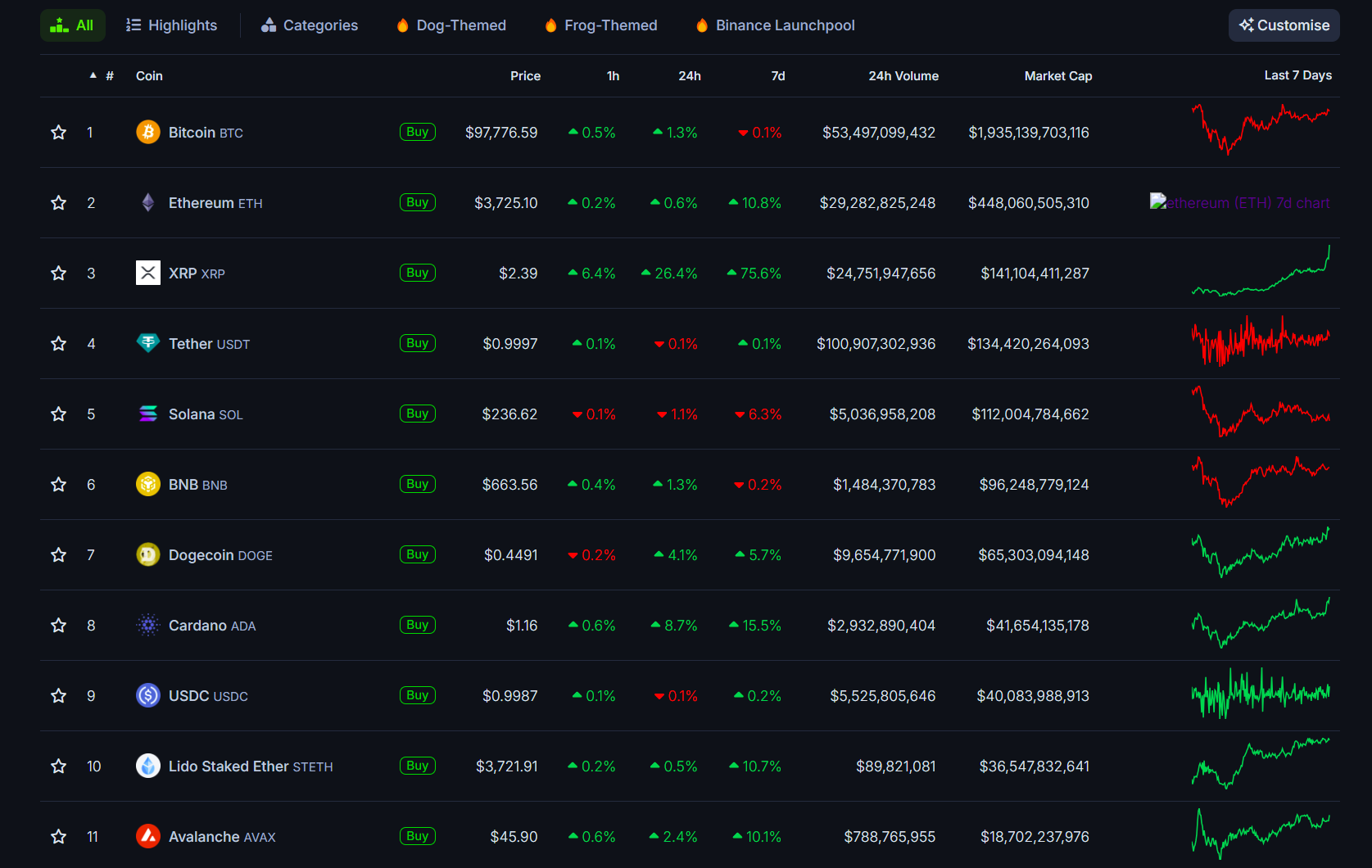

Ripple’s market cap hit a record $140B, overtaking Tether and Solana to become the third most valuable crypto asset.

Key receivers

Ripple's XRP market cap has risen to $140 billion, making it the third most valuable crypto asset. The brand's rise follows positive sentiment from political changes and ongoing regulatory developments.

Share this article

XRP's market capitalization has reached a new all-time high of over $140 billion, surpassing Tether and Solana to become the third largest crypto asset by market value, according to CoinGecko data.

