Mixed signals make traders uncertain.

The price of Tron (TRX) is showing mixed signals, leaving traders unsure about its next move. Recent indicators suggest a balance between leverage and countervailing forces, with no clear direction yet emerging.

Since the market is closely tied to future movements, TRX can either rise or fall.

TRX Aaron indicator shows mixed signals

The Aroon Tron indicator currently shows an Aroon Up value of 64.29% and an Aroon Down value of 7.14%. These numbers show that TRX has experienced recent highs, but the upward trend is not particularly strong, with a lack of recent lows indicating lower bearish pressure.

The Aaron's indicator is a tool used to measure the strength of a trend by measuring the time between a high (Aron's Up) and a low (Aron's Down) over a period of time. When Aroon Up is above 70%, it shows a strong improvement. On the other hand, an Aaron Down above 70% indicates a strong downtrend.

Conversely, values below 30% indicate a weakening of the respective trend. In the case of TRX, the current values of Aron indicate some positive momentum but not a dominant trend.

Read More: TRON (TRX) Price Prediction 2024/2025/2030

Moreover, Aroon's frequent swings between high and low values reflect an inconsistent trend, as TRX has been switching between up and down movements without a clear direction.

This rapid change between Aaron's Up and Aaron's Down shows the volatility in the market. Neither buyers nor sellers were in control for long.

Tron RSI is close to the overbought level.

TRX's current RSI is 61.45, which is above the midpoint of 50, but shows that it is not yet in overbought territory, which normally starts at 70.

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and volatility of price movements. It ranges from 0 to 100 and helps traders identify overbought or oversold conditions in an asset. When the RSI rises above 70, it indicates that the asset may be overbought. This usually leads to a potential price reversal or correction.

While TRX's RSI is not yet in overbought territory, the sideways price movement indicates indecisiveness in the market. If the RSI continues to rise and touches the overbought threshold, it may trigger a correction.

This situation makes it critical to closely monitor TRX for signs of upward pressure pushing the RSI towards 70, as such a move could result in a near-term price decline.

TRX Price Prediction: Can Cardano Overtake Tron?

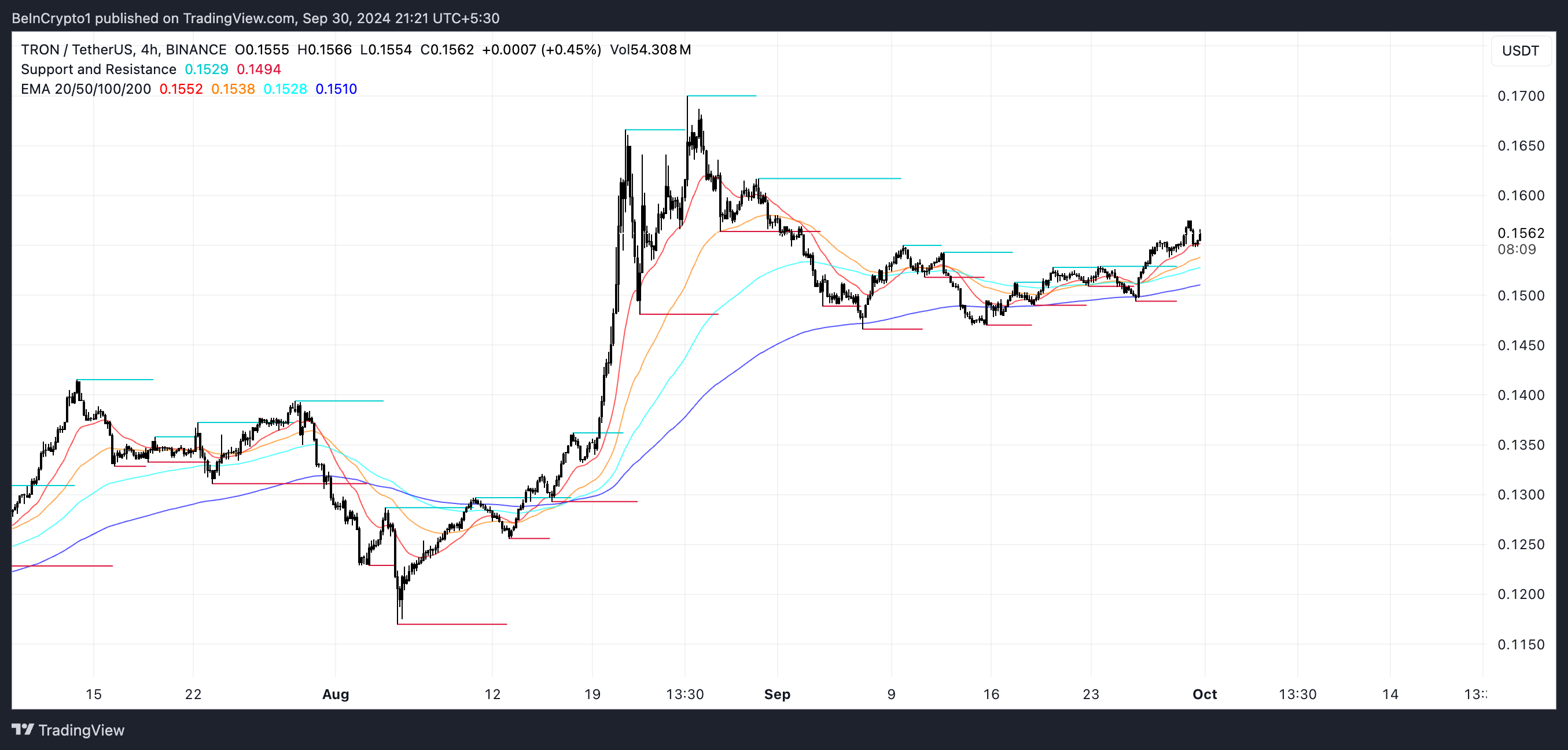

The market gap between Cardano (ADA) and Tron (TRX) is $280 million, with TRX showing signs of slowing down after the initial excitement from SunPump. Although the EMAs for TRX still indicate bearish sentiment, the narrow gap between them suggests that the strength of this trend may not be as strong as it initially appeared.

EMA lines, or exponential moving averages, are key tools in technical analysis. They are designed to smooth out price volatility and assign more weight to recent price action. When the short-term EMAs lag above the long-term, it indicates that the asset is in a bullish trend, reflecting constant upward momentum.

However, when the distance between these lines is small, like TRX, the strength of the trend is questioned. This indicates that it may not have the energy to sustain further significant upward moves.

If the uptrend continues, TRX could push to the next resistance levels at $0.1617 and $0.17, roughly 10% from current levels. These price points are critical.

Read more: 7 Best Tron Bags to Store TRX

That could be fueled by news like Justin Sun introducing new features like Tron-based NFT platform. However, a narrow EMA gap raises the risk that the trend may lose momentum, and if this happens, TRX may face a reversal. In such a case, the asset may face a decline when it has support levels around $0.1295 and $0.1170.

Falling to these levels is significant as it threatens TRX's position among the top 10 coins by market capitalization. In such a case, ADA may outperform TRX.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.