Solana (SOL) Set For 25% Rally, Breakout Soon?

Amid recent market volatility, SOL, the native token of the Solana blockchain, seems to be strengthening and is poised to make a new all-time high as it has formed a bullish price action pattern on the four-hour time frame. Traders and investors have shown strong strength and confidence in the property when analyzing the current outlook.

Solana (SOL) technical analysis and upcoming levels

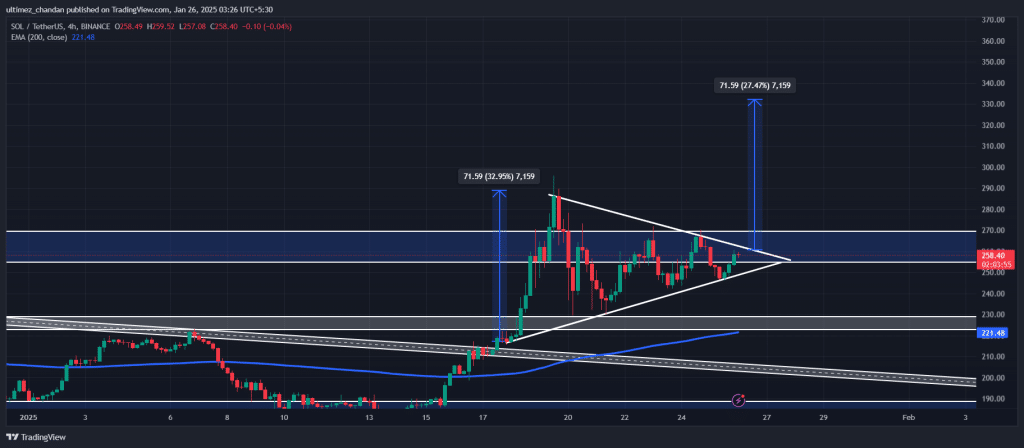

According to CoinPedia's technical analysis, SOL has formed a symmetrical triangle price action pattern and has reached a potential zone. Based on the recent price action, if SOL breaks the pattern and closes the four-hour candle above the $270 level, it may rise by 25% to reach the $330 level in the coming days.

The Relative Strength Index (RSI) at 54 indicates that SOL has the potential to break this pattern and potentially move higher.

Solana DEXs record size

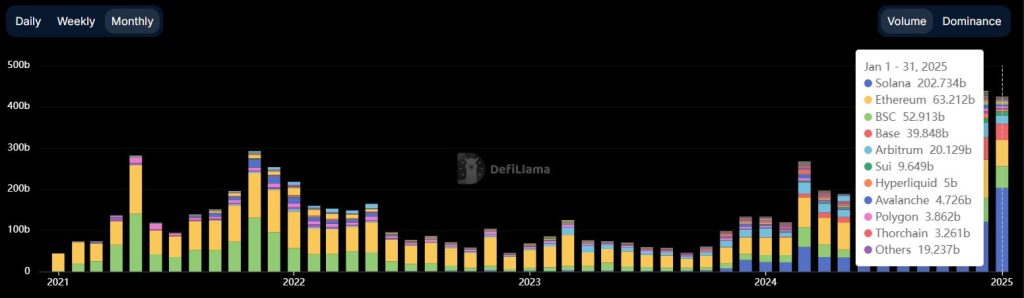

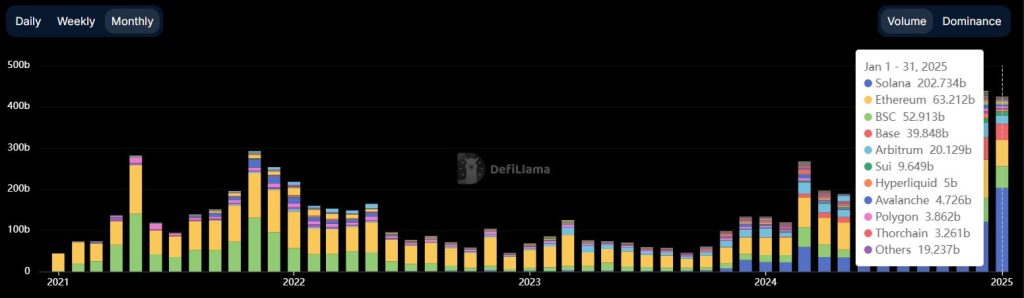

In addition to this high price action, the volume generated by decentralized exchanges (DEXs) shows that Solana is getting stronger by the day. Recently, an on-chain analysis firm, DeFillama, reported that SOL-based DEXs recorded a significant total volume of $202.7 billion, which is more than Ethereum, which only recorded $63.21 billion in the previous month.

Looking at this, SOL-based DEXs seem to be getting more attention than other DEX tools that are based on blockchain.

$40 million SOL cost

With this strong growth and record adoption, long-term holders are hoarding the token, according to on-chain analytics firm Coinglass. According to the inflow/outflow data, exchanges have seen a significant inflow of SOL worth $40.60 million in the last 24 hours.

This indicates that a large amount of the exchange flow may be accumulated by long-term holders and may create buying pressure, leading to higher volatility.

SOL is currently trading around $258 and has experienced a modest price drop of 0.50% in the last 24 hours. At the same time, the trading volume decreased by 32%, indicating lower participation of traders compared to the previous day.