Stablecoin Launches for Cyber-Scammers, Sony L2 Drama: Asia Express

10 months ago Benito Santiago

Table of Contents

ToggleA stable coin for pork pickers

Telegram-based illegal marketplace Huione Guarantee has launched its own stablecoin USDH, according to security firm Ellipti.

The platform operates under Cambodia's Huyone group and is said to play a central role in enabling pork scams that use trust and relationships (often romantic relationships) to defraud victims. Hundreds of vendors on Huione's website offer illegal goods and services, including pork butchering.

Elliptic calls it the largest illegal online marketplace with up to $24 billion in transactions. Chainalysis says it has tracked an even higher transaction volume north of $49 billion.

Huione Guarantee and its users rely heavily on Tether's USDT, the world's largest stablecoin by market capitalization. But USDT comes with a feature that allows Tether to suspend blacklisted accounts, a protection widely used to combat illegal activity.

Elliptic's freeze on such assets may have partly motivated Huione Guarantee's decision to launch its own dollar currency.

According to blockchain forensics company Chinalysis, the pork scam is one of the most widespread scams. According to a study by the University of Texas, more than $75 billion has been stolen.

These scams often rely on human traffickers and kidnapped individuals who are forced to carry out the scams. Victims are imprisoned by criminals in compounds and exploited to attack others. Some of these compounds are linked to politicians in Southeast Asia.

In Cambodia, award-winning journalist Mech Dara was arrested last year for what human rights activists say was his exposure of crypto scam sites and alleged links to Senator Lee Yong Fat.

Fata, a leading member of Prime Minister Hun Manet's ruling Cambodian People's Party, faces allegations of forced labor related to human trafficking and cryptocurrency scams. The Cambodian government has been sanctioned by the US Treasury Department for allegations it has publicly condemned.

Dara Cambodia's former leader Hun Sen and current prime minister were released on bail after publicly apologizing to their son. He then announced his decision to retire from journalism.

Disgraced former Philippine mayor Alice Guo is also cited. In the year In 2019, Guo Baofu Land Developments, a company whose properties were raided to save hundreds of traffickers, was involved in a pork scam.

