PENDLE Aims for 25% Rally, Despite Arthur Hayes Sales of $1.26M

After 350,010 Pendle (PENDLE) tokens worth $1.26 million were sold on Binance and Bybit, a post by former BitMEX CEO and co-founder Arthur Hayes on X (formerly Twitter) gained widespread attention. On September 21, 2024, Hayes Maelstrom (a Hayes Family Office Fund) posted that it had reduced its holdings in PENDLE. Despite the token decline, PENDLE remains one of the largest holdings.

ARTHUR HAYES PENDLE HOLDING

According to data from on-chain analytics firm Spotonchain, Arthur Hayes currently holds a whopping 1.66 million PENDLE tokens, worth $5.93 million. In the post, Hayes emphasized that he still fully believes that PENDLE will be the leader in crypto interest rate derivatives.

Additionally, he said, “We have reduced our ability to fund emergencies. People who follow our wallet will get a hint of what's coming soon.

Current price momentum

As of now, PENDLE is trading around $3.53 and has experienced a price drop of over 2% in the last 24 hours. However, it seems that the interest of traders and investors in the tokens has decreased significantly, resulting in a decrease of more than 45% in trading volume during the same period.

PENDLE technical analysis and upcoming levels

According to expert technical analysis, PENDLE is on the verge of breaking out of the strong resistance level of $3.70 and the 200 Exponential Moving Average (EMA) in the daily time frame. If it breaks this 200 EMA and closes the candle above the $3.70 level, there is a strong chance of a 25% rally to the $4.80 level in the coming days.

However, this bullish thesis will only hold if the PENDLE daily candle closes above $3.70, otherwise it may fail.

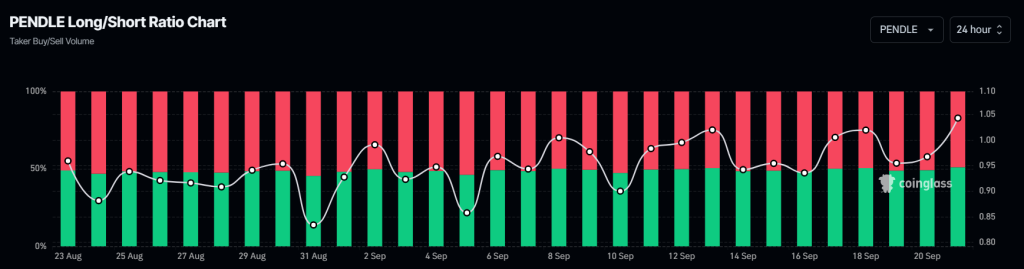

Bullish gauges on the chain

In addition to this bullish technical analysis, PENDLE's benchmark on the chain further supports its positive outlook. Coinglass PENDLE's long/short ratio is currently at 1.042, the highest since August 20, 2024, (a value greater than 1 indicates market sentiment among traders). Additionally, futures open demand increased by 4.5% in the last 24 hours and 3.5% in the last four hours, indicating that more long positions have accumulated.

Often, traders and investors increase open interest and the long/short ratio by more than 1 when building long positions. Currently, 51.01% of top traders and investors hold long positions while 48.99% hold short positions.