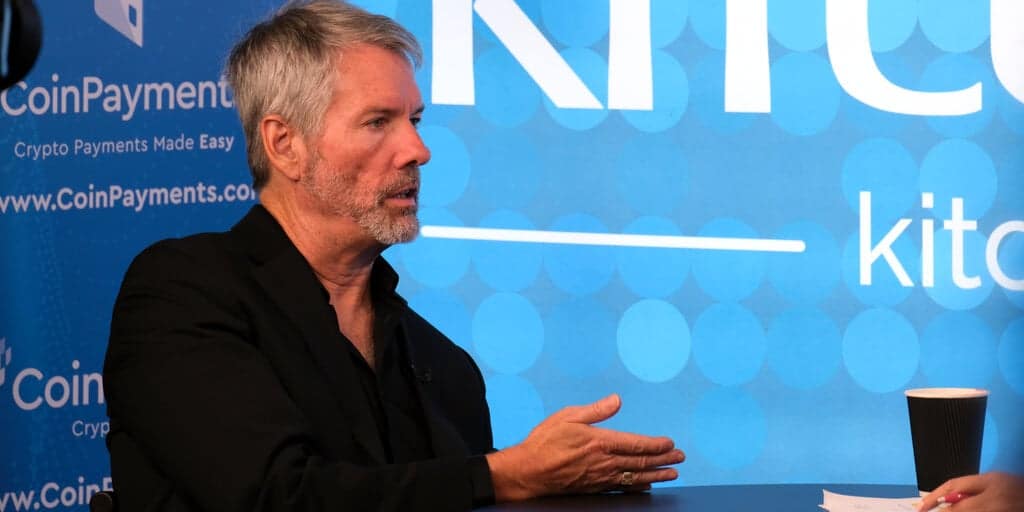

In an interview with Bloomberg Television on Tuesday, Michael Saylor, founder and chairman of MicroStrategy, said the recent approval of the Bitcoin ETF has opened the door for institutional capital to flow into the Bitcoin ecosystem, with demand outstripping current supply.

“It's a rising tide; it's going to lift all boats. MicroStrategy has an operating strategy that works for Bitcoin,” Sayler told Bloomberg's Katie Grefeld. “But if you look at what the ETFs are doing in the space, they're facilitating the digital transformation of capital. And hundreds of millions of capital are being moved every day from traditional analog practices.” – The ecosystem is flowing into the digital economy.

When the US Securities and Exchange Commission approved the Bitcoin ETF, Chairman Gary Gensler told CNBC that the approval was not a confirmation of the digital asset.

“As we like to say, we're independent,” Gensler said. “This was in no way a proof of Bitcoin — it's how you trade it in these exchange-traded products.”

A prominent owner of Bitcoin, MicroStrategy has accumulated more than 190,000 BTC, which is around $10 billion. For his part, Saylor said that he and Microstrategy have become anything but traditional when it comes to investing in Bitcoin.

“I've famously said, ‘I'll buy the top forever,'” says Saylor. “Bitcoin is an exit strategy, it's the strongest asset, so what we're seeing now is bitcoin emerging as a trillion-dollar asset class. And it's alongside names like Apple, Google and Microsoft.”

Last year, despite widening losses, Microstrategy continued to buy Bitcoin. In January, Saylor sold $216 million in private MicroStrategy stock options to buy more bitcoin.

“There's not enough room in the capital structure of those companies to hold $10 trillion or $100 trillion of capital,” Salor said. “So Bitcoin is competing with gold, which is 10x. Currently, it is competing with the S&P index, competing with the real estate $100 trillion-plus asset class as a store of value.

Calling Bitcoin technically superior to these asset classes, Saylor said he believes Capital will continue to move into Bitcoin from those asset classes.

“That being said, there is no reason to sell winners to buy losers,” Salor said.

Edited by Ryan Ozawa.

Stay on top of crypto news, get daily updates in your inbox.