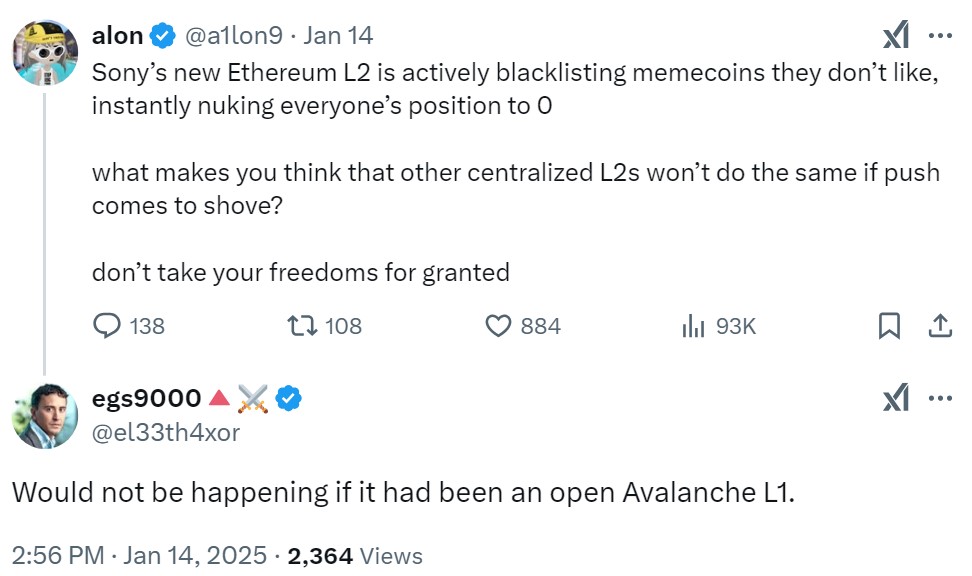

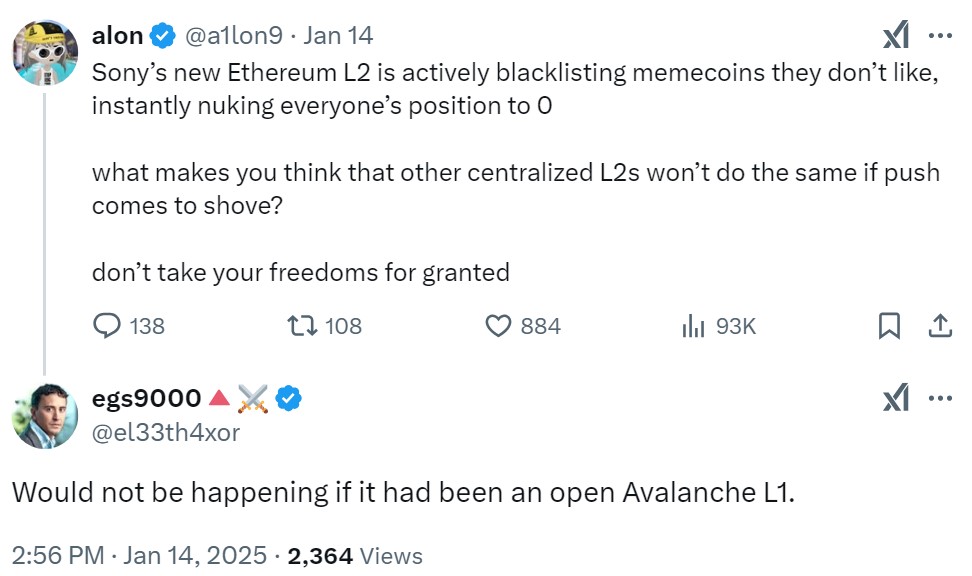

Sony's blockchain ambitions clash with decentralized ideas and memecoins.

Sony launched the Ethereum layer-2 network Sonium, but the initial controversy sparked after the platform blacklisted some memecoin contract addresses.

Blockchain participants have noticed that two token contracts have been suspended by Sonium, which has led to accusations that the chain has “corrupted” users for $100,000 worth of Ether.

Sonium director Sota Watanabe told Cointelegraph that the tokens have been blacklisted for intellectual property infringement, but added that these decisions are open to appeal. The two projects in question have launched appeals to comply with the network's policies and are updating their tokens. The embargoed list restricts public RPC's dealings with the suggested contracts, so no funds have been embargoed, he said.

Meanwhile, the crypto community has criticized the centralized nature of the permission chain. Many expressed concern that other centralized networks might follow suit, while others used the event as an opportunity to highlight the decentralization of their own platforms.

That said, community members have demonstrated that it is possible (though not easy) to get around sequence-based censorship to buy a token that is banned by forced trading on L1.

Built by Sony's blockchain arm, Sonium is built on the Optisism Foundation's OP Stack—the same framework that powers other layer-2 networks like Coinbase's Base.

The blockchain startup has partnered with Sony Pictures and Sony Music, giving fans access to exclusive content via non-exploding tokens (NFTs).

Also read

Features

How the Metaverse Works: Secrets of the Founders

Features

Australia's world-leading crypto laws are at a crossroads: the inside story

The triple vow on Lazarus

A joint statement from Japan, South Korea, and the United States says North Korea is responsible for at least $650 million in cryptocurrency theft by 2024.

The biggest heists of the year targeted Asia-based exchanges, with $308 million worth of bitcoins stolen from Japan's DMM and $235 million from India's WazirX. Even before the official announcement, security experts linked these attacks to North Korean government hackers, including the notorious Lazar group.