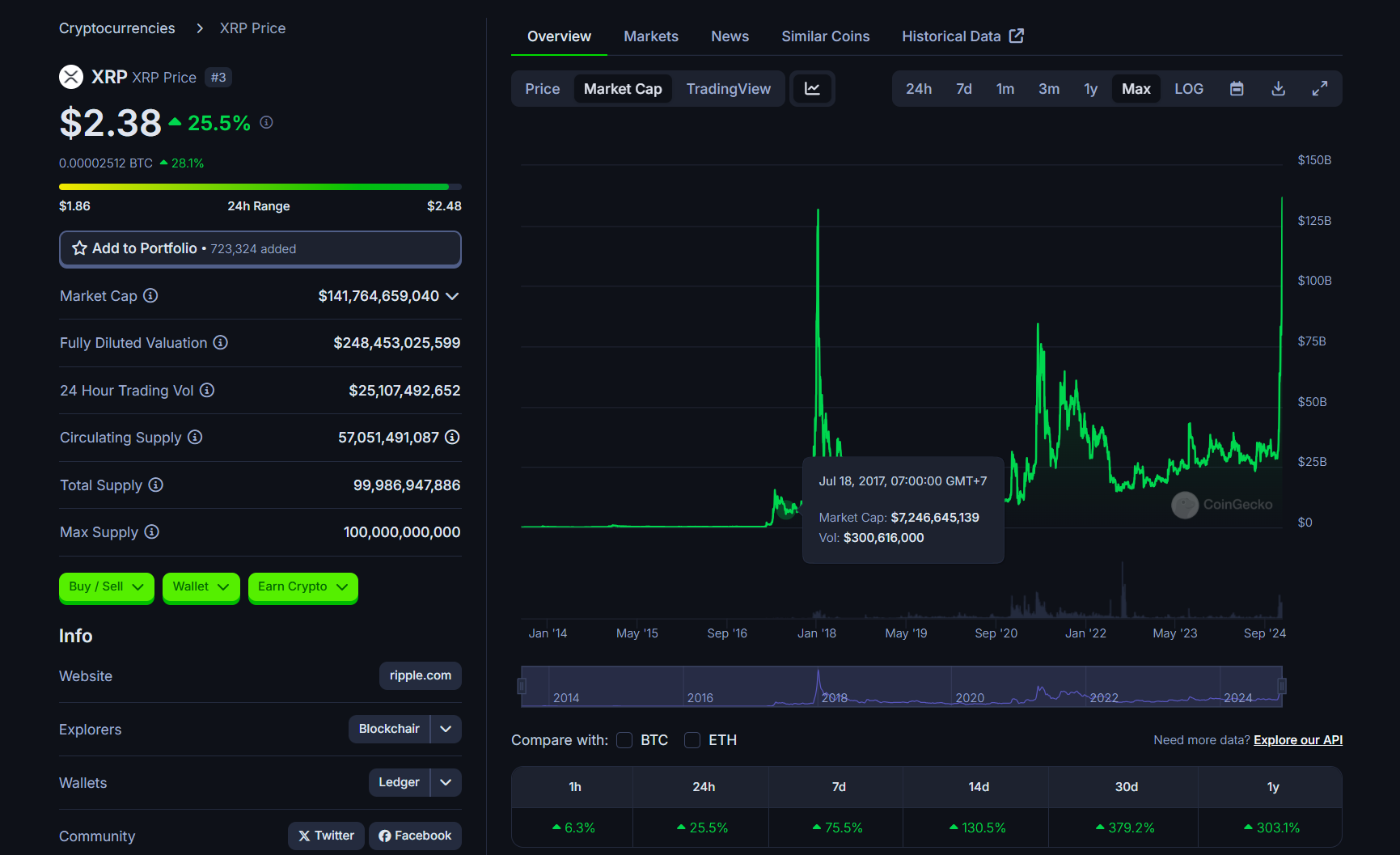

XRP has exploded in value over the past month, skyrocketing nearly 400% and outperforming most leading crypto assets. It is now trading around $2.3, up 26% in the last 24 hours.

