Polymarket traders play a big part in the market dynamics

Polymarket is registering high activity as traders are increasingly looking for current market conditions. Participants gamble thousands of dollars in a daring attempt to predict the market.

While platform neutrality is questionable, especially in terms of market sentiment, its role in driving crypto adoption cannot be ignored.

Polymarket Traders Big

According to Dune's analysis, Polymarket showed a significant increase in daily volume and active traders when participants tried to predict market results. These metrics have been steadily increasing since May.

Narratives like America's Choice continue to drive this demand. However, the recent collapse of the crypto market has contributed to the increase in activity. Different dashboards on Polymarket show participants betting on multiple questions.

Among them, the price of Bitcoin (BTC) dropped below $45,000 before September and Ethereum (ETH) recovered above $3,000 on August 9. According to data from BeInCrypto, at press time, BTC is trading at $53,625, while ETH remains below $2,400.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

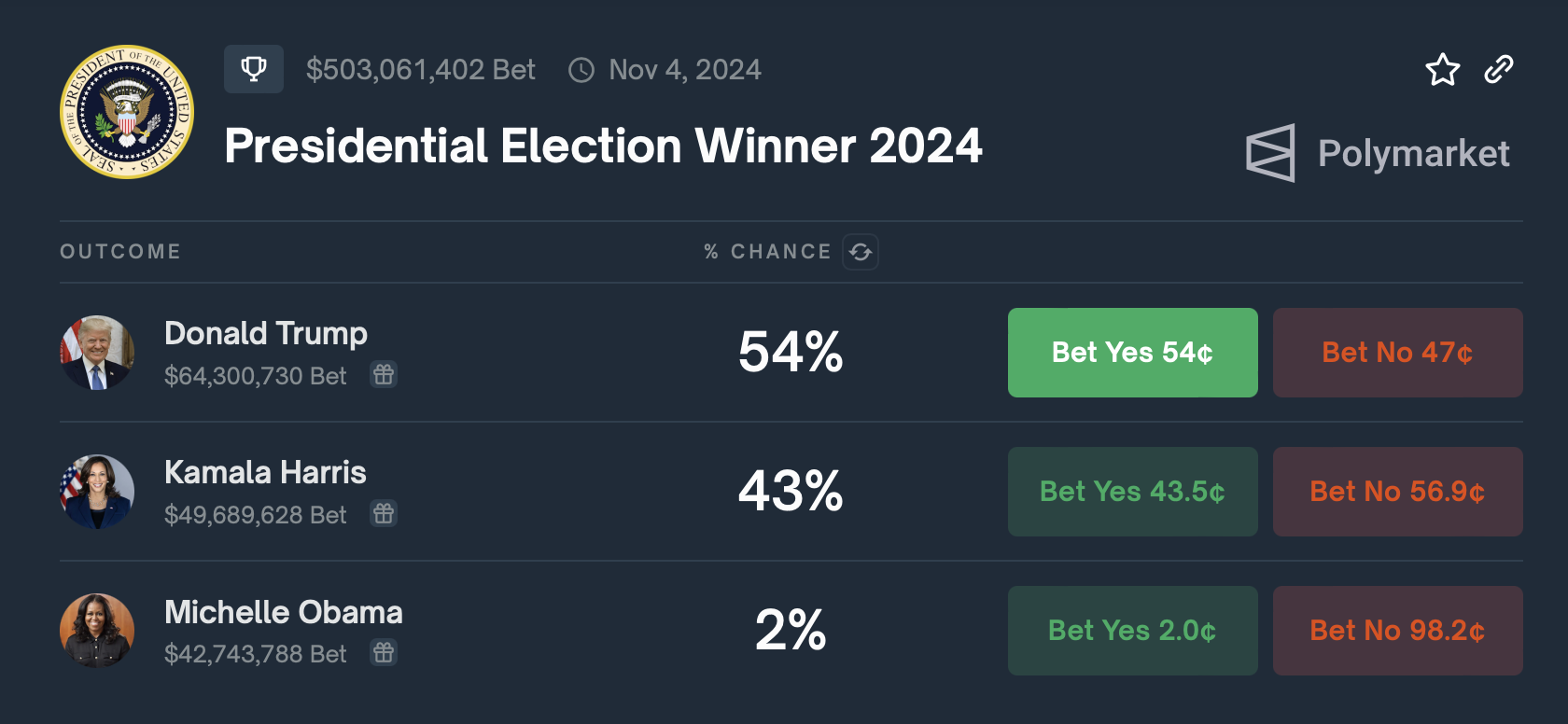

The US presidential race remains one of the most popular topics among Polymarket users. The crypto community is engaging in predictions and betting on possible outcomes.

Republican ticket candidate Donald Trump is leading with a 54 percent chance of success. In contrast, Kamala Harris has a 43% chance, while former US First Lady Michelle Obama has a 2% chance.

Read more: How Blockchain Could Be Used for Voting in 2024?

Polymarket betting traders show their interest in whether there will be an “emergency reduction in 2024”. This comes as gambling markets report the latest industry downturn.

“Jerome Powell should now call a meeting and announce an emergency cut,” said bitcoin veteran Kyle Chase.

At a recent meeting, Federal Reserve Chairman Jerome Powell They hinted at a possible policy reform by the end of 2024. They acknowledged that a rate cut could be on the table in September. Whether there will be a reduction in emergency rates in the interim is unknown.

In addition to emergency cuts, Polymarket participants predict a recession in 2024. However, this bet may soon continue as US economic activity defies recession warnings.

As BeInCrypto reports, markets watched Monday's S&P final US services PMI data. The latest data shows that economic activity in the services sector expanded in July, with the services PMI registering 51.4%, marking the 47th expansion of the sector in 50 months.

“In July, the services PMI registered 51.4%, 2.6 percentage points higher than June's figure of 48.8%. “The composite index reading in July is in expansion territory for the fifth time in 2024,” the report said.

Read more: How to protect yourself from inflation using cryptocurrency

The bullish growth is helping Bitcoin bounce back. It indicates a high demand for services, and therefore, increases the entry into businesses. Positive economic data often influences investor sentiment in the crypto space.

As traditional markets strengthen, investors may feel more confident about the economy. This could increase appetite and interest in alternative assets such as cryptocurrencies.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.