Respected key price levels

Injective ( INJ ) had a strong 24-hour performance, gaining 17% in the last 24 hours.

This increase begs the question: Can INJ recover from its all-time high of 65%?

Injective Technical Analysis: Testing Key Levels

The injection price has approached or tested the daily Ichimoku cloud, which is a very scary sign. The size of the cloud emphasizes the importance of this step.

Key resistance levels in the medium to long term are $29.5, $34, $38.4 and $43. If the daily Ichimoku cloud breaks on INJ, it could witness a price appreciation towards $33. Additionally, if the price of Bitcoin returns to $73,000, the price could easily increase by another 18% in the medium term.

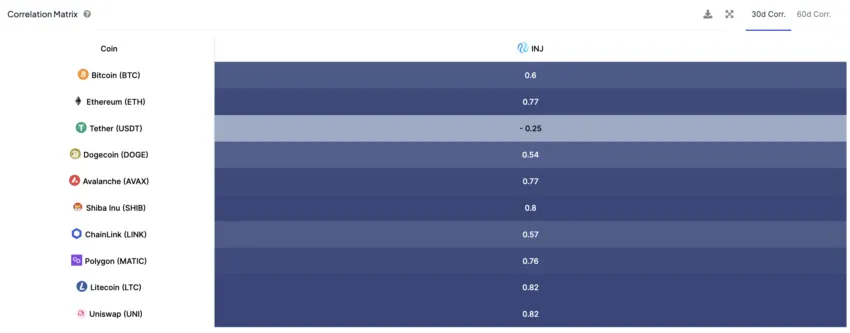

Correlation with Bitcoin: INJ stands at 0.6 and shows significant correlation with Bitcoin. This shows that movements in the price of Bitcoin have a significant impact on INJ. If Bitcoin continues its upward movement and reaches $73,000, we can expect INJ to trade between $30 and $34.

Read more: 7 must-have cryptocurrencies for your portfolio before the next bull run

Measurements on the Chain: Ensuring Value Appreciation

The movement on the chain indicates that the price advance is real, with significant gains in key metrics.

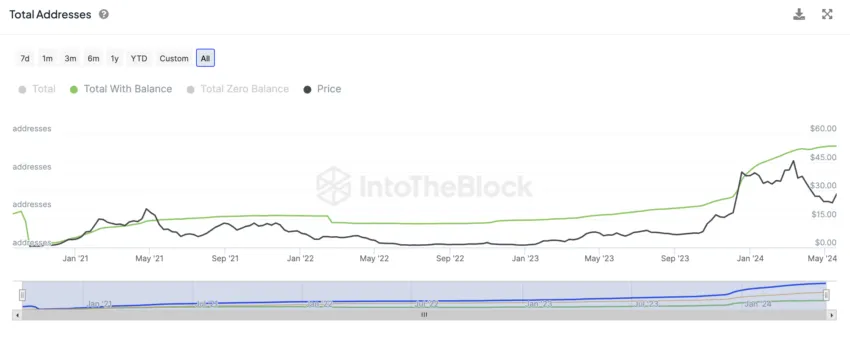

Total Addresses at All-Time High: The total number of addresses held by INJ is at an all-time high, reflecting growing demand and adoption.

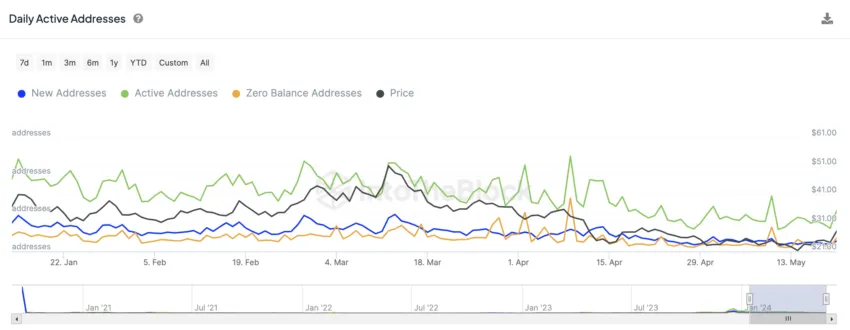

Increase in Active Addresses: The number of active addresses is increasing, which is a positive indicator of network activity and engagement.

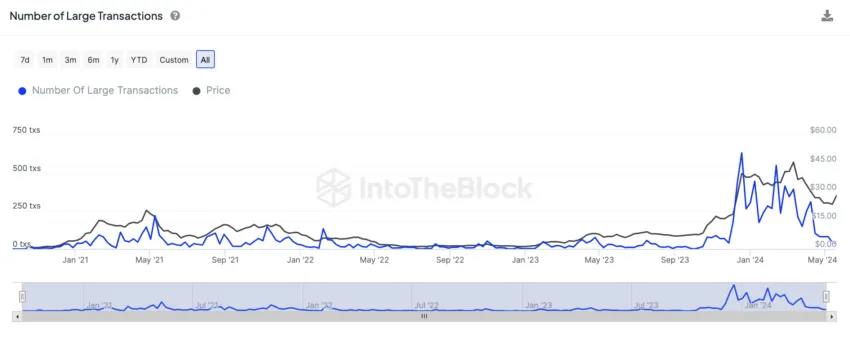

Declining Large Transactions: The number of large transactions has decreased significantly, which may be beneficial for the stability of the coin. Reducing large transactions reduces volatility and leaves the market vulnerable to sudden and large sell-offs, leading to a more stable price and risk-averse investment environment.

Read more: 9 cryptocurrencies that will offer the highest dividend yield in 2024 (APY)

Strategic recommendations and price forecasts

From energy to neutral perspective:

Target level at $29.5: If the price enters the daily Ichimoku cloud, the initial target is $29.5. This level serves as a significant resistance.

Major Price Appreciation: A break above $29.5 could trigger a major price appreciation, with potential targets retracement at $34, $38.4 and $40.

Low Risk: If the price tests the lower boundary of the Ichimoku cloud and fails to hold it, it may move to the downside, negating the bullish opportunity and leading to further declines.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.