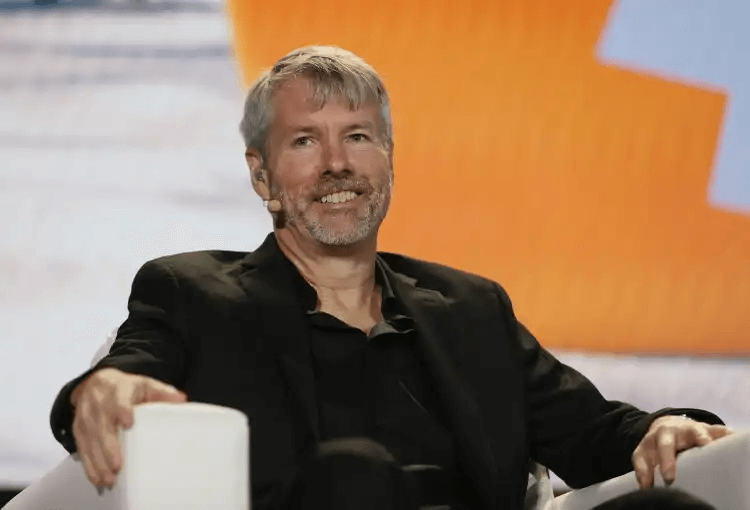

Michael Saylor announced plans to raise $21 billion from the stock sale

Michael Sayler has announced plans to raise funds to buy Bitcoin by issuing and selling $21 billion worth of MicroStrategy shares. The equity raise is part of a larger plan to raise $42 billion in Bitcoin purchases over the next three years. The equity offering on the market will reduce the capitalization of the existing shares by 42%, which is currently at 50 billion dollars.

Michael Saylor, founder and chairman of MicroStrategy, has announced plans to raise $21 billion to buy more bitcoins by offering additional MSTR shares at market value. The amount of shares issued reduces the value of the shares held by existing shareholders.

Often, this level of dilution results in a significant reduction in stock price to maintain the same total value.

However, MicroStrategy's stock price did not decline significantly after the announcement, largely due to the shareholder rally, the stock's underperformance since 202, and Bitcoin holdings.

An overview of micro strategy Bitcoin purchases

MicroStrategy began buying Bitcoin in 2020, a time when adding Bitcoin to corporate balance sheets was not as accepted as it is today. Over the past four years, the company has issued corporate debt notes to finance its Bitcoin purchases and currently holds 252,220 Bitcoin (about 1% of the total supply of Bitcoins) for $17.6 billion.

The company's most recent purchase was in September 2024, when it bought 7,420 bitcoins at an average price of $61,750 per BTC, for a total of $458.2 million, which it raised through the issuance of senior debt notes.

Despite the risks of dilution, shareholders are hopeful

Microstrategy is in a unique position because the size of Bitcoin holdings creates a correlation between Bitcoin's price performance and the stock's performance. With every major Bitcoin purchase, MSTR moves into a quasi-Bitcoin spot ETF.

However, as the total cost of MicroStrategy's bitcoin purchases hovered around $9.9 billion, the company's current holdings were 95% higher than their value, a performance that fueled the company's stock rally.

MSTR, which traded around $13 in 2020 when MicroStrategy started its Bitcoin buying strategy, is currently trading at $244.50. The stock price has risen 250% this year alone, outperforming Bitcoin's 60% performance.

Microstrategy capital plans and sales forecasts

Michelle Saylor plans to buy $42 billion worth of bitcoin over the next three years, fueled by a $21 billion increase in equity and debt notes that will triple the company's bitcoin holdings as an average purchase price.

Saylor expects Bitcoin to reach $3 million to $49 million in the next 20 years, so he's building a micro strategy into Bitcoin banking.

Bitcoin is trading at $70,105 as of press time after recently testing the $73,000 high reached in March 2024.