Satoshi Nakamoto Explains Why Bitcoin’s Supply Is 21 Million BTC

Emails from purported Bitcoin developer Satoshi Nakamoto surfaced on Friday, courtesy of Marty Malmi, an early contributor to the original digital asset. The correspondence goes deeper into the Bitcoin legend, shedding light on its humble beginnings and Nakamoto's decision-making process.

The emails emerged amid a legal battle in London with Australian scientist Craig Wright, who claimed to be Nakamoto.

Why is the Bitcoin supply capped at 21 million?

The exchange between Nakamoto and Malmi revealed that the decision to cap Bitcoin's supply at 21 million tokens was a deliberate choice, not a random one. Nakamoto describes it as an “educated guess” that aims to align Bitcoin's pricing volatility with that of established currencies while recognizing the uncertainty of future market conditions.

“My selection of the number of coins and distribution schedule was an educated guess. It was a difficult choice because once the network is in, it is locked and we are stuck with it. “I wanted to pick something that would have a similar value to existing currencies, but without knowing the future, that's very difficult,” Nakamoto said.

Moreover, Nakamoto emphasized that 21 million BTC represents a part of the global trade, which ensures the expansion of the global monetary system. This decision was made with the assumption that Bitcoin's value could fluctuate relative to traditional fiat currencies.

“If he thinks that a part of the world is used for trade, it's only 21 million coins for the whole world, so it will be worth more per part. The values are 64-bit integers with 8 decimal places, so 1 cent is represented internally as 100000000. If the usual prices are small, there are many qualities. For example, if 0.001 is worth 1 euro, it can be easy to change where the decimal point is displayed, so if you have 1 bitcoin, it will now be displayed as 1000, and 0.001 will be displayed as 1,” added Nakamoto.

Read more: Bitcoin price prediction for 2024/2025/2030

These revelations provide important insights into Bitcoin's early development and the assumptions that shaped its founding principles.

Other revelations from Satoshi's emails

Beyond supply dynamics, the emails delve into various aspects of Bitcoin. These include exposure as an investment vehicle and concerns regarding energy consumption and anonymity. Nakamoto cautioned against describing bitcoin as just an investment, emphasizing its inherent risks and relying on individual judgment.

“Obviously, I'm not comfortable saying ‘consider it an investment'. That's a dangerous thing to say and you should delete the point. It's fine if they come to that conclusion on their own, but we can't consider it that way,” Nakamoto explained.

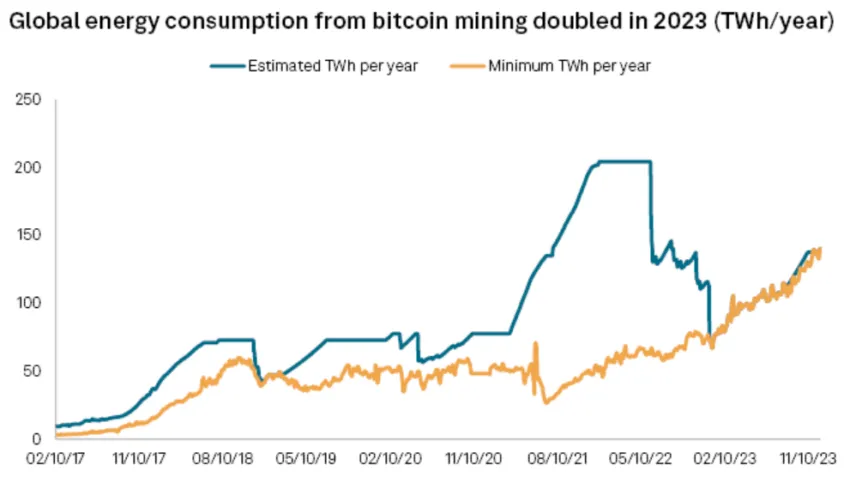

Additionally, while recognizing the potential for increased energy consumption at the scale of bitcoin, Nakamoto argued that it would still be less resource-intensive than conventional banking.

“If it grew to consume more energy, I think it would still be less wasteful than the labor- and resource-intensive normal banking activity that it replaces,” Nakamoto said.

Read more: 7 Best Crypto Exchanges in the US for Bitcoin (BTC) Trading

Regarding anonymity, Nakamoto cautioned against overstating Bitcoin's privacy features, warning that transaction history could reveal users' identities. Anonymous BTC creator said, “Anonymous sounds a bit shady.” Moreover, the emails reveal that Nakamoto did not coin the term “cryptocurrency”.

“Someone came up with the term ‘cryptocurrency'. […] Maybe that's the word we should use when describing Bitcoin, do you like it? ” asked Nakamoto.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.