Solana ETF apps fail to boost market appetite: Caico

Key receivers

VanEck and 21Shares File for Spot SOL ETFs, But Market Impact Is Limited Composite BTC/ETH ETFs show an improved risk profile, which may appeal to traditional investors.

Share this article

![]()

Last week, VanEyck became the first US asset manager to list the Spot Solana (SOL) exchange-traded fund (ETF), following 21Shares. The news initially sent SOL shares up 6%, but the overall market impact was limited, according to research by chain analytics firm Kaiko.

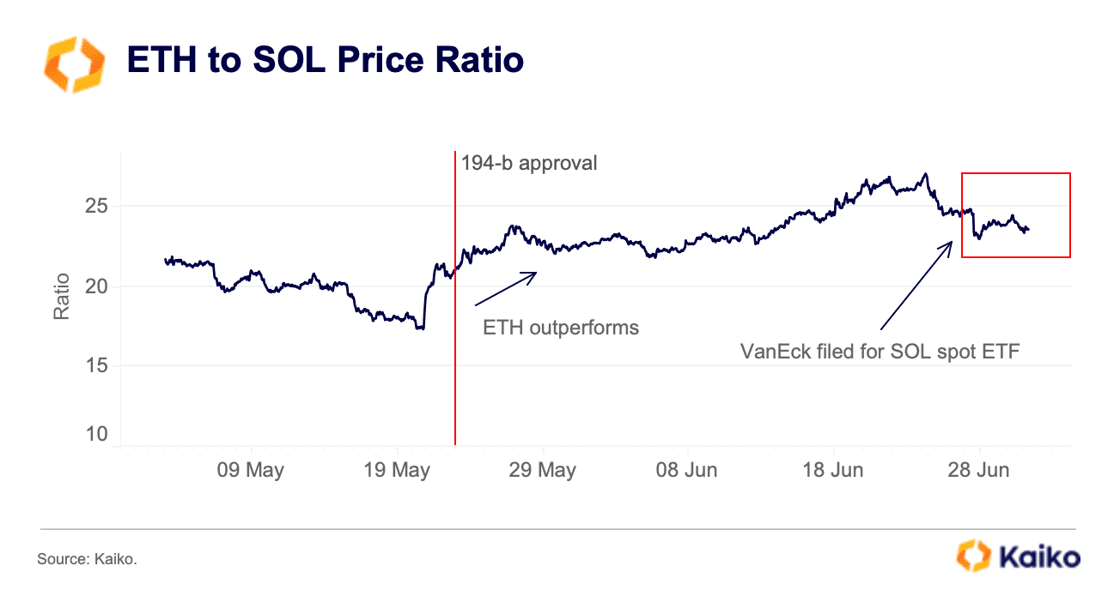

SOL recorded a net positive cumulative volume delta (CVD) of $29 million last week, with significant buying on Coinbase contributing to this increase. However, after falling in early March, the ratio of ETH to SOL has remained largely flat despite the filing of the SOL ETF.

Derivatives markets showed little reaction to the ETF news. SOL volume-weighted funds rose briefly on June 27 but quickly returned to neutral levels, indicating a lack of bullish sentiment. Open interest remains 20% below early June.

Market skepticism over the SOL ETF's chances of approval may be due to the insufficient size of the underlying market and regulatory challenges, with SOL cited in several SEC filings.

Moreover, the asset manager Hashdex presented a combined position of Bitcoin (BTC) and Ethereum (ETH) ETF last week, according to Crypto Briefing. This is a move that follows the HashKey file for the same product last month.

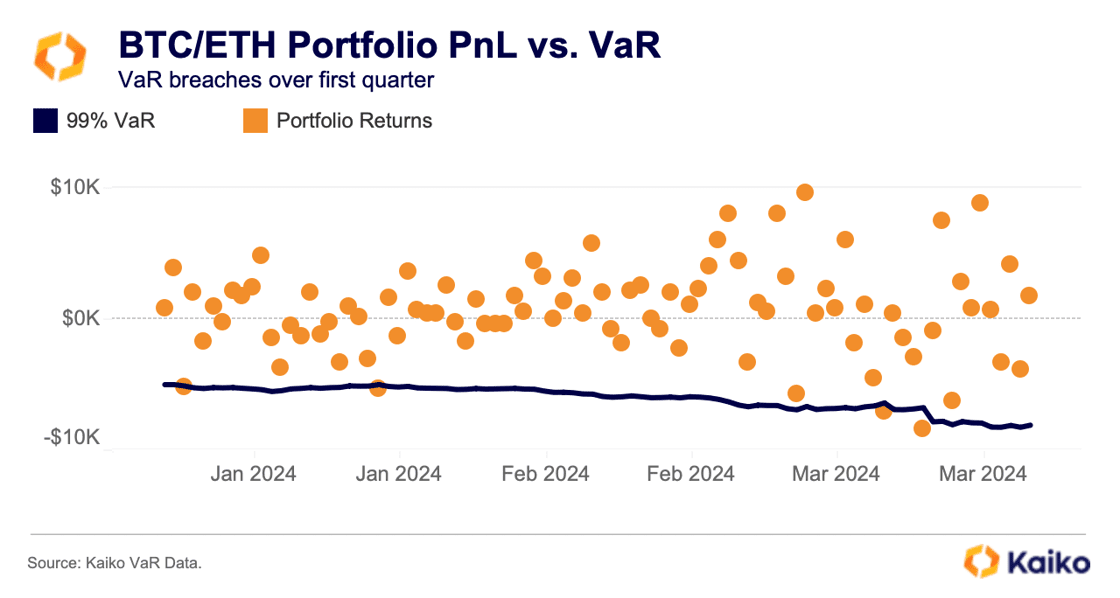

Kaiko's Value at Risk (VaR) tool predicts an equally weighted Bitcoin and Ethereum portfolio would return 58% in 2024, compared to 20.6% in 2021.

Traditional investors may be drawn to these ETFs for the high returns and improved risk profile of their BTC/ETH portfolio. Using a 99% confidence interval for VaR, the BTC/ETH portfolio maintains a manageable level of risk and the balance of gains and losses during the first quarter bull run.

Share this article

![]()