Michael Seiler shares his philosophy of Bitcoin stock

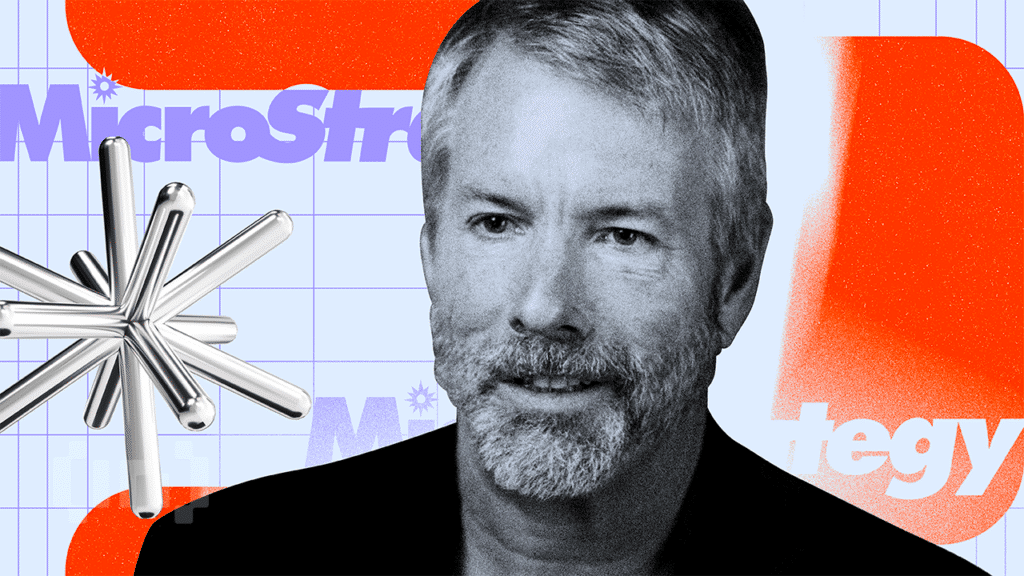

MicroStrategy Executive Chairman Michael Saylor, known for his vocal advocacy, has shared his Bitcoin (BTC) portfolio strategy for the crypto pioneer. Saylor explained the philosophy behind the company's bitcoin purchases, cementing his reputation as one of BTC's staunchest supporters.

This comment comes after Bitcoin's recent surge passed the $100,000 milestone. The 2024 trend has fueled interest in BTC as a long-term investment.

Michael Saylor shares his Bitcoin investment plan

In a recent interview, Saylor reiterated his longtime mantra, “Buy Bitcoin, Don't Sell Bitcoin.” They explained MicroStrategy's unwavering commitment to its digital assets and explained the simplicity behind their strategy.

“Every day for the last four years, I said, buy bitcoin. “I will buy bitcoins forever,” he said.

Saylor emphasized the importance of viewing Bitcoin as a long-term capital asset rather than a short-term gain. He advised investors to invest quarterly dollar cost averaging (DCA) into Bitcoin and set aside money they will not need for at least a decade.

“If you have money that you won't need for four years, or better yet ten years, you put it into a portfolio. Put some long-term savings into bitcoin and don't get too worked up about the near-term volatility,” Salor advised.

Dollar cost averaging is an investment strategy in which you invest a fixed amount at regular intervals regardless of the market's performance. This approach helps reduce the impact of volatility by spreading your investment over time. With DCA, the investor takes advantage of market volatility by spreading the risk.

For Seiler, the volatility that often stymies investors isn't a problem when bitcoin is approached with a long-term view. It works on the assumption that it will always appreciate against the dollar. Saylor also explained that MicroStrategy's large bitcoin holdings have created “a significant amount of shareholder value.”

This sentiment reflects a growing belief that Bitcoin's price trajectory is increasingly influenced by large institutional participation. Companies such as MicroStrategy and Marathon Digital (MARA) not only store Bitcoin, but also contribute to a broader storage of value and inflation prevention.

Marathon Digital joins the Bitcoin stock race

Saylor's comments come as Marathon Digital Holdings is showing confidence in Bitcoin. In the last two days alone, the Bitcoin mining company has received 2,723 BTC and spent more than 270 million dollars on the digital asset.

According to blockchain analytics firm Lookonchain, Marathon acquired 1,300 BTC worth $130.66 million on Saturday. This followed a significant purchase on Friday, when the company bought 1,423 BTC for $139.5 million. These purchases demonstrate Marathon's commitment to expanding its Bitcoin reserves, aligning with MicroStrategy's aggressive accumulation strategy.

Both companies have solidified their position as Bitcoin powerhouses. At MicroStrategy, known for its fixed deposits, it pooled the company's treasury in bitcoins. Meanwhile, Marathon's recent purchases indicate a growing trend among institutional investors to hoard the cryptocurrency as it hits new all-time highs.

Meanwhile, Saylor's confidence extends beyond the company's profits. He believes that institutional investors such as MicroStrategy and Marathon Digital will contribute to the rise in Bitcoin's value.

“You don't have to understand how we do it. Just take your bitcoins and let's raise the value,” he said.

According to BeInCrypto data, BTC is trading at $99,575, a modest gain of 1.22% over the past 24 hours.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.