Solana aims at $165 as an on-chain metrics signal buying opportunity.

On September 20, 2024, Solana (SOL), the sixth largest cryptocurrency by market cap, is set to find significant support due to a bullish breakdown and on-chain metrics. After struggling for almost three weeks, SOL broke the consolidation zone and is now heading towards the $165 level again.

Solana price momentum

At press time, SOL is trading near $144 and has experienced a price increase of over 10% in the last 24 hours. During the same period, the transaction volume increased by 31%, which shows the high participation from crypto lovers in the recent period.

Solana technical analysis and future levels

According to expert technical analysis, SOL looks bullish as it is trading above 200 Exponential Moving Average (EMA) on daily time frame. The 200 EMA is a technical indicator that investors and traders use to determine whether an asset is trending higher or lower.

As of now, this breakout is not considered successful until the SOL price closes the daily candle above the $141.5 level. If this happens, there is a strong possibility that it could rise by 15% to the $165 resistance level in the coming days.

SOL's Bullish On-Chain Metrics

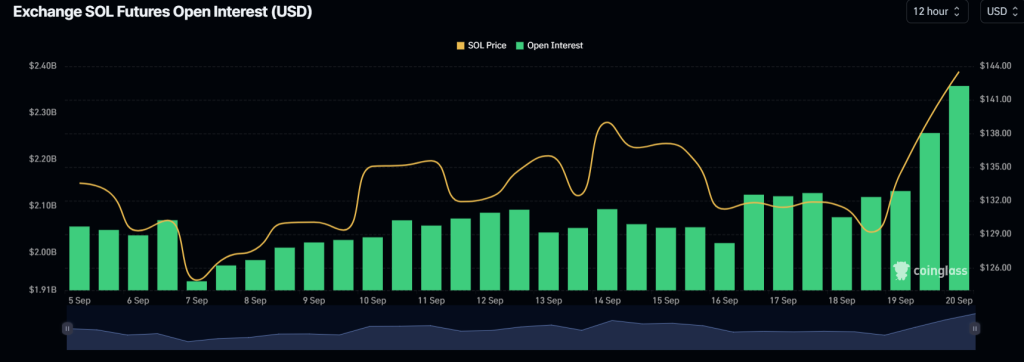

In addition to this breakdown, SOL's on-chain metrics such as long/short ratio, futures open interest and OI-weighted liquidity are bullish signals. Coinglass's long/short ratio currently stands at 1.02 (a value greater than 1 indicates bearish market sentiment). Meanwhile, its futures open interest has increased by 13% in the last 24 hours and is growing steadily.

This increasing open interest indicates that bulls are betting more on long positions compared to short positions. So far, 51% of top traders hold long positions while 49% hold short positions. These data indicate that the bulls have returned to the market and are currently dominating the property.

Typically, traders and investors use a combination of open interest and a long/short ratio greater than 1 to build their long or short positions.