MicroStrategy’s stock hit a 25-year high of $245 ahead of its Q3 earnings report

Key receivers

MicroStrategy's stock hit a 25-year high of $245 ahead of its Q3 earnings report. The MSTR/BTC ratio hit a record high, reflecting a strong performance against Bitcoin.

Share this article

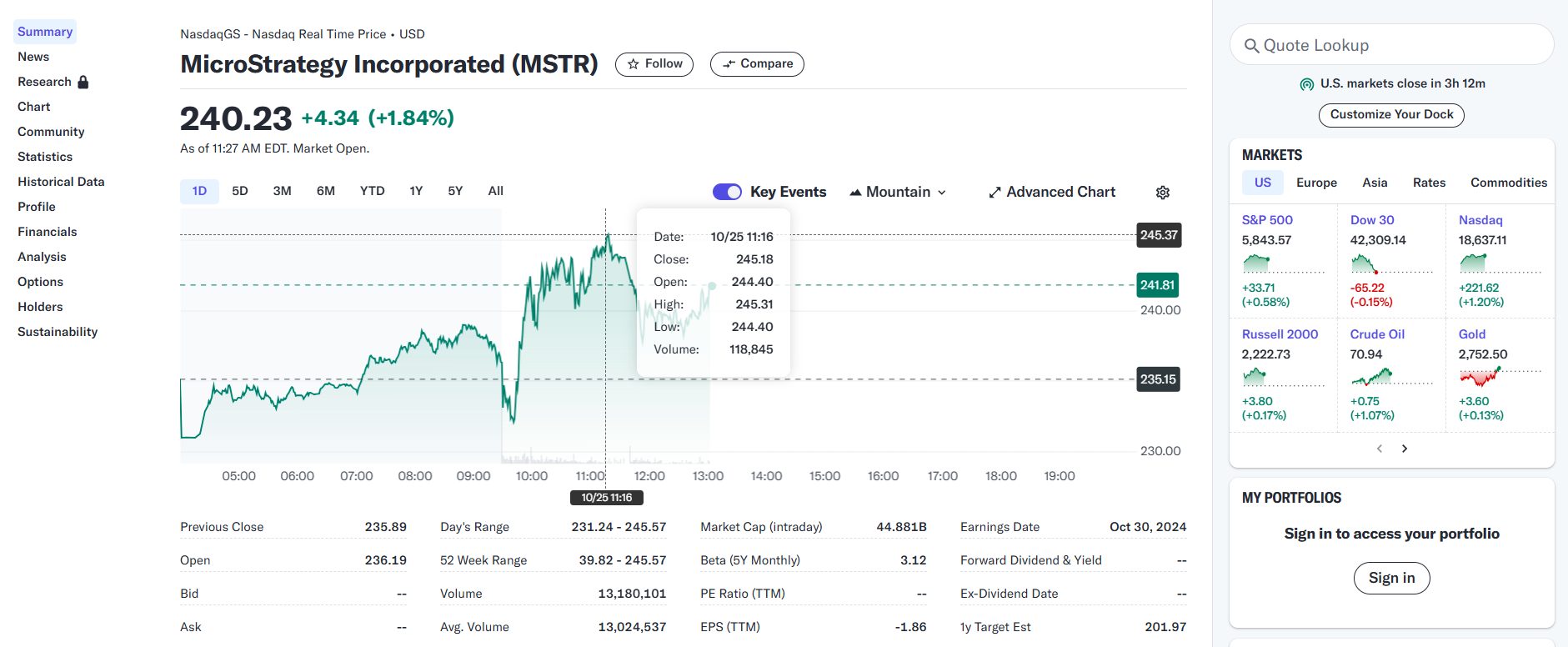

Shares of MicroStrategy ( MSTR ) rose after U.S. markets opened Friday, rising from $235 to $245. The jump comes ahead of the company's third quarter earnings report due next Wednesday.

At the time of the report, MSTR had cooled to around $242, but still outperformed the S&P 500. The data shows that MicroStrategy's stock is up 286%, while the S&P 500 is up 37% during the stretch.

Over the past five years, MicroStrategy has posted an impressive 1,588% share price increase, outperforming the S&P 500's return of 94.18%.

Microstrategy stocks tend to work with the broader crypto market, particularly Bitcoin, due to the company's proximity to the largest crypto asset.