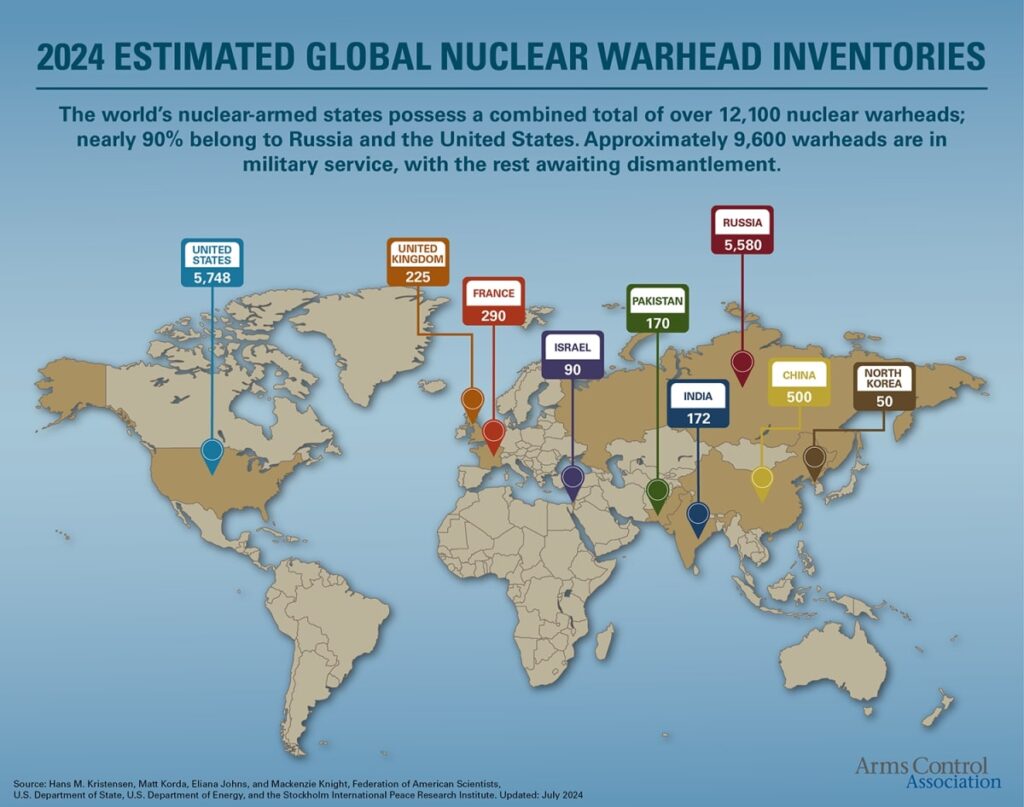

According to the United Nations, the Hermit Kingdom is using these looted funds to bankroll its weapons program. In a July 2024 briefing, the US-based Arms Control Association estimated that North Korea had developed 50 nuclear weapons. The US and Russia are depleting North Korea's arsenal with 5,748 and 5,580 warheads respectively.

The joint statement warned of a significant increase in sophisticated social engineering tactics by DPRK operatives designed to deploy malware in cyber attacks. Beyond hacking, North Korean information technology workers present a significant internal threat to the private sector. These IT operators masquerading as legitimate employees are believed to generate between $250 million and $600 million a year for the regime, according to the United Nations.

The DPRK's indiscriminate tactics and reliance on cybercrime underscore its reliance on illegal activity to sustain its ambitions. Crossed by blockchain companies and exchanges, the global crypto industry finds itself on the front lines of a shadow economic war.

Also read

Features

Influencers shilling memecoin scams face serious legal consequences.

Asia Express

Asia Express: China's NFT market, Moutai metaverse popular but difficult…

The largest South Korean exchange in limbo

Upbit has reportedly been served with a trading ban order by financial authorities for breaching Know Your Customer (KYC) and Anti-Money Laundering (AML) obligations.

According to unnamed sources cited by Mail Business Newspaper, Upbit received a preliminary notice of alleged violations from financial authorities on January 9.

If the suspension is completed, Upbit will face restrictions on new customer registrations for up to six months. Upbit must provide a statement to the authorities regarding the suspension order by the 20th.

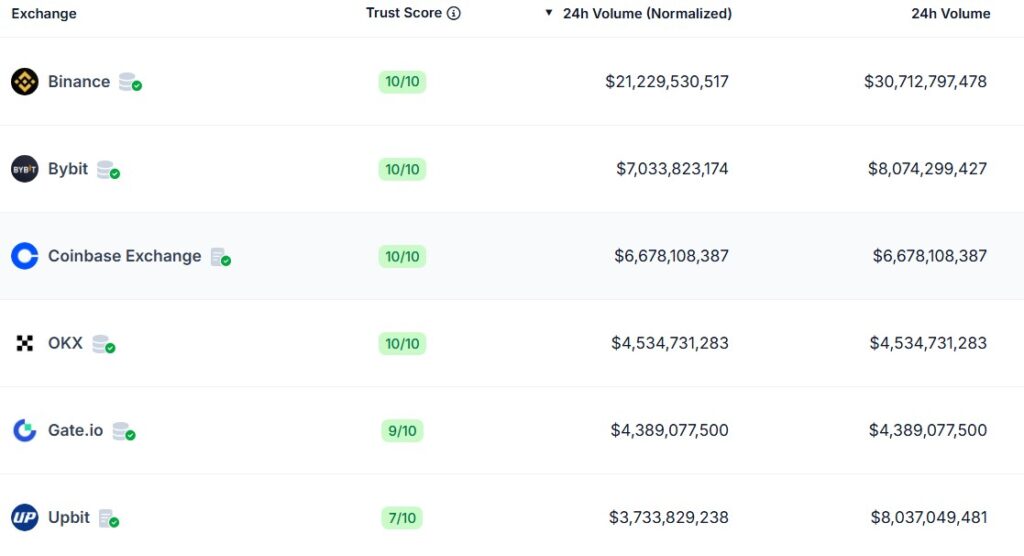

Apbit is the largest cryptocurrency exchange in South Korea, and on January 16, it ranked sixth in global 24-hour trading volume, according to CoinGecko.

The Financial Intelligence Unit's suspension order is expected to affect Upbit's ongoing business license renewal. The permit, which must be renewed every three years, expired last October and is currently under review.

FIU has begun an on-site review of Upbit's renewal application in August 2024. During the investigation, around 700,000 suspected non-compliant KYC requirements were identified.

Subscribe

A very engaging read in Blockchain. It is given once a week.

John Yun

Yohan Yun is a multimedia journalist who has been reporting on blockchain since 2017. He has contributed as an editor to crypto media outlet Forkast and covered Asian technology stories as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking and experimenting with new recipes.