Although this year's stock performance does not indicate such success, the largest Bitcoin mining companies are increasingly asserting their dominance over the security of the Bitcoin network.

JP Morgan analysts summed up the current state of the market in their “September 24 Bitcoin Mining Semi-Term Report” published on Monday, noting that publicly listed US mining companies saw their slice of the network's hash rate pie expand for the fifth consecutive month. Record 26.7%

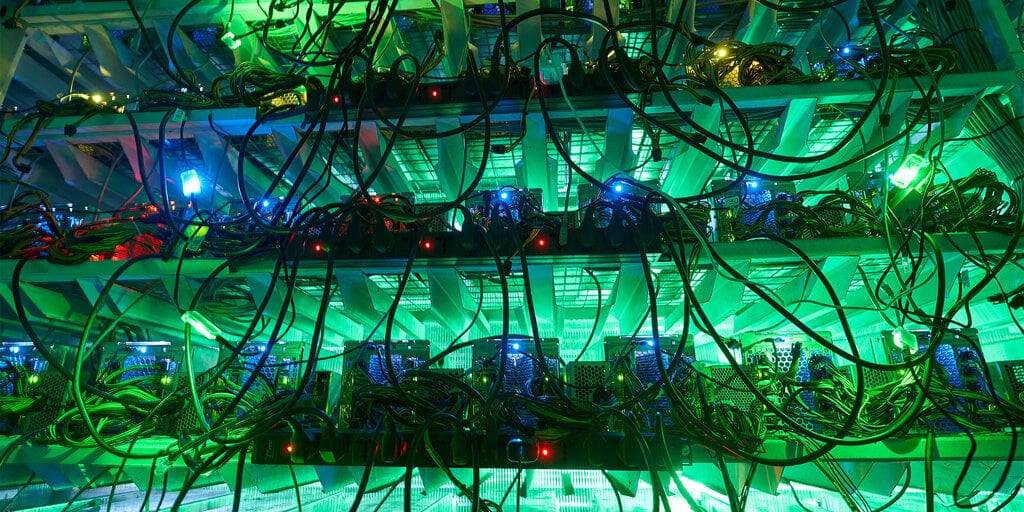

Hash rate measures the speed at which miners are working to mine the next block of Bitcoin, and the associated subsidy and payment rewards they receive. As the hashrate increases, it generally means that miners are using more electricity and more powerful machinery to mine bitcoins. As a result, mining is more competitive and the entire Bitcoin network is more secure.

In August, the 14 miners tracked by JP Morgan collectively added another 12 exahashes per second (EH/s) to their mining fleets. These gains were led by Canadian miner IREN, which added 5.5 EH/s, and Marathon Digital – the world's largest corporate miner – with another 3.7 EH/s.

In general, miners have increased their hash rate by more than 50% since the year. Their total combined hash rate is now 175 EH/s, comprising 26.7% of the entire Bitcoin network.

However, the increased hash rate hasn't necessarily translated into more revenue in recent months. IREN was the only public miner to increase its BTC mining in August compared to the previous month.

According to JP Morgan, the monthly bitcoin output has decreased significantly this year, due to the Bitcoin halving event in April. The halving will cut the reward amount in half, from 6.25 BTC to 3.125 BTC in the last four-year event.

The analysts added: “As the network hash rate (and mining difficulty) increases, this parameter decreases over time, and miners tend to slow down during the summer months as activity tends to be lower.”

Since September began, Bitcoin's hash rate has risen to new all-time highs, while Bitcoin's price has trended lower, a deadly combination for crushing mining profitability. Most public miners have seen their share values fall, with CleanSpark (CLSK) down 12%.

The Valkyrie Bitcoin Miners ETF (WGMI) – a diversified proxy for the large mining industry – is now down 2%, while the price of BTC is up 30%.

“The total market capitalization of the 14 US-listed bitcoin miners we track is down 3% since late August, and currently trade at just 2x the four-year reward share, the lowest level since May 24,” JP Morgan wrote.

Edited by Andrew Hayward.

Daily Debrief Newspaper

Start every day with top news stories, plus original features, podcasts, videos and more.