MKR price rises after Greyscale’s Bold MakerDAO bet.

The price of Maker (MKR), the governing token of the MakerDAO protocol, has increased by 7.47% in the last 24 hours. This increase comes after Grayscale announced the launch of the MakerDAO Investment Trust on Tuesday.

Following the announcement, the manufacturer is experiencing other positive changes, which this analysis will discuss.

New investment vehicle sparks frenzy for MakerDAO.

In the year On August 13, leading crypto asset manager Grayscale announced the launch of MakerDAO Trust. This launch is the second in a series in a few days after investing in two other altcoins last week.

According to the firm, the trust provides investors with exposure to MKR. Additionally, investors can access the on-chain lending protocol and real-world assets (RWAs) that the MakerDAO ecosystem provides.

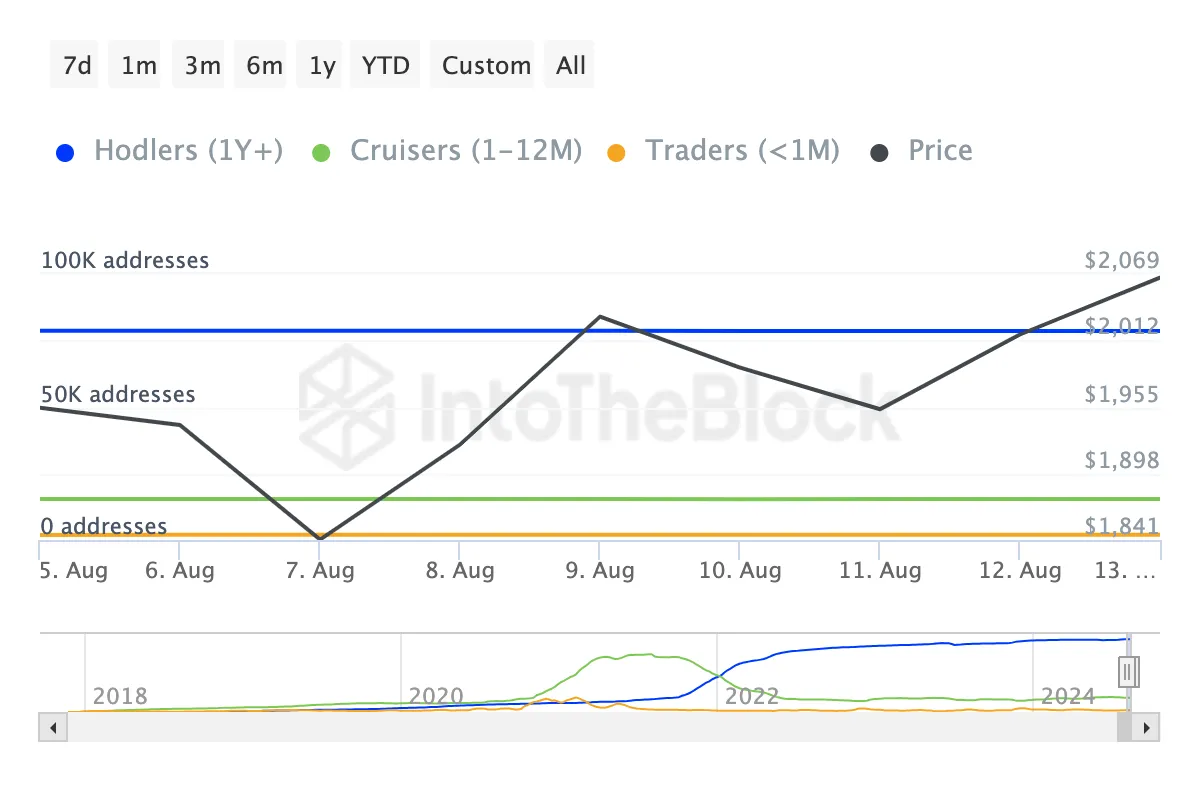

However, the MKR price is not the only metric affected by the development. On-chain data shows a significant increase in active addresses on the network.

Read more: What are Tokenized Real-World Assets (RWA)?

Active addresses measure the level of user engagement on the blockchain. If the scale increases, users will participate in sending and receiving tokens on the network. However, the decline indicates a lack of buying and selling among cryptocurrency holders.

Therefore, it appears that MKR's price increase is not only related to grayscale investment, but also to broader market demand. If it continues or improves, the price of MKR could benefit as the hike continues.

Beyond that, data from IntoTheBlock shows an increase in the number of short-term holders. Specifically, the timed view by addresses shows a double-digit increase in the number of addresses that have purchased tokens in the last 30 days.

Typically, an increase in accumulation during this period indicates confidence in the short-term potential of the cryptocurrency. But shrinking suggests the opposite.

Therefore, an increase also represents an increase in buying pressure. As with the effect of active addresses above, an increase in this figure could be difficult for MKR.

MKR Price Prediction: $2,500 likely next.

Before the MKR price recently rose to $2,127, the token experienced a 38% decline, dropping to $1,716. According to the Relative Strength Index (RSI), at that time, MKR was oversold.

RSI measures momentum using the speed and magnitude of price changes. A reading of 70.00 and above means that the asset is overbought, while an RSI reading of 30.00 or below indicates that it is oversold.

On August 7, the indicator level was 26.33. But the rise to 44.07 at the press conference suggests that buyers will rally back. If this continues, the price may rise. To confirm a bullish bias, the RSI should cross the neutral line at 50.00.

Once this happens, MKR can break through resistance at $2,184.82. If this happens, the next level the token will reach could be between $2,354.73 and $2,537.86.

Read More: Maker (MKR) Price Forecast 2023/2025/2030

However, if activity on the MakerDAO network slows down, a loss of value may occur. It could happen if bulls pull back from buying the MKR dip. If this is the case, the price may return to $1991.46.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.