Starbocks to disrupt the Japanese dollar’s 9th dollar bond market

The Bank of Japan (Boj) may soon enter the country's sovereign landscape (BOJ) in the market (BGB), which may have an impact on the Bank of Japan.

JPCO, the Tokyo-based issuer behind Japan's first non-commercial trailer, said that digital asset companies could become the capital of major government channels as they grow.

JPC revised Japan's Payment Services