Microstrategy shareholders will vote on proposals to increase the supply of shares for Bitcoin Strategy

Key receivers

MicroStrategy shareholders will vote to increase their authorized common stock to 10.3 billion shares. The vote also concerns the company's equity incentive plan and changes to the Board of Directors' procedures.

Share this article

MicroStrategy's shareholders will vote on key proposals to increase authorized shares and amend the equity incentive plan—a strategic move to support the company's bitcoin strategy.

Michael Saylor, founder and executive chairman of MicroStrategy, said: “As a Bitcoin treasury company, the ideas we ask you to consider reflect a new chapter in our evolution and our future ambitions.

The vote will be held at the 2025 special meeting. The exact date will be revealed later, according to a recent filing with the SEC.

The meeting, which will be webcast, will allow shareholders of record to vote on four proposals in 2025, including increasing the number of shares of common stock from 330 million to 10.3 billion shares and increasing the number of shares of preferred stock to 1 billion shares. 5 million.

The proposed expansion aims to support the '21/21′ plan, which involves raising $42 billion in future Bitcoin purchases over three years. Sayler said last week that the company will reevaluate its capital allocation strategy after its $42 billion target is completed.

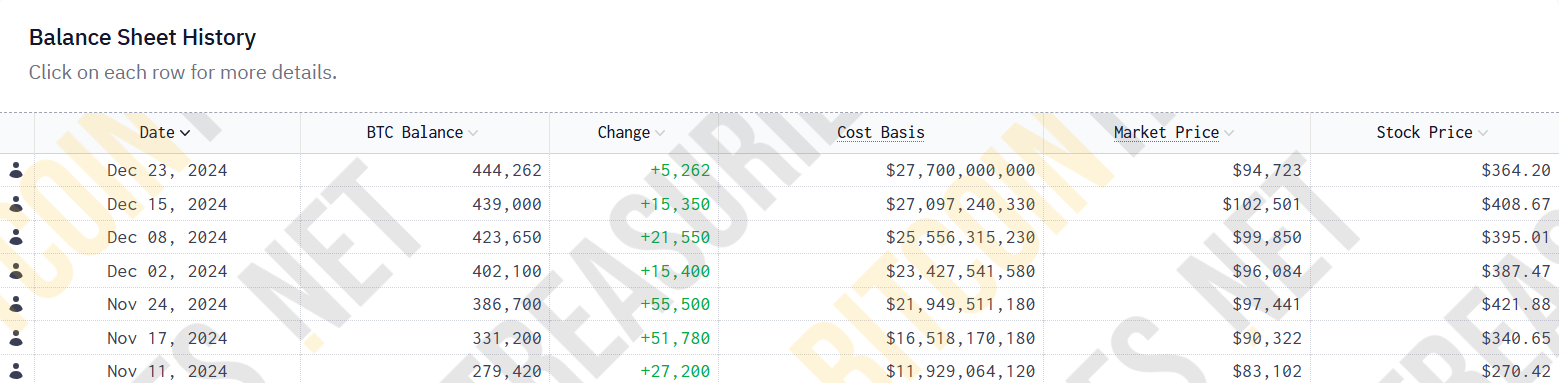

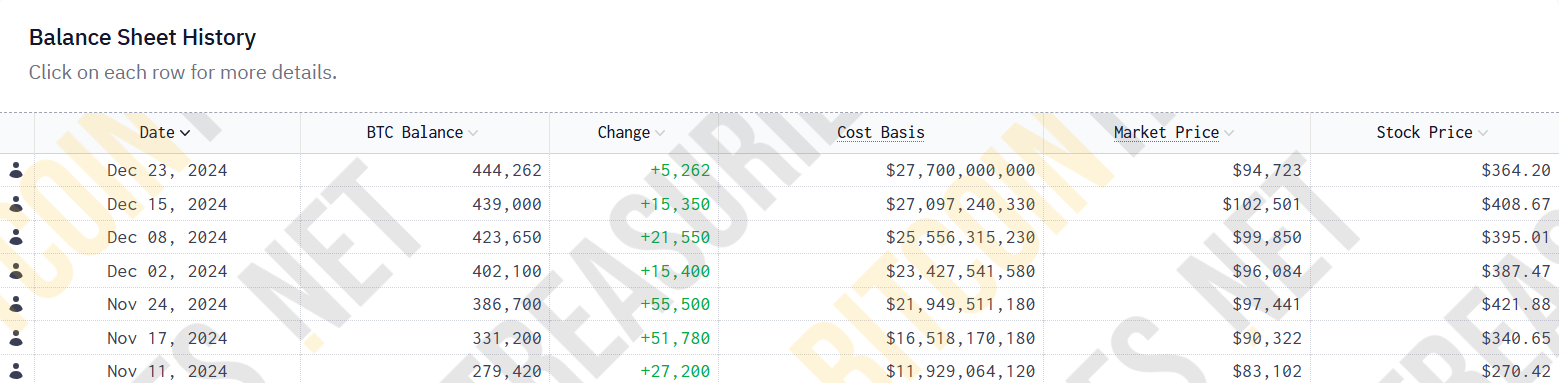

Since announcing the plan, Microstrategy has acquired about 192,042 BTC worth around $18 billion. This means that in less than two months, it has achieved about 42% of the planned investment goal.

The Virginia-based company is seeking shareholder approval to amend its current equity incentive plan. If approved, the amendment would grant equity awards to three newly appointed directors—Brian Brooks, Jane Dietz and Greg Winiarski—upon their initial appointment to the board.

This proposal reflects the company's strategy to attract and retain qualified directors while continuing to focus on its Bitcoin acquisition strategy.

If shareholders do not have enough votes to approve any proposal, they decide on a procedural step that allows for an additional vote solicitation.

Microstrategy proposals were implemented on December 23 after being incorporated into the Nasdaq-100 index. The move is expected to increase purchases from index-tracking funds, such as the popular Invesco QQQ Trust, investors said.

Share this article