Solana defaults are stored in the middle of the dress

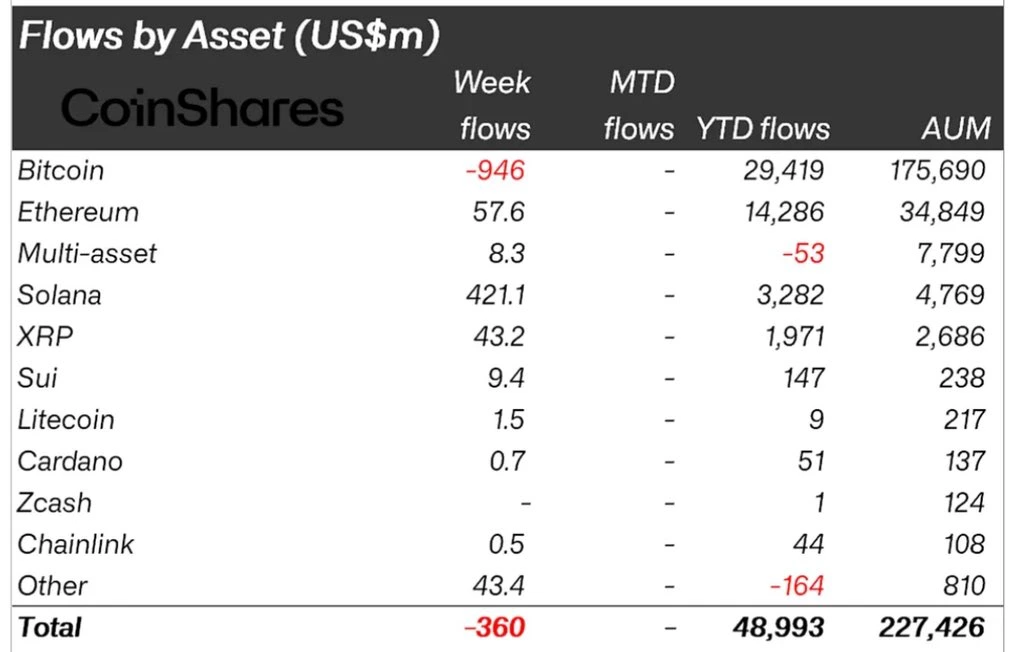

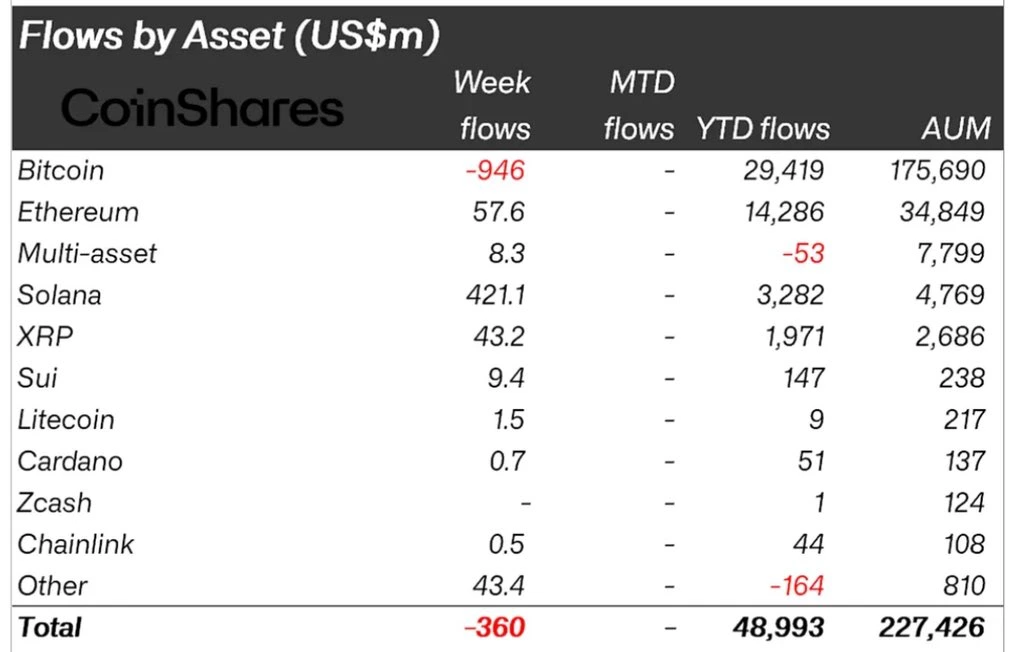

Solana (Sol) whales last week in the middle of the mid-term professional sentiments have accumulated significantly. According to Solana's weekly report, the rest of the “Everpto” investment products, about 421 million dollars left in funding.

Likewise, Solitary Investments' parent investments are about $3.2 billion, so around $4.76 billion under management. Incredibly, Solana earned a net fine of $57.6 million and $43 million, or $43 million and $2 million over Eve/XIP.

Source: – Coins

Bitcoin investment products last week recorded a cash flow of approximately 946 million dollars.

Why are investors buying Solana Ared's foreign affairs?

SOS SEST ETF HYPE HELDERDER HIGH HIGH HIGH HIGH HIGH HIGH HIGH HIGH HIGH HIGH HIGH HIGH HIGH HIGH HIGH HIGH HIGH HIGH HIGH HIGH HIGH HIGH HIGH HIGH HIGH

In the United States, the organic interest of the solanic interest is that of the TF FFM in the United States. The Bit BitWon Cock Socking Exf Disturbed NF will increase the growth of more similar products that will join the United States government shutdown.

Capital rotation from Bitcoin to SINTION will be very seamless in the ETF market. Also, your elevation 2025 in ELFSESON 2025. In December 2025, it is expected that the number of meals will be 2025.

Ecosystem development and network resilience

The Solana Ecologist majored in digital assets with a diploma. According to the analysis of market data, the total value of Solana is locked at around 145 billion dollars, the market cap has increased by 10 billion dollars.

In recent times, Solana's ecology has been greatly affected, and the resistance of the network has been destroyed. In the last twelve months, the Solana network has experienced no adoption, but no exit has been included.

What's next for SOL pricing?

From the technical analysis perspective, the SOL/USD pair is approaching a multi-year triangle.

Source-XA is higher than the recent high in the previous period, in the coming months the price of SOL will rise further to the price of SOL.

Trust with the agreement

In the year From 2017 To ensure accuracy, transparency and reliability, each article is known in fact. Our review guidelines ensure unedited reviews when indicated by exchanges, platforms or tools. We strive to provide up-to-date information on everything Crypto and Countchant, from origins to industries.

Investment responsibility

All opinions and insights shared represent the market conditions of the author. Please do your own research before making any investment decisions. However, the author or publication is not responsible for your financial choices.

Sponsored and advertisements

Sponsored content and affiliate links may appear on our site. Ads are clearly marked, and our editorial content is completely independent from our advertising partners.