Spot Bitcoin ETFs Record $243 Million Of BTC Dumps

The Bitcoin ETF recorded a $243 million outflow as markets tumbled amid Iran's missile attack on Israel. BTC price also fell, before recovering to a low above $60,300.

Bitcoin-traded funds recorded their first net outflow in two weeks, with $243 million exiting on October 2, 2024.

The outflow follows a sharp decline in the price of Bitcoin (BTC) on Tuesday as geopolitical tensions in the Middle East could be further exacerbated by Iran's attack on Israel. Bitcoin ETFs hit their first inflows since September 18, with institutional investors mostly concerned about the Middle East trend.

Bitcoin ETFs break down the income stream

On October 1, outflows meant the US spot BTC ETFs market broke an eight-day net inflow. Bitcoin ETFs saw their biggest outflow since more than $287 million was withdrawn from the market on September 3. This outflow also marked eight consecutive days.

With the exception of BlackRock's IBIT, which posted inflows of more than $40.8 million, all other ETFs saw outflows or zero net inflows.

Fidelity's FBTC led the way with a negative flow of more than $144.7 million, while Arc 21Shares' ARKB dropped more than $84.3 million. Meanwhile, there were zero net outflows for Greyscale's Mini Bitcoin Trust as well as Franklin, Invesco, Valkyrie, Wisdomtree ETFs.

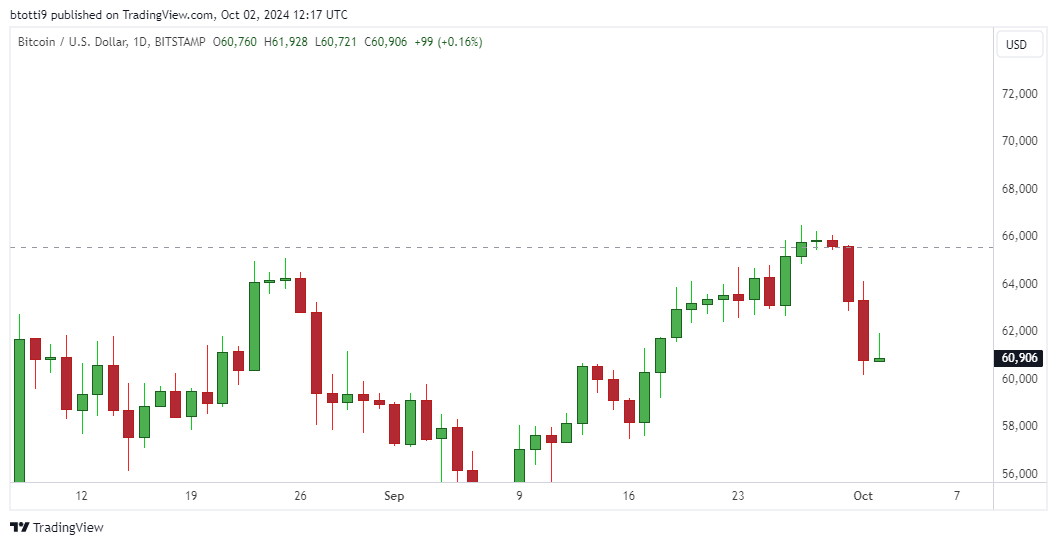

The price of BTC is back to $60.3k

Amidst these moves, the price of BTC fell more than 4%, with losses falling to $60,300 on major crypto exchanges. At over $64k, that means the bulls gave up almost 4k before finding support.

This was the best price drop for Bitcoin since September 6, when BTC fell from over $56,170 to $52,500.

When the price of BTC dropped, a major whale dumped more than $46 million in BTC on Binance. In the year Between August 29 and September 15, 2024, this particular whale accumulated 3,933 BTC worth more than $234 million.

Despite the massive selloff, the BTC whale still holds 9,736 bitcoins worth more than $601 million.

Bitcoin traded over $61k.