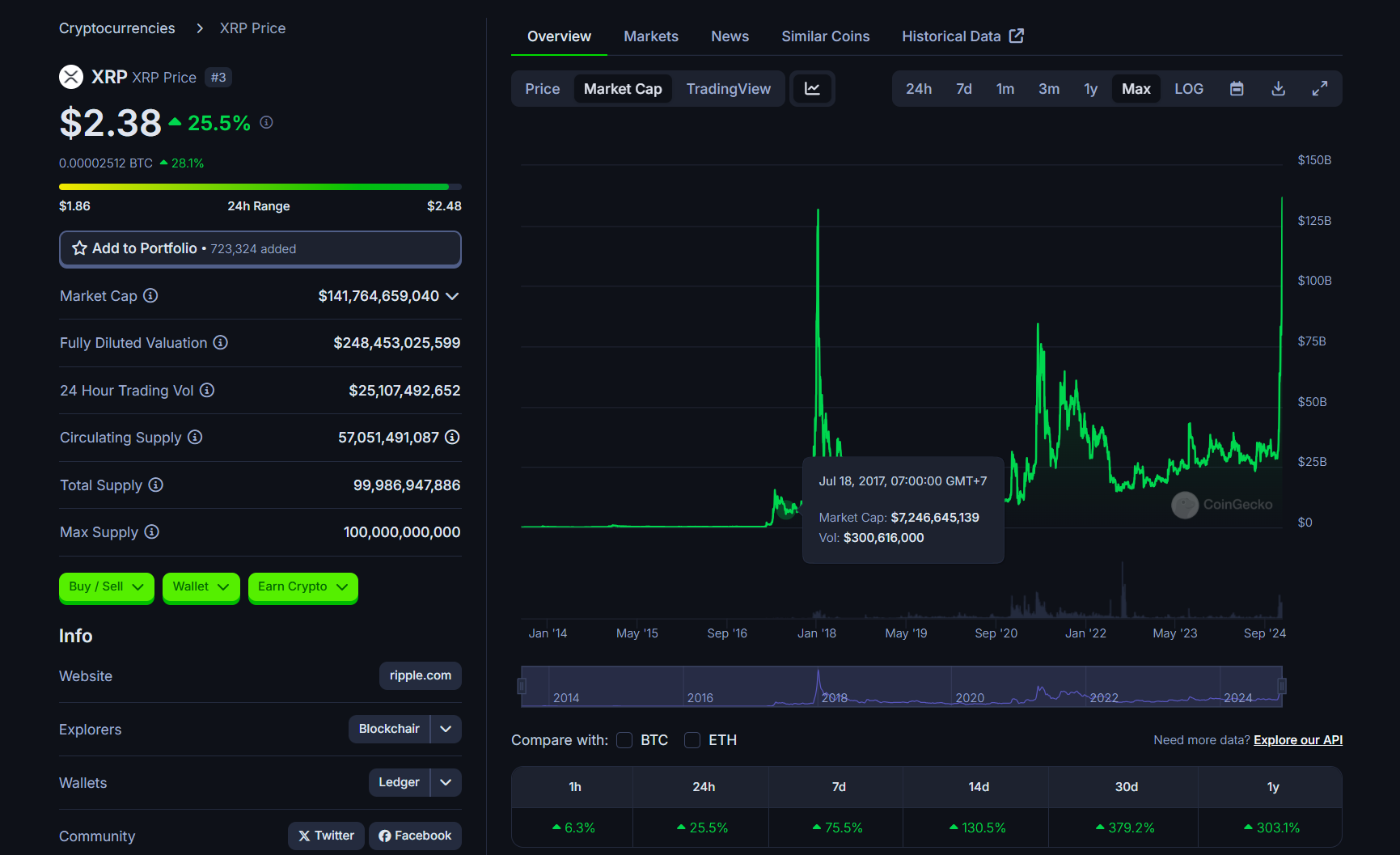

The success brings Ripple's native crypto closer to its pre-SEC lawsuit glory days. Following the SEC allegations in December 2020, the crypto asset dropped significantly.

During that time, the price of XRP dropped from $0.5 to $0.17, a drop of about $15 billion. It took XRP four years to re-establish its place among the top 7 crypto assets, and now it's on the rise.

XRP is 27% away from its all-time high of $3.40 set in January 2018. It now trails only Bitcoin and Ethereum in the crypto asset rankings. Bitcoin holds the top spot with a market cap of nearly $2 trillion, followed by Ethereum at $448 billion.

XRP's upward trajectory began following Donald Trump's presidential victory as his pro-crypto stance boosted market sentiment. However, XRP's major gains are tied to the resignation of SEC Chairman Gary Gensler.

After Gensler hinted at his resignation, the token surpassed $1 for the first time since November 2021, followed by a 25% surge to $1.4 after he officially announced his resignation.

Market observers see Gensler's departure as a major boost to Ripple's resolution of legal challenges, with experts suggesting ongoing SEC cases against crypto companies could be dismissed or settled.

XRP's price appreciation is supported by positive news such as Ripple's stablecoin development, business expansion and growing institutional interest.

Asset management firms including Bitwise and Canary Capital are seeking SEC approval for XRP ETFs, while Ripple is seeking approval from the New York Department of Financial Services to launch the RLUSD stablecoin.

Share this article