Shiba Inu witnesses reduced trading volume in the derivatives market

A double-digit drop in the Shiba Inu (SHIB) spot price last month has led to a sharp drop in trading activity on the underlying market.

At $35.43 million at press time, SHIB's daily trading volume is currently at its lowest level since February.

Get the Shiba Inu traders out of the market

When an asset's derivatives market experiences a decline in trading volume, it generally indicates a decrease in speculative activity. This means that traders are not willing to take risks or bet on the future price movements of the asset.

SHIB's daily derivatives market volume rose year-to-date to $138 million on March 6 and has been trending downward since then.

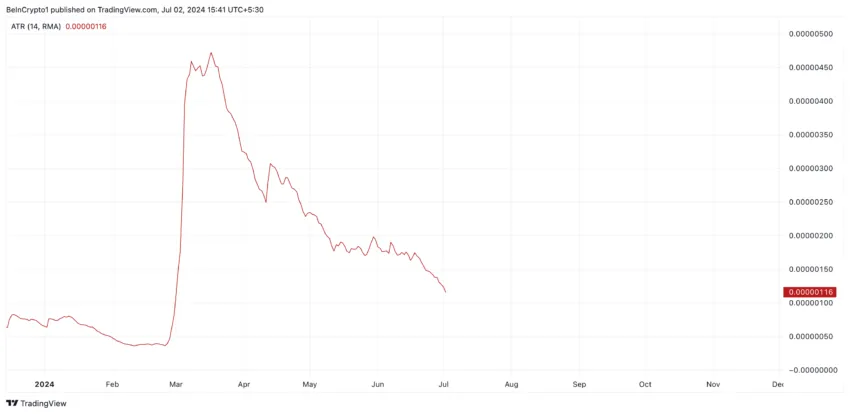

A key factor to note is that reduced trading activity in derivatives is often associated with reduced price volatility. The decline in SHIB's Average True Range (ATR) over the past few weeks confirms the decline in market volatility. At press time, at 0.0000011, SHIB's ATR is down 77% since March.

A stock's ATR measures market volatility by calculating the average range between high and low prices over a given period.

As it decreases, it indicates that the probability of price fluctuations is becoming less significant.

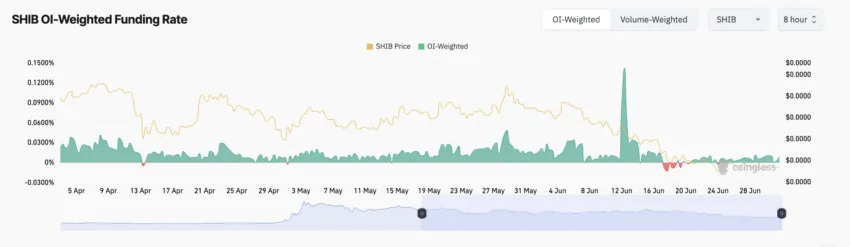

In particular, demand for long positions continues despite the fact that SHIB prices have not been reduced and activity in the market has been low. Readings from the currency have remained largely positive over the past few months. SHIB's funding rate in cryptocurrency exchanges is 0.0093% as of this writing.

Read more: How to buy a Shiba Inu (SHIB) and everything you need to know

Cash-out prices are a technique used in perpetual futures contracts to ensure that the contract price is close to the spot price.

If the asset's funding rate is positive, many traders will take long positions, which is often considered a great sign.

SHIB Price Forecast: Selling movement to put downward pressure on price

SHIB's current price decline is likely to continue as the demand for Meme Coin declines. For example, the Relative Strength Index (RSI) is currently trending down at 33.30.

This indicator measures the overbought and oversold market conditions of an asset. It ranges between 0 and 100, and values above 70 indicate that the asset is overbought and due to decline. On the other hand, values below 30 indicate that the asset is oversold and may be witnessing a rebound.

At 33.78 at press time, SHIB's RSI indicates increasing selling pressure on Mem Coin.

SHIB price could drop to $0.000016 if coin holders continue to sell their holdings.

Read More: Shiba Inu (SHIB) Price Prediction 2024/2025/2030

However, if sentiment changes from bearish to bullish and buying activity rises, SHIB price could reach $0.000019.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.