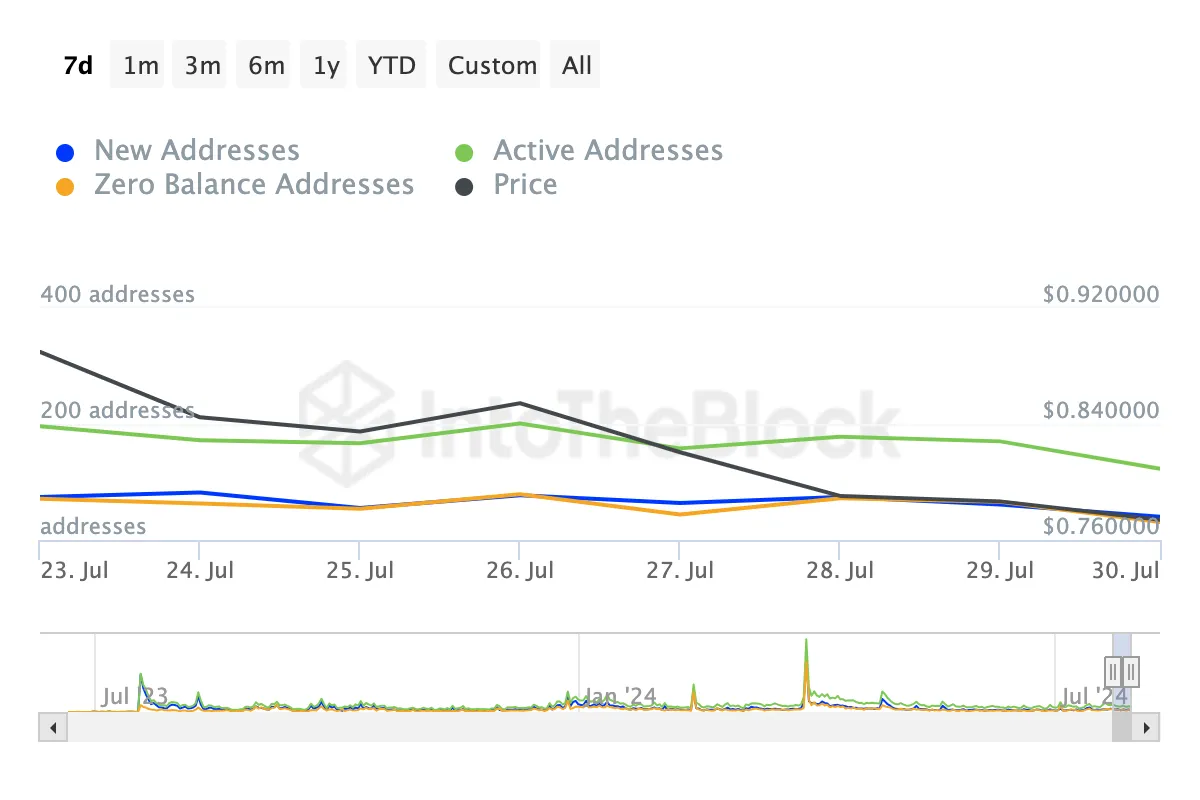

Additionally, data from IntoTheBlock indicates that Mantle Network activity has faced challenges in recovering. To gain a clear understanding of network activity, BeInCrypto analyzes the status of active and new addresses.

Simply put, active addresses estimate the number of users on the blockchain. If the number increases, it indicates that there is a lot of interaction with the native token, and this can be difficult for the price. A decline in the scale suggests otherwise.

New addresses, on the other hand, track the number of transactions for the first time on the blockchain. As a measure of traction, an increase in the number indicates an increase in adoption, while a decrease indicates a decrease in demand.

As shown above, active, new, and zero-balance addresses on Mantle have all declined in the past seven days, indicating a decrease in interactions with the MNT token. If this continues, MNT prices may find it challenging to recover from recent lows.

MNT price forecast: Downward pressure lingers

Based on the daily chart, the Moving Average Consolidation Divergence (MACD) has dropped into negative territory. MACD is a technical indicator that uses the correspondence between two exponential moving averages (EMAs) to determine momentum and price trends.

From the chart below, the 26-day EMA (orange) is above the 12-day EMA, indicating the dominance of sellers and bearish momentum. If the short EMA is above the long one, then the trend is bullish.

If the trend continues, MNT may not miss another drop and the Fibonacci retracement series will show the levels the token could reach. If the selling pressure increases, the MNT price may drop to $0.70 — where the 23.6% Fib level is located.

Read more: Layer-2 Crypto Projects for 2024: Top Picks

However, increased buying pressure coupled with increased network activity may overturn the study. If this happens, MNT could rise to $0.83 or even $0.89.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.