Solana (SOL) price trading above $100.

Solana (SOL) price is trading above the $100 level, but the 2023 high is yet to be reached.

Solana has been in neutral design since the aforementioned high. Is it hatching for him or is there rather a breakdown in store?

Solana strengthens over $100.

The weekly timeframe view for SOL has risen after falling to a low of $79 in January. It formed a series of bullish weekly candlesticks over the past two weeks, leading to a high of $119.

However, while SOL closed above the long-term Fib retracement resistance level of $100, the 2023 high of $126 was not reached. Instead, it created a slightly lower elevation.

The weekly Relative Strength Index (RSI) gives a mixed reading. The RSI is a momentum indicator that traders use to determine whether the market is overbought or oversold.

Read more: How to buy Solana (SOL).

A reading above 50 and an upward trend indicates that the bulls are still in advantage, while a reading below 50 indicates the opposite. When the indicator is above 50, it also creates a bearish divergence (green), which often precedes downward movements.

SOL Price Prediction: When will the price come out?

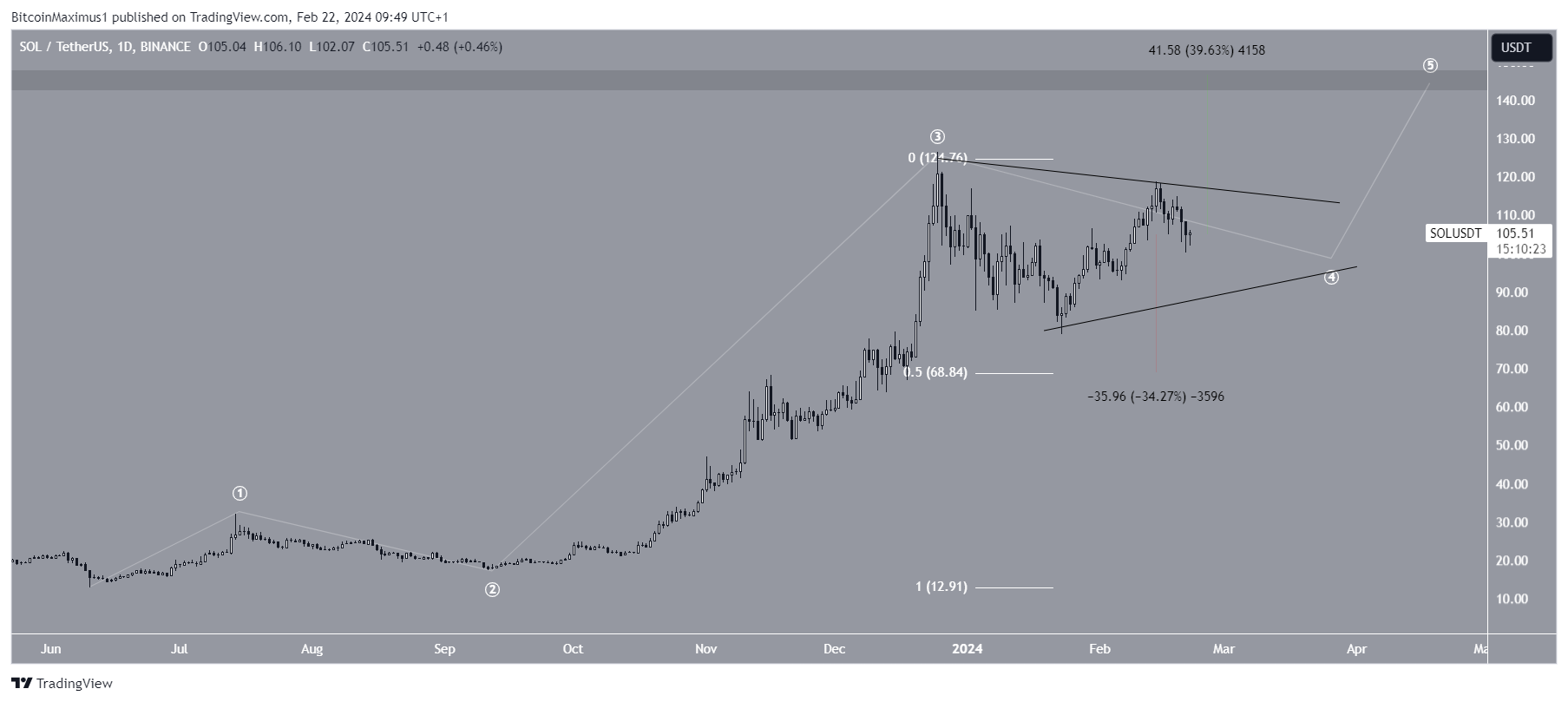

Daily time frame analysis does not confirm the direction of the trend because of mixed price action and number of waves. The price action shows that SOL may be trading in a balanced triangle from the December 25, 2023 high. A symmetrical triangle is considered a neutral pattern, meaning that both a breakout and a breakout are possible.

However, cryptocurrency trader Altcoin Sherpa pointed out that the price of SOL is in a good position to enter trades.

“$SOL: Looking right to buy around $100; this is still a very nice chart. I think just buying and holding will be the best overall strategy for most people. #solana.”

The wave count suggests that the SOL price is consolidating in anticipation of another upward move. Elliott Wave Theory involves the analysis of recurring long-term price patterns and investor psychology to determine the direction of a trend. The most predictable count suggests that SOL is in wave four of a five-wave uptrend. Wave 4 may take the shape of an equilateral triangle.

Read more: What is Solana (SOL)?

If the count is correct, the SOL will continue to strengthen in the triangle before finally disappearing. If that happens, a near 40% rally could come to the next resistance at $145.

Despite the high SOL price forecast, the breakdown of the triangle means that it is in the upper part of the area. Then the SOL could fall 35% to the 0.5 Fib retracement support level at $69.

Click here for BeInCrypto's latest crypto market analysis.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.