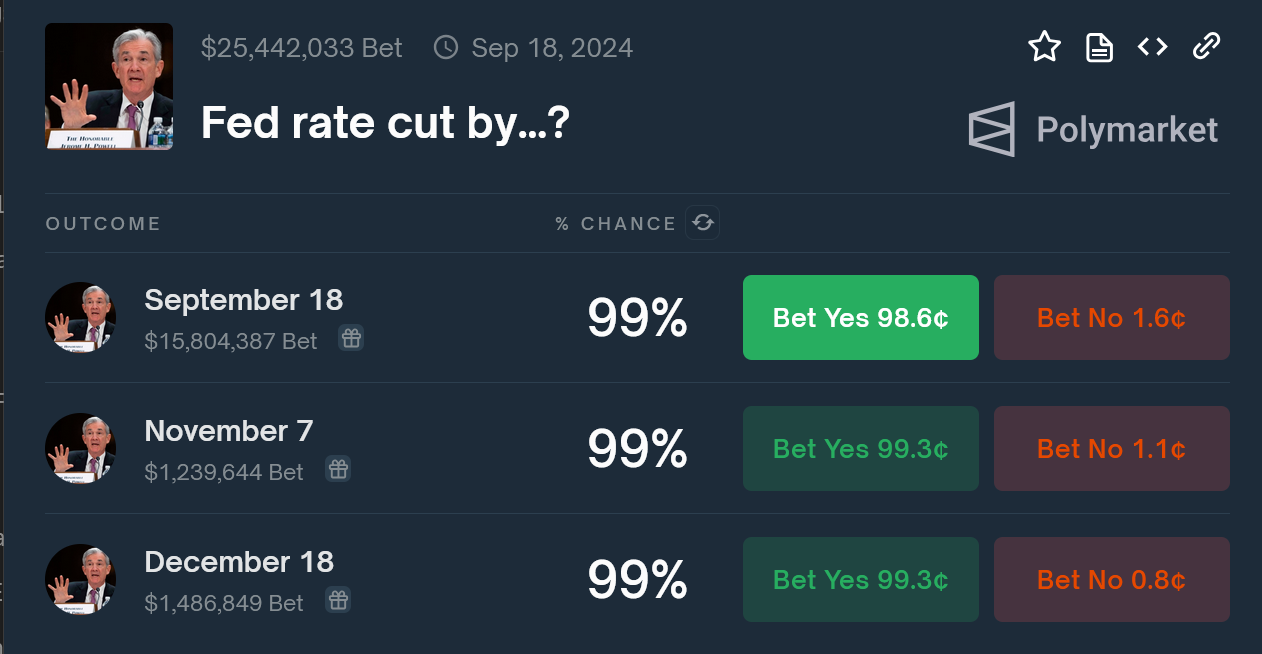

Polymarket traders will see a 99% chance of a reduction this week.

Key receivers

An expected drop in prices could boost Bitcoin's price as investors seek riskier assets.

Share this article

Polymarket traders are betting heavily on a Federal Reserve rate cut this week, with a 99% chance of a rate cut at the upcoming September 18, 2024 meeting. Traders are expecting a 25 basis point cut, which will reduce the federal funds rate from 5.00% to 5.25%.

Although some economists expect a more drastic cut of 50 basis points, the general consensus expects two cuts this year, which is the end of the year target of 4.75%-5.00%.

According to the CME FedWatch tool, the probability of a 50 basis-point cut has risen to 65%, up from the previous 35% probability of a 25 basis-point cut.

This interest rate change is expected to have a significant impact on risky assets such as Bitcoin. Low rates typically increase market liquidity, pushing investors toward higher-yielding and riskier assets. Analysts predict an increase in the price of Bitcoin as a result, although this may also introduce short-term market volatility.

A Bitfinex analyst predicts a 15-20% drop in bitcoin prices following the price cut, which could be as low as between $40,000 and $50,000. This forecast is based on historical data showing cyclical peaks and troughs and average bull market corrections. However, these forecasts may be affected by changing macroeconomic conditions.

The Fed last implemented rate cuts in March 2020 in response to the COVID-19 pandemic.

Earlier this week, one economist predicted that an expected 25-basis-point rate hike by the Federal Reserve could trigger a ‘sell-news' phenomenon affecting risk assets.

Share this article