Michael Saylor to present Bitcoin investment strategy to Microsoft board

Key receivers

Michael Saylor of Microsoft Board presents Bitcoin investment strategy. The board argued that Microsoft had previously evaluated various assets, including Bitcoin, and now focused on stability and risk mitigation.

Share this article

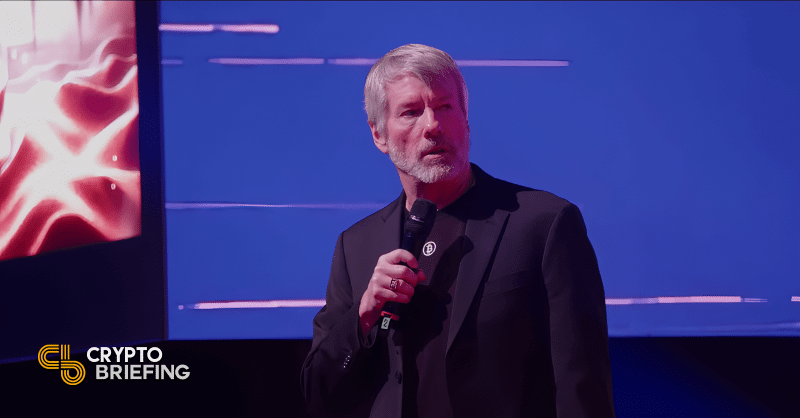

Michael Saylor shares his insights on Bitcoin investment strategies in a three-minute presentation to Microsoft's board of directors following a recommendation from the National Public Policy Research Institute (NCPPR) that Microsoft consider investing in Bitcoin.

“The activist who came up with this idea contacted me to present it to the board, and I agreed to give a three-minute presentation,” the MicroStrategy co-founder said at an XSpace event hosted by VanEck. “I present to the board of directors.”

Saylor publicly encouraged Microsoft to consider adding Bitcoin to its treasury. He believes he will get “the next trillion dollars” for Microsoft shareholders.

Companies like Berkshire Hathaway, Apple, Google and Meta (formerly Facebook) should discuss and evaluate bitcoin, Salor suggested, “because they all have huge amounts of cash and they're all burning shareholder value.”

Microsoft shareholders are scheduled to vote on a proposal to add bitcoin to its balance sheet on December 10. Major shareholders include major financial institutions such as Vanguard Group, BlackRock, State Street and Fidelity Management & Research.

Vanguard, a known crypto skeptic, has invested in MicroStrategy's stock ( MSTR ) as well as shares in other crypto firms such as Coinbase and MARA Holdings. As of September 30, Asset Management reported holding a whopping 16 million MSTR shares.

MicroStrategy's Bitcoin strategy has outperformed Microsoft stock (MSFT), leading to stock price appreciation.

According to data from Yahoo Finance, MicroStrategy stock hit a record high in late trading on Tuesday. It's up 581 percent this year, while Microsoft stock has gained about 12 percent over the same period.

NCPPR previously used MicroStrategy's Bitcoin strategy to convince Microsoft's leadership about Bitcoin buying strategies. He also pointed out that the company's stock price is higher than that of Microsoft.

Microsoft's board initially recommended a vote against the proposal, saying it would “evaluate multiple investable assets,” including bitcoin. Despite interest from certain shareholders, Microsoft's priority is artificial intelligence.

However, Ethan Peck, deputy director of the NCPPR Free Enterprise Project, warned that the review could trigger shareholder lawsuits if they decide to invest in Bitcoin and the asset's value rises over time.

Share this article