Microstrategy sells $2 billion in shares for Bitcoin

MicroStrategy aims to sell up to $2 billion of Class A stock to invest in Bitcoin and other enterprise services.

The Virginia-based company announced this plan in a recent regulatory filing with the US Securities and Exchange Commission (SEC).

Micro Strategy Eyes Buy $2 Billion Bitcoin

According to Amol, MicroStrategy, widely recognized in the digital assets industry by Michael Saylor's unshakable faith in Bitcoin, plans to increase its cryptocurrency holdings. However, it does not specify a time limit for stock sales. The exact portion of revenue allocated to Bitcoin purchases is also not mentioned.

This announcement coincides with MicroStrategy's announcement of its second quarter financial results. The report shows an estimated $13.77 billion in quarterly losses driven by corrupt payments on Bitcoin holdings.

During the second quarter of 2024, MicroStrategy acquired 12,222 bitcoins, spending more than $805 million at an average of $65,880 per coin. This purchase increased the company's total BTC holdings to 226,500, cementing its position as the public company with the largest BTC reserves.

Commenting on the second quarter results, the company's president, Fong Le, stated that the market value of the company's holdings rose by 70% and described their Bitcoin strategy as “successful”.

“After another successful quarter for our bitcoin strategy, MicroStrategy today holds 226,500 bitcoins, which is 70% higher than our current market value,” Le said.

Read more: Who will have the most Bitcoins in 2024?

Despite the bold statements from MicroStrategy Management, broad market sentiment is negative. The US government started the bullish trend by announcing the sale of $2 billion of its BTC holdings, followed by the Fed rate cut decision on July 31st and a weak US jobs report on August 2nd.

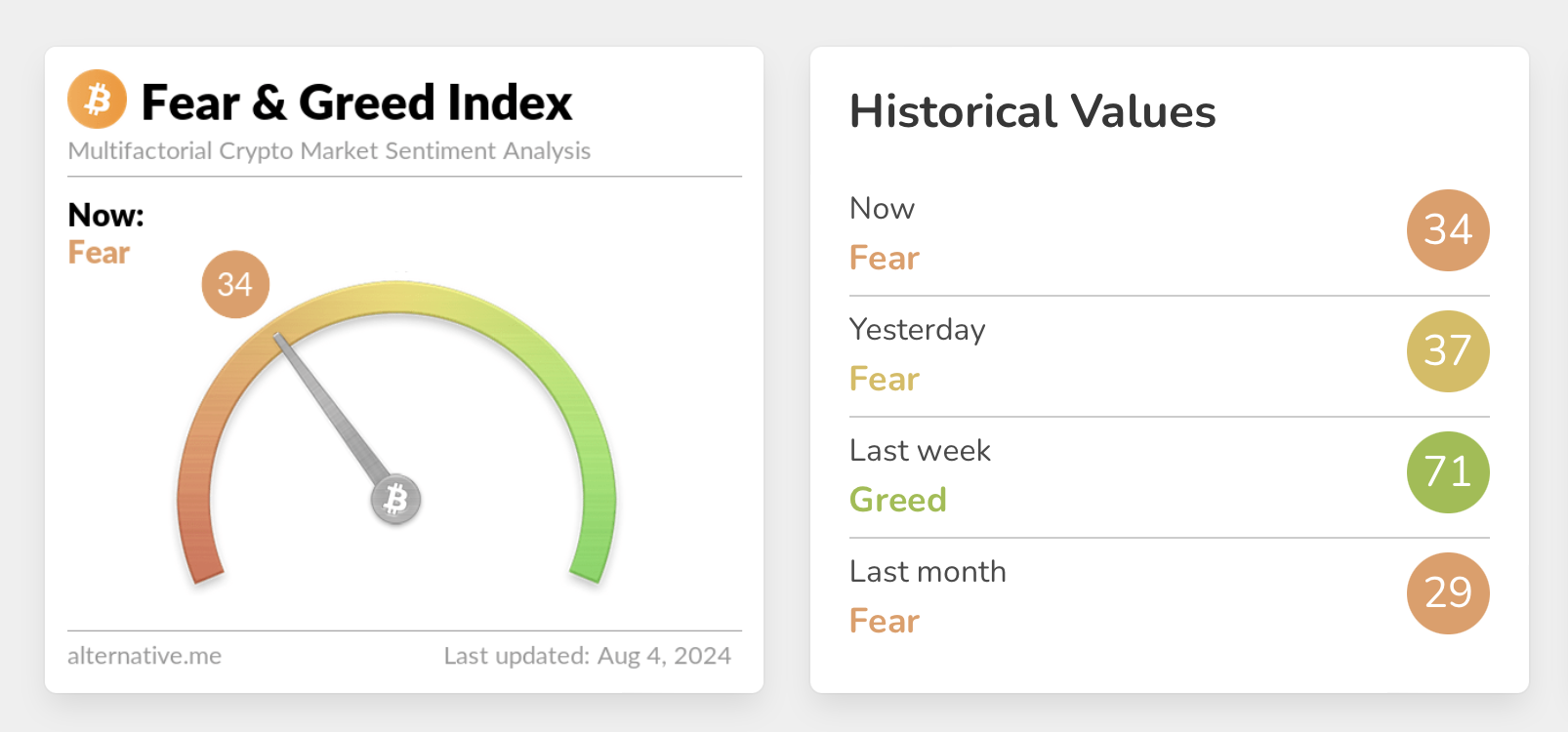

Contributing to the bearish momentum, Genesis Trading transferred more than $1.5 billion in Bitcoin and Ethereum. As a result, the price of Bitcoin fell below $61,000, and the fear and greed index dropped into the fear zone.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Despite these ups and downs, industry leaders' long-term outlook on Bitcoin is optimistic. Jan van Eck, CEO of VanEck, predicts that Bitcoin will eventually match half of gold's market capitalization. This estimate would make Bitcoin worth approximately $350,000.

“To me, there is no doubt that Bitcoin is taking over gold in some way. It's clear,” said Jan van Eyck.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.