Solana Price Set For 20% Rally, Here’s Why

Solana (SOL) price is set for a major upside rally after experiencing strong selling pressure at the $161 strong resistance level. Over the past few days, SOL has dropped over 18% due to the overall bearish market sentiment and the recent drop in Bitcoin (BTC) prices.

Trend reversal signal

However, the SOL daily chart has formed a significant divergence, indicating that the downtrend may be on the upside. Since early August 2024, the SOL has been making new lows and the Relative Strength Index (RSI) has been making new lows.

A bullish divergence on the daily time frame indicates the possibility of an inverted rally. Traders and investors see this as a good buying opportunity.

Solana price forecast

According to expert technical analysis, SOL is consolidating in a tight range near the critical support level of $127. This level of support has always been unique to Solana. Since March 2024, SOL has visited this level several times, and each time has seen at least a 20% large reversal rally.

However, given the higher variance and historical price momentum, there is a strong possibility that SOL could rise by 20% to the $161 level.

Metrics and market sentiment on the chain

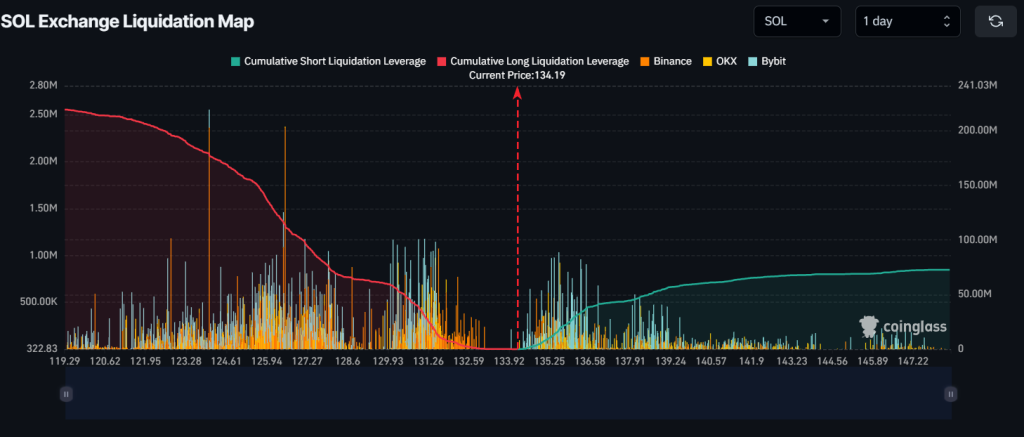

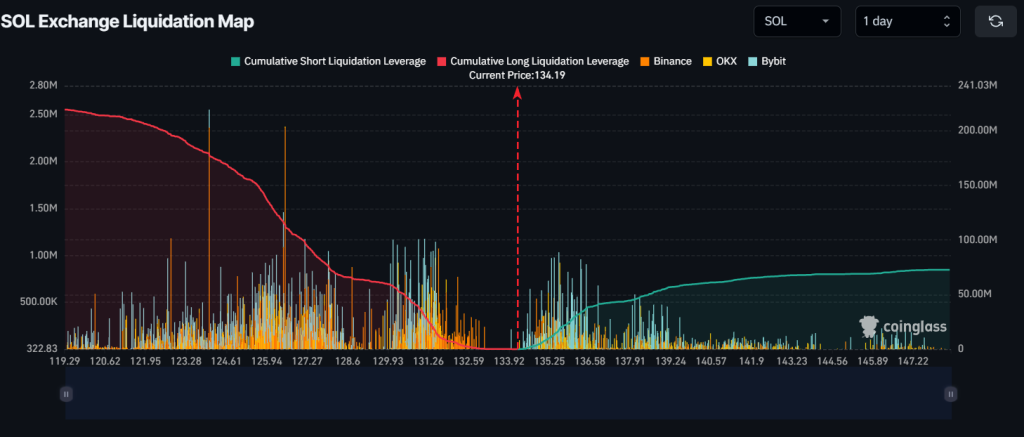

Currently, the main liquidity levels are near $126.5 on the lower side and $136.8 on the upper side, as traders are overextended at these levels, according to on-chain analytics firm Coinglass.

If the market sentiment for SOL remains bullish and the price rises to the $136.8 level, nearly $41 million worth of short positions will be lost. Conversely, if the sentiment changes and the price falls below $126.5, about $115 million of long positions will be liquidated.

The high long liquidation indicates that bulls currently dominate the asset and have the potential to destroy large short positions.

At press time, SOL is trading around $134 and has experienced a price increase of over 3% in the last 24 hours. Meanwhile, the transaction volume also increased by 65 percent during the same period.