Saylor drops hints about the next micro-strategy of Bitcoin investment

Michael Saylor, founder of MicroStrategy, has sparked speculation about another major Bitcoin acquisition.

This is a milestone that highlights the company's growing influence in the technology and financial sectors following its recent inclusion in the Nasdaq-100 index.

Bitcoin acquisition through the eyes of micro strategy

On December 15, Saylor privately questioned whether SaylorTracker, a portfolio tracker that highlights every Bitcoin purchase by the company, had lost a green signal. These indicators typically indicate new Bitcoin purchases, leading to speculation in the crypto community about an imminent acquisition.

In the past five weeks, Saylor has dropped subtle hints about Bitcoin purchases on social media, followed by public announcements of large-scale purchases next Monday. During this period, MicroStrategy expanded its Bitcoin holdings to over 171,000 BTC, investing over $15 billion.

If the new purchase is confirmed, it will mark MicroStrategy's first purchase of Bitcoin since its inclusion in the Nasdaq-100 index on December 13. Analysts see this inclusion as a prerequisite for the company to enter the S&P 500, which tracks the company's performance. 500 largest companies in the US

According to CoinDesk's James Van Straten, the only remaining requirement for entry into the MicroStrategy S&P 500 is generating positive earnings over the past four quarters.

“Theoretically, if FASB is implemented in Q1 2025 and the BTC price is $120,000 and there is no increase in BTC holdings, MSTR will have $25 billion in net income. MSTR could be incorporated as early as Q2 2025,” Van Straeten predicted.

Introduction to Marathon Digital Targets Nasdaq-100

As MicroStrategy strengthens its position, Marathon Digital Holdings is working to follow suit. Saylor touts Marathon as the next Bitcoin-focused firm to secure a Nasdaq-100 spot. In a Dec. 14 post, he responded to a congratulatory message from Marathon CEO Fred Thiel, expressing confidence in the company's upward trajectory.

“Thanks, Fred. I expect MARA to be next,” Saylor said.

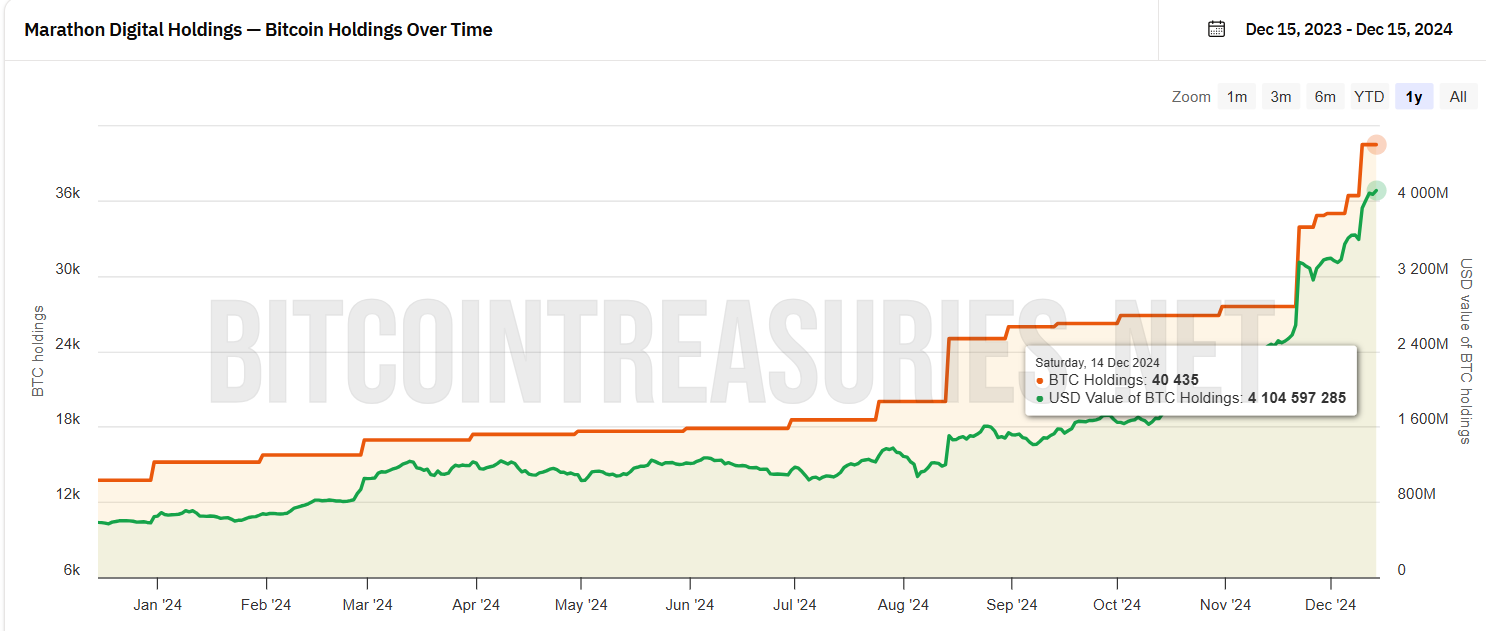

Marathon still has a challenging road ahead of it, with a current market capitalization of less than $10 billion – well below MicroStrategy's pre-merger figure. However, Marathon has significantly expanded its Bitcoin strategy, spending more than $1 billion this month to increase its holdings to 40,435 BTC, now worth nearly $3.9 billion.

Meanwhile, this purchase will make Marathon the second largest corporate bitcoin holder, following only MicroStrategy. As the company continues to grow its Bitcoin portfolio, it is becoming a key contender in the growth of institutional crypto investment.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.