Solana shares hit $250 for first time in three years amid SEC’s progress on Solana ETF filings

Key receivers

Solana's SOL token price rose to $250, near an all-time high amid SEC discussions with ETF issuers. The SEC has initiated discussions on S-1 forms with Solana ETF issuers such as VanEck and 21Shares.

Share this article

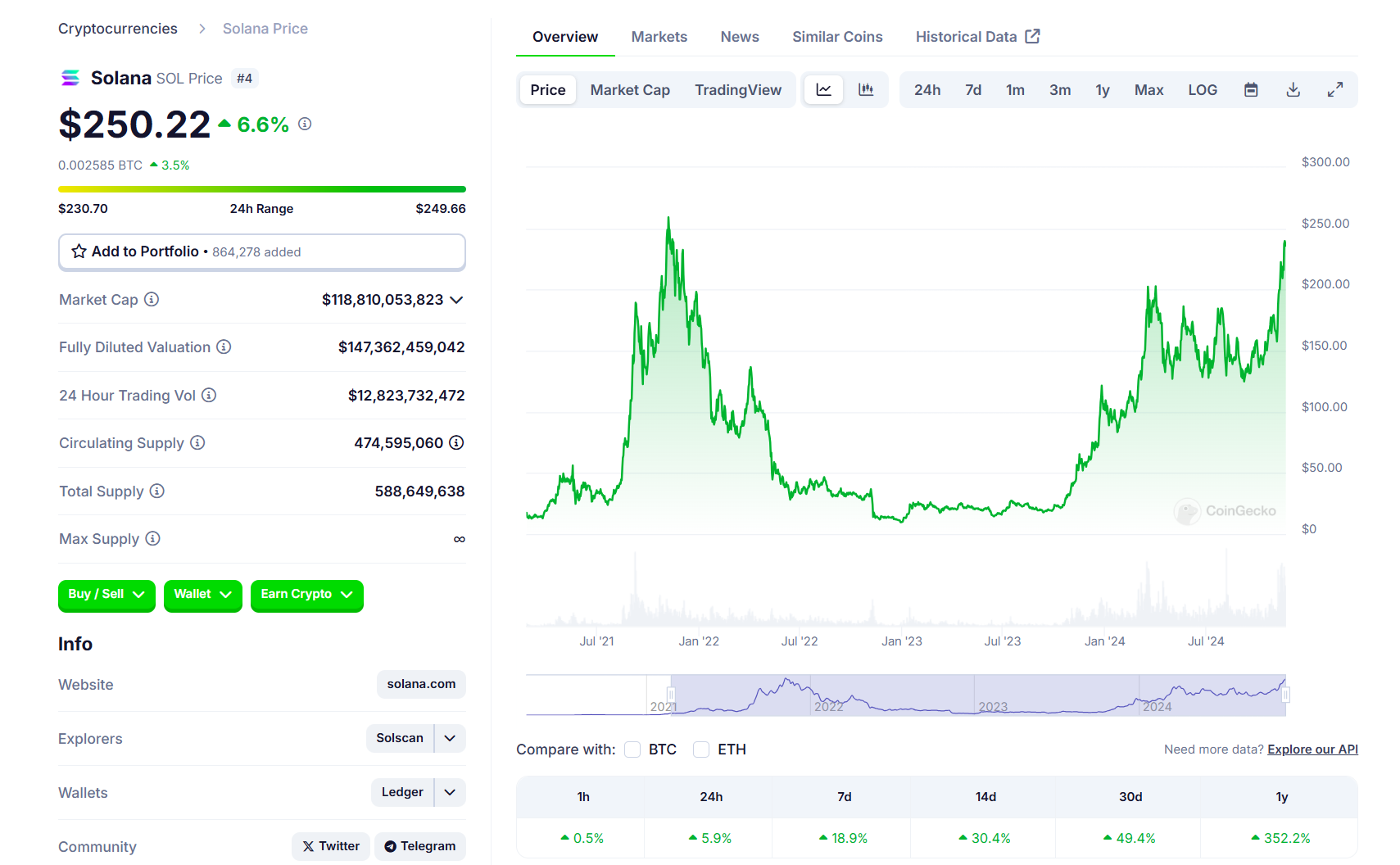

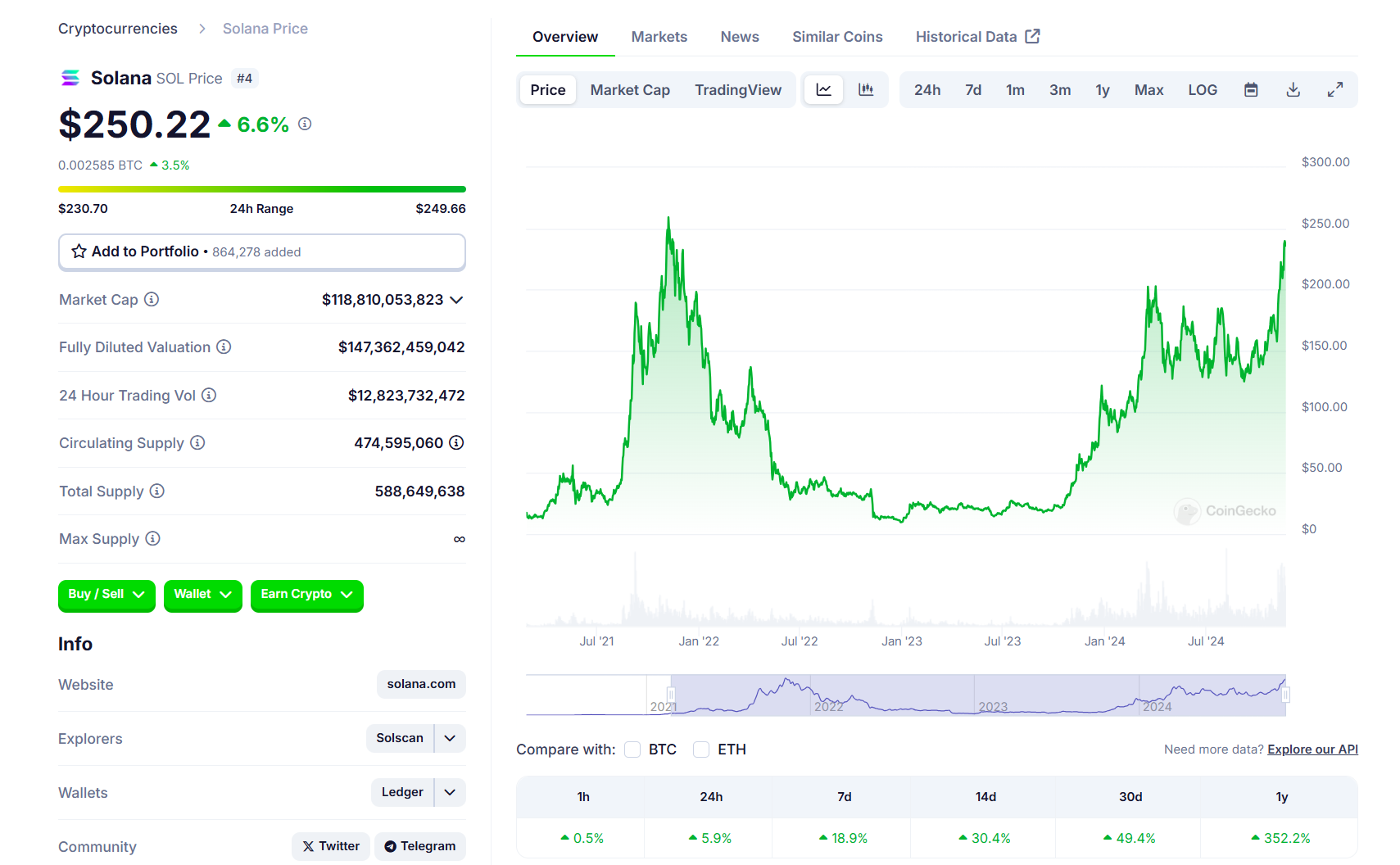

Solana's SOL token rose to $250 on Thursday morning, the highest level since November 2021. The rally shows progress in discussions between SEC staff and Solana ETF issuers.

According to CoinGecko data, the fourth-largest crypto asset is now only 4% away from its November 2021 peak of $260. If the current bullish trend continues, Solana will soon surpass its all-time high before Ethereum does.

FOX Business reporter Eleanor Terrett cited “two people familiar with the matter” as saying the SEC has begun talks with Solana's ETF issuers regarding their S-1 filings.

VanEck, 21Shares and Canary Capital filed S-1 filings for Solana ETF earlier this year. Both VanEck and 21Shares plan to list their products on the Cboe exchange if approved.

“There's a good chance we're going to see some 19b4 filings coming from exchanges on behalf of issuers — a continuation of the ETF approval process — in the coming days,” Terrett said. Those filings kick off the 240-day SEC review period.

Previous 19b-4 filings from VanEck and 21Shares were removed from Cboe's website in August, although issuers now report greater participation from SEC staff. Coupled with the upcoming pro-crypto administration, this makes us optimistic about Solana ETF approval in 2025.

Solana's ETF approval is likely tied to changes in the US political landscape. Donald Trump's re-election may lead to a new SEC leadership that is more receptive to new financial products.

“We expect the SEC to approve more crypto products than they have in the last four years,” said Matthew Siegel, head of crypto research at VanEck. “I think the chances are very high that there will be a Solana ETF transaction by the end of next year.”

Following VanEck and 21Shares, Bitwise has filed to form a trustee for the Solana ETF, scheduled for Nov. 20 in Delaware.

In addition to the Solana ETF, asset managers have filed for similar funds that invest directly in other crypto assets such as XRP and Litecoin.

Moreover, the recent launch of options trading in Bitcoin ETFs shows a growing trend among fund managers to promote investment options tailored to clients' specific needs and risk exposures.

Share this article