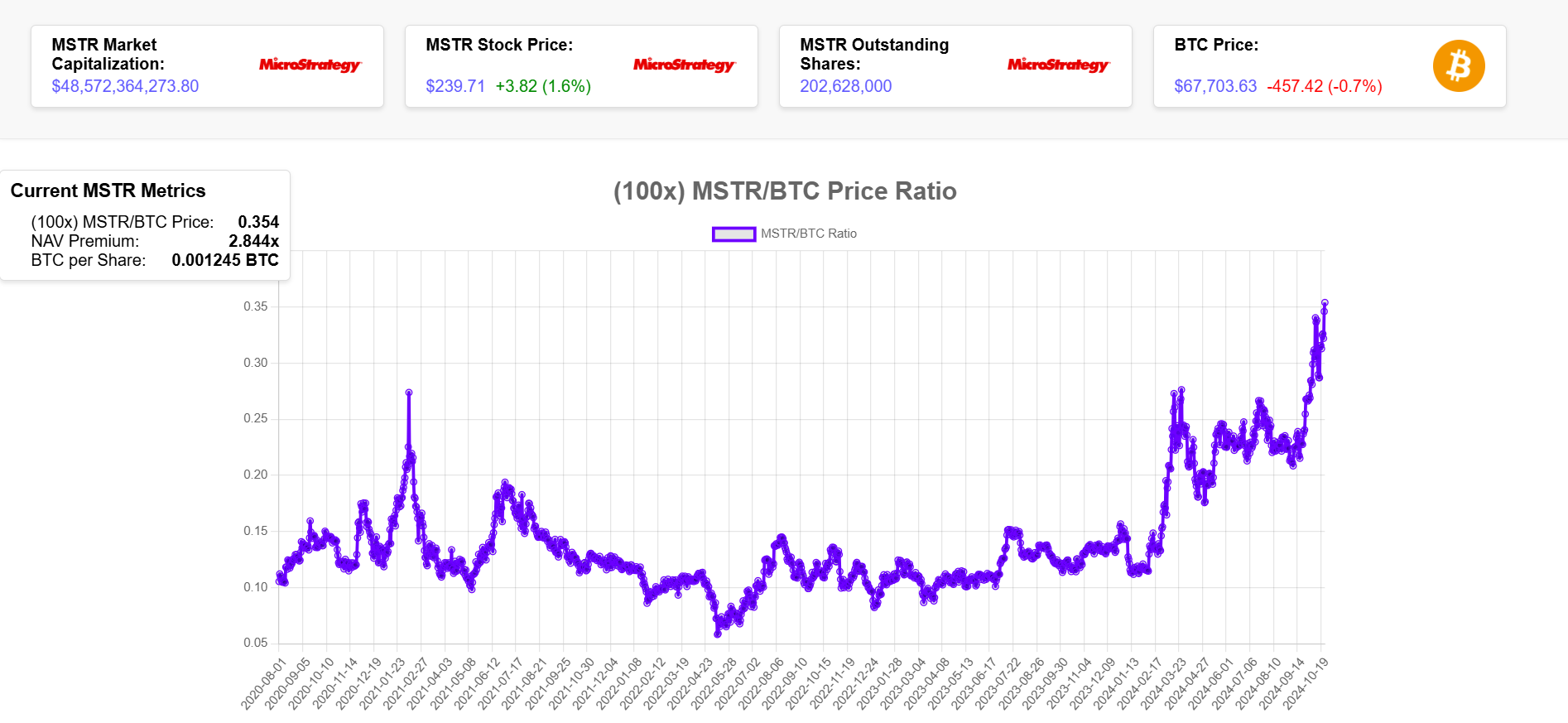

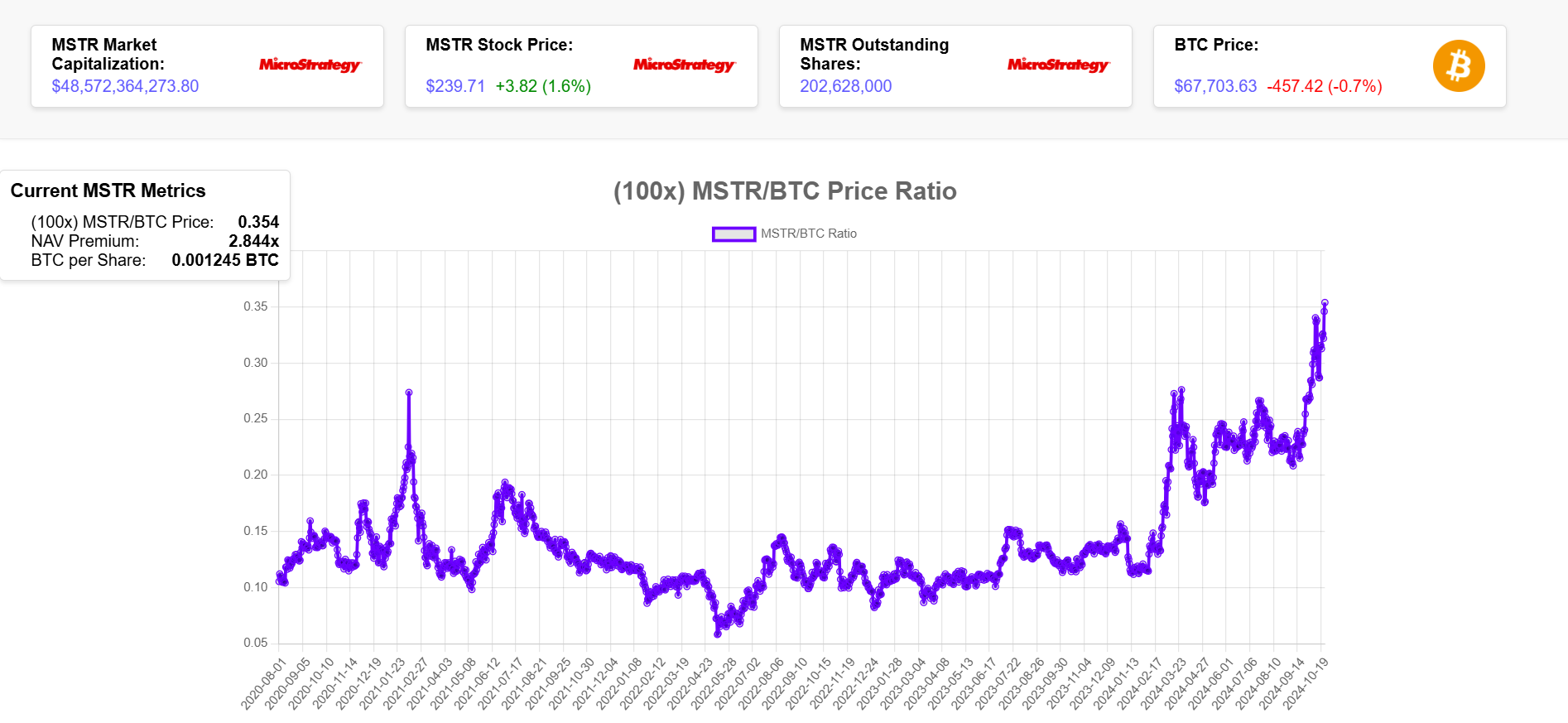

According to the MSTR tracker, the MSTR/BTC ratio, which provides insights into how MicroStrategy's stock price is performing in relation to bitcoin market movements, reached an all-time high of 0.354. This indicates that the stock has performed well relative to Bitcoin.

The company's net asset value (NAV) has seen growth, with the NAV premium approaching 3, the highest since early 2021.

According to CoinGecko, Bitcoin is nearing the $69,000 level after rallying above $68,000 early Friday. It has since corrected below $68,000, but still outperforms the broader market.

MSTR is 23% away from its previous all-time high of $313 in March 2020. The market cap now sits at around $44 billion. If the MicroStrategy Bitcoin Playbook is successful, the stock price could reach new highs in the future.

Since adopting the strategy, MicroStrategy has seen its stock outperform Bitcoin itself. BTC is the world's largest corporate holder, currently owning more than 252,000 BTC, worth an estimated $17 billion at current prices.

The company has no intention of selling its Bitcoin holdings. Instead, he plans to raise more coins using a variety of funding methods.

As the company's bitcoin reserves grow over time, so does demand. MicroStrategy CEO Michael Saylor has a vision for the company to become the leading Bitcoin bank with trillion-dollar strategic US capital markets activities.

Share this article