Shiba Inu (SHIB) Eyes 50% Rally, Insights from On-Chain Data

With the ongoing potential bull run, Shiba Inu (SHIB), the popular and second largest meme coin is about to finish consolidating and is set for a major upside rally. This bullish hypothesis stems from the coin's positive price action and continued attention from investors and traders.

Shiba Inu technical analysis and upcoming levels

According to expert technical analysis, SHIB looks bearish following the strong downtrend it has been experiencing since March 2024. However, the account has not yet been verified. Due to the positive market sentiment and Bitcoin's famous inverted rally, SHIB looks bullish and could rally significantly in the coming days.

Based on the recent price action and historical progress, if SHIB closes the daily candle above the $0.000021 level, there is a good chance that the asset could rise by 50% to reach the $0.000029 level in the coming days.

However, Mem Coin is trading above the 200-day Exponential Moving Average (EMA) on a daily time frame, indicating an uptrend. The 200 EMA is a technical indicator that traders and investors use to determine whether an asset is in an uptrend or downtrend.

The SHIB bullish thesis holds only if the daily candle closes above the $0.000021 level, otherwise it may fail.

Bullish gauges on the chain

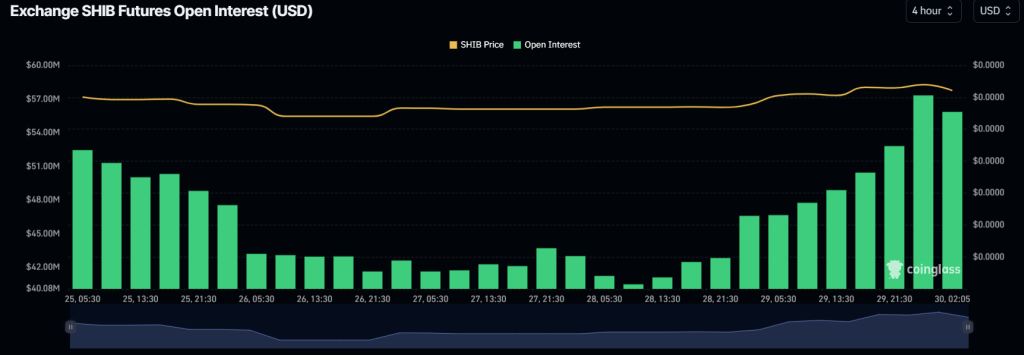

Mem Coin's positive outlook is further supported by chain metrics. SHIB's long/short ratio currently stands at 1.03, indicating strong bullish sentiment among traders, according to on-chain analytics firm Coinglass.

Additionally, open demand has increased by 27% in the last 24 hours and by 11% in the last four hours. This higher open interest reflects growing trader interest and more positions building compared to the previous day.

Often, traders and investors consider increasing the open interest and long/short ratio to more than 1 when building long positions.

Current price momentum

At the time of press, SHIB is trading near $0.0000188 and has experienced a price increase of over 6% in the last 24 hours. During the same period, the transaction volume increased by 125 percent.