Microstrategy’s Bitcoin portfolio has exceeded $20 billion

In recent days, Bitcoin has hit a new all-time high of nearly $81,800. This increase is close to the $82,000 milestone.

As a result, MicroStrategy's Bitcoin portfolio grew to $20.6 billion. Saylor Tracker, an independent website, tracks this review in real time.

MicroStrategy's Bitcoin portfolio has over $10 billion in leverage.

Microstrategy, known for its significant Bitcoin investments, now holds over 252,220 BTC in its portfolio. The latest purchase, disclosed in a September 20 SEC filing, involved the purchase of 7,420 BTC. These accumulated payments of an average of $61,750 in Bitcoin, worth nearly $458.2 million.

As a result, the company's unrealized profit grew to more than $10.6 billion, indicating a 107 percent increase in portfolio value.

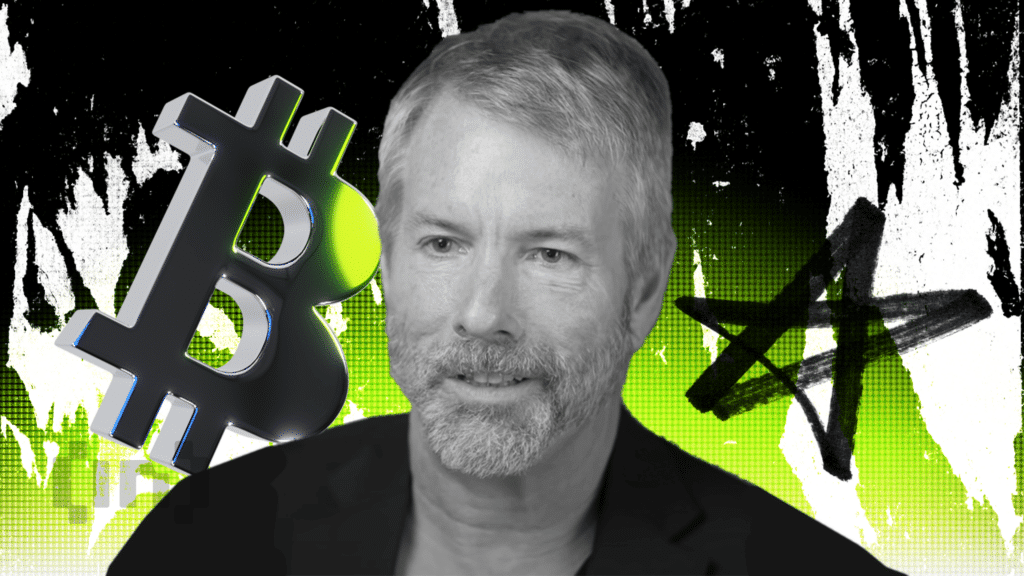

The company's vision extends beyond its current holdings. That's because MicroStrategy founder Michael Saylor recently hinted at further expansions in a post on X (formerly Twitter).

“I think saylortracker.com needs more green dots,” Saylor said.

Moreover, MicroStrategy announced a bold financial strategy in its Q3 earnings report. The firm unveiled a $42 billion capital raising initiative dubbed the “21/21 Plan.”

CEO Michael Saylor and CEO Fong Le aim to secure significant Bitcoin reserves. They plan to raise $21 billion in equity and $21 billion in fixed income securities over three years.

In describing the plan, Saylor emphasized its potential to transform corporate treasury strategies. He called Bitcoin “digital capital”.

This strategic direction highlights MicroStrategy's role as a pioneer in positioning Bitcoin within corporate financial strategies. Such activities have raised the stock to the highest levels in 24 years.

The company's aggressive stance on Bitcoin purchases has attracted widespread attention. For example, Saylor set a $13 million Bitcoin price target in a September CNBC interview. Although critics such as economist Peter Schiff dismiss these predictions as unrealistic, Saylor's optimism resonates with Bitcoin supporters.

A microstrategy approach could set a new standard for corporate investment in digital assets. Each purchase strengthens the presence of Bitcoin in international markets. It points to a future where digital assets are as fundamental as traditional assets in corporate and personal investment portfolios.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.