Pre-token markets can change the relationship with financial instruments: Keyrock report

Share this article

![]()

Pre-token trading platforms are still unpredictable markets for buyers and sellers, according to a recent Keyrock report. While tokens offer early access before they launch, data collected by Keyrock indicates that few buyers on these platforms are making a profit.

Nevertheless, the speculation surrounding the token price will serve as a critical barometer for initial market reactions and investor sentiment. In cases like JUP and W, the price after the Token Generation Event (TGE) showed significant convergence with the pre-market prices.

However, not all tokens are like JUP and W, with some showing significant price differences, according to the report. In particular, the Welsh market often commands a premium over AEVO or Hyperliquid.

Moreover, pre-token markets differ in trading activity, which can lead to inconsistent price forecasts.

“Trading a token before its official launch is a pioneering idea. Yet, if pre-token markets occasionally struggle to agree on the right price, can they accurately predict post-TGE prices? This raises critical questions: Can these markets be trusted and are they really efficient?” The report highlights.

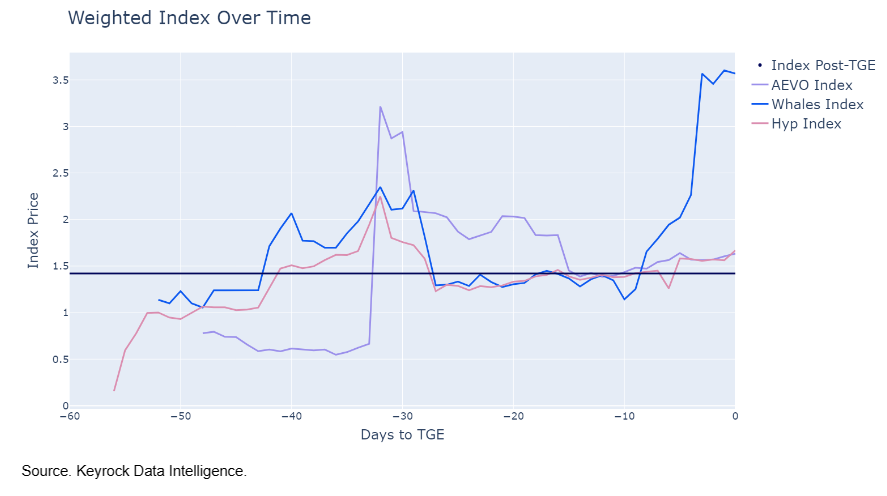

To track post-TGE activity, Keyrock created index values that use market capitalization as a weight to determine the average. Basically, the pre-TGE index price should be mixed after the TGE. Analyzed trading activity on AEVO, Hyperliquid and Whales Market for ALT, DYM, ENA, JUP, Pixels, Portal, STRK, TNSR and W.

Keyrock analysts explain that the navy blue line shown in the image above tracks the price of the index after the TGE, as a benchmark. And over time it should be synchronized with the pre-token market index value.

Although the AEVO and Hyperliquid indices are close to the TGE, the Wells market line shows an impressive rise a few days before the TGE.

“These observations provide more than data points; they provide deep insights into the emotional and psychological changes driving pre-TGE market behavior. Understanding these is critical for anyone looking to navigate the choppy waters of pre-TGE launches.”

The report then found that both buyers and sellers can make high profits depending on their timing, and that the market landscape does not support a single set of winners.

Another common feature of pre-token markets is a point system where users qualify for airdrops and sell their points. The report found a lack of correlation between price movements in the primary markets and these points.

“Blast and Parcl, for example, feature unique trading patterns in their token value that do not reflect their spot markets. This disconnect underscores a broader issue: an apparent lack of liquidity that hampers price discovery, resulting in volatility 10-20 times greater than that seen in pre-token markets post-TGE.

However, despite the flaws identified by Keyrock, they still see this as a “development of interest to the industry” that has the potential to shape the wider financial landscape. The possibility of trading assets before they materialize could change the way investors interact with financial instruments, the report concluded.

Share this article

![]()

The information on or included in this website is obtained from independent sources that we believe to be accurate and reliable, but we make no representations or warranties as to the timeliness, completeness or accuracy of any information on or accessible from this website. . Decentralized Media, Inc. Not an investment advisor. We do not provide personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may be out of date, or may be incomplete or incorrect. We may, but are not obligated to, update any outdated, incomplete or inaccurate information.

Crypto Briefing may also include articles with AI-generated content created by Crypto Briefing's own proprietary AI platform. We use AI as a tool to deliver fast, useful and actionable information without losing the insight – and control – of experienced crypto natives. All AI-added content is carefully reviewed, for accuracy, by our editors and writers, and we always draw from multiple primary and secondary sources to create our stories and articles.

You should not make an investment decision in an ICO, IEO or other investment based on the information on this website and you should never interpret or rely on any information on this website as investment advice. If you are seeking investment advice on an ICO, IEO or other investment, we strongly recommend that you consult a licensed investment advisor or other qualified financial professional. We do not receive compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities or commodities.

See full terms and conditions.