MasterCard boasts NFTs in CBDC pilot

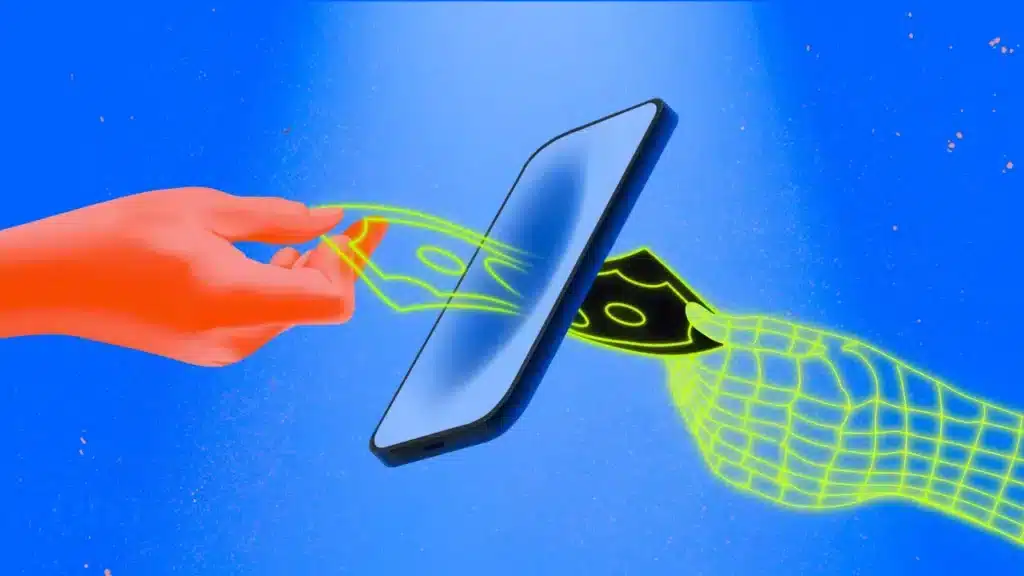

MasterCard has detailed its latest findings regarding non-perishable tokens (NFTs) following its participation in the Central Bank of Australia's digital currency (CBDC) pilot project.

“It also opens up new opportunities for collaboration between public and private networks to make a real impact in the digital currency space,” the statement said.

Mastercard's new discoveries in the CBCC pilot

In a recent statement, MasterCard said it has acquired new capabilities to promote CBDCs on various blockchains. The payment giant believes this, adding enhanced and improved security:

“It successfully demonstrated a new solution capability that allows CBCCs to be added (or “bundled”) across multiple blockchains, providing a new option for consumers to engage in transactions across multiple blockchains with greater security and ease.

Zach Burks, CEO and founder of Mintable, a participant in Mastercard's startup development program, identified a potential connection between NFTs and CBDCs with MasterCard:

“During this progressive CBDC pilot, the vast potential of NFTs was clear. With MasterCard, we have identified a use case where digital currencies and NFTs can easily connect.”

Burks said the link between the two “can prevent fraud and theft and stop the loss of documents and records.”

He further stated that NFTs are showing wider applications in society than digital currencies at this time.

“While digital currencies are still in their infancy, NFTs are being used for new media, gamification, digital identities, loyalty programs, tickets, authentication, certification and more.”

This follows BeInCrypto's recent report that Australia's CBC pilot showed CDCs should serve to complement rather than replace crypto.

The pilot explored the potential of using CBCCs to support stablecoins and settle automated transactions.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content.