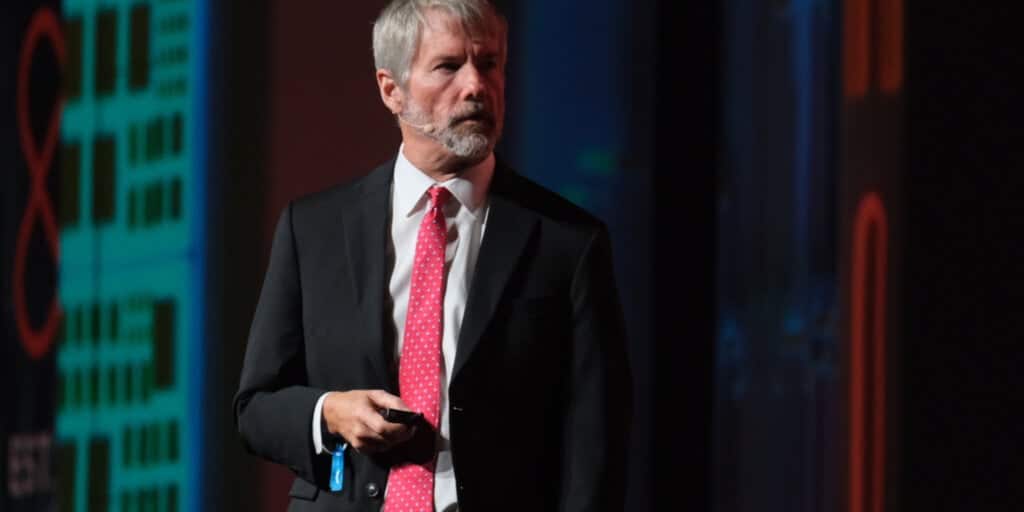

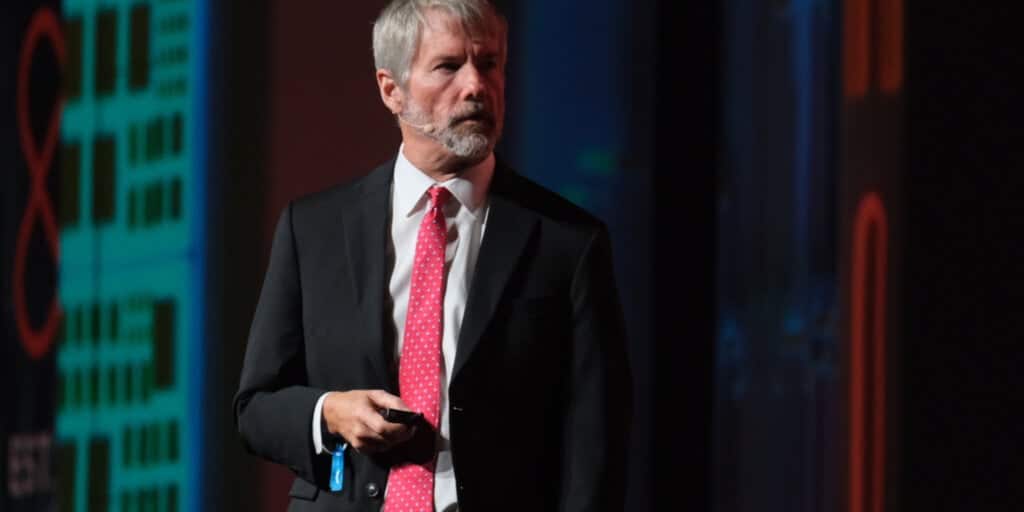

Michael Saylor, co-founder of MicroStrategy It has been shared. A detailed Bitcoin adoption strategy with Microsoft's board of directors shows how the tech giant could reach $584 per share and create a shareholder worth of nearly $5 trillion by 2034 through various Bitcoin treasury strategies.

Microsoft shares are up 14 percent year-to-date to $423.46, according to Google Finance data.

Speaking at Microsoft's December 2024 shareholder meeting, Saylor said Presentation Microsoft has revealed how it will convert its current $200 billion capital allocation into Bitcoin holdings, reducing its enterprise value at risk from 95% to 59% and increasing annual revenue. It shows its potential by showing 10.4% to 15.8%.

“Bitcoin is a universal, eternal, profitable integration partner,” said Salor, comparing the strategy he gave to the board, “a 100 billion dollar company growing at 60% per year at 1x revenue.”

Universal and sustainable

Saylor pitched Bitcoin to Microsoft as a unique corporate acquisition target, noting that Bitcoin's 62% annualized rate of return (ARR) compared to Microsoft's 18% ARR doesn't come with traditional integration and risks. Acquisitions (M&A).

Bitcoin is an always-available acquisition target that can absorb capital compared to Microsoft's current dividend and return strategy, Salor said.

The style is aimed primarily at Microsoft's board and executive leadership, who are familiar with traditional M&A dynamics but may be looking for new ways to deploy capital at their current size.

Bitcoin has no risk

Saylor also said that bitcoin has been resilient to traditional trade and geopolitical risks. His emphasis on “counterparty risk” is a key concern for corporate treasurers: the need to determine the performance, stability, or cooperation of other parties.

Combined with the previous slides showing Microsoft's current 95% value-at-risk metric, this point becomes even more powerful: Saylor essentially argues that Microsoft's current treasury strategy leaves them exposed to all of these associated risks, while Bitcoin offers a way to mitigate that exposure. significant.

Saylor went on to reinforce the argument that Bitcoin is a “commodity, not a company.” Unlike Microsoft's current treasury holdings, Bitcoin's value is not based on any legal performance or stability .

using Bitcoin24 modelAn open-source simulation model for Bitcoin adoption, Saylor showed how Microsoft could transform its current position—an estimated $3 trillion in market value with $27 billion in net cash and $70 billion in cash flow, growing at 10% annually—to a larger and more solid financial base.

In October, Microsoft He asked the shareholders To vote on whether to invest in Bitcoin.

“Do what's right for your customers, your employees, your shareholders, your country, the world and your legacy,” Salor concluded, making a final push that represented one of the most important corporate Bitcoin adoptions to date. “Accepting Bitcoin”.

Edited by Sebastian Sinclair.

Daily Debrief Newspaper

Start every day with top news stories, plus original features, podcasts, videos and more.