MicroStrategy has announced that it has offered a $1.75 billion note to buy Bitcoin

MicroStrategy founder Michael Saylor has announced that the company will issue $1.75 billion in zero-coupon convertible notes to buy more bitcoins. Earlier today, Microstrategy bought more than $4.6 billion in BTC.

The post-Trump bull market has turbocharged MicroStrategy's bitcoin-first policy as the company makes record investments in BTC.

Micro strategy to buy more Bitcoin

According to the new announcement, the convertible senior notes will be offered as zero-coupon convertibles, meaning they pay no interest. In the year In 2029, these notes will vest in MicroStrategy's stock and be issued at a discount.

“MicroStrategy intends to use the net proceeds from this offering to acquire additional bitcoins and for general corporate purposes,” the company said in a press release.

This $1.75 billion fundraiser led to subsequent Bitcoin purchases on the same day MicroStrategy bought $4.6 billion in BTC. A week earlier, he had invested more than $2 billion in bitcoin purchases.

This unequivocally makes MicroStrategy the world's largest bitcoin holder, continuing its original Bitcoin policy.

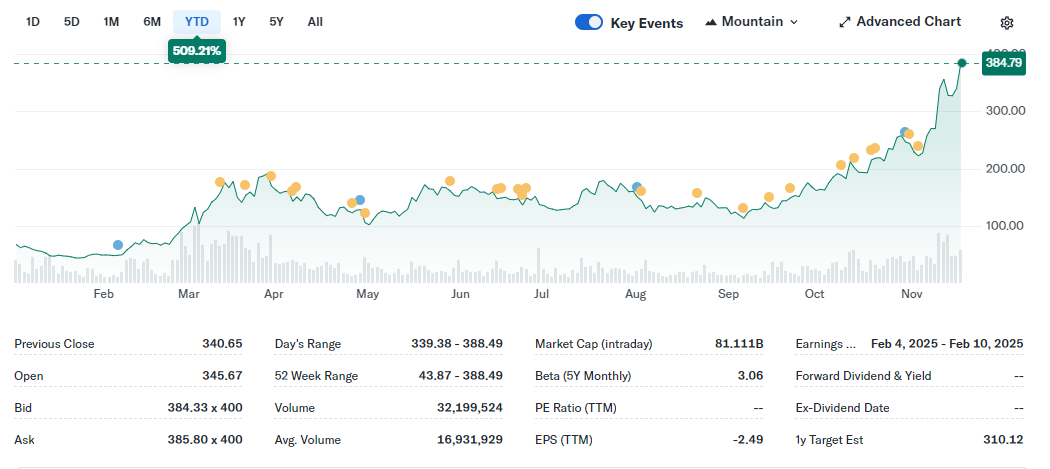

Microstrategy's stock price has ballooned since adopting this policy, surpassing Bitcoin's 24-year high in October. Shares are up more than 460% in a year and 75% this month alone.

A company's value is tied to Bitcoin's performance, but they don't always line up directly. Either way, the micro-strategy hit these highs before Trump's re-election, sending them soaring in the subsequent bull market.

Some of the exact details surrounding this personal offering were not made clear in the press release; For example, the actual terms of asset maturity and the right to redeem the MicroStrategy notes for cash.

To that end, Saylor announced a webinar on Tuesday, November 19 to discuss the offering. It is open to qualified institutional buyers to purchase the notes.

As long as the bull market continues, there is no clear limit to microstrategy's appetite for bitcoin. However, there is a limited supply of bitcoins, and ETF issuers outpace the production level of miners. These huge acquisitions aren't sustainable forever, especially with such a buyer's market, but Saylor says they can continue as long as possible.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.