Solana (SOL) resists the trends of the Crypto market, eyes the $190 level

The ongoing selling pressure on the cryptocurrency market has turned the overall sentiment into a bearish trend. In this, Solana (SOL), the fifth largest cryptocurrency in the world by market value, is holding itself positive in terms of price changes and is gaining significant attention from crypto enthusiasts.

Solana Bit Bitcoin and Ethereum

In addition to this, SOL has outperformed major cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH) and Binance Coin (BNB). At press time, SOL is trading near $172 and has experienced a price increase of over 3.4% in the last 24 hours. During the same period, the trading volume fell by 20 percent, reflecting the fear among traders and investors due to the current market conditions.

Solana technical analysis and upcoming level

According to expert technical analysis, SOL looks bullish. A strong consolidation recently occurred between the $162 and $170 levels that lasted for two days. Following this breakdown, it could rise by 10% to reach the $190 level in the coming days.

As of now, SOL is trading above the 200 exponential moving average (EMA) on the daily time frame, indicating an uptrend.

In this recent crash, short sellers liquidated nearly $3.5 million worth of short positions, while bulls recorded $350,000. This liquid is now exhausted bears.

Bullish On-Chain Indicators

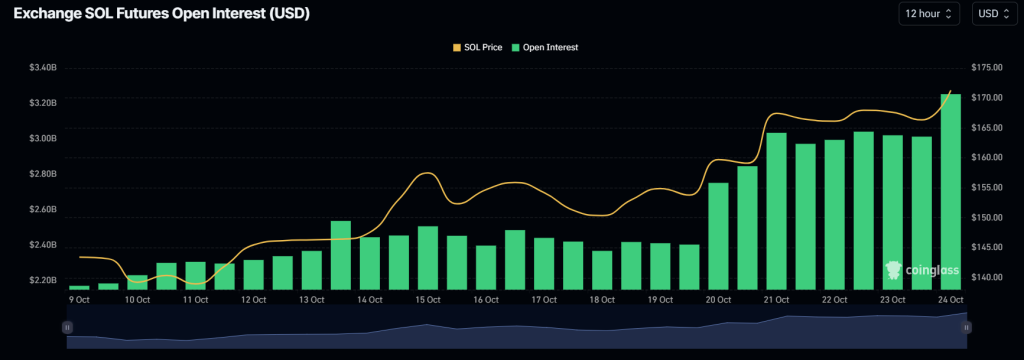

SOL's bullish attitude is further supported by chain measurements. According to on-chain analysis firm CoinGlass, the SOL Long/Short ratio currently stands at 1.02, indicating strong market sentiment among traders. Additionally, open demand jumped 11 percent, reflecting the accumulation of new positions due to recent consolidation.

Often when traders and investors build long positions, open interest and the long/short ratio increase above 1. By combining these indicators on the chain with technical analysis, the bulls are currently dominating the asset and can support the bulls hitting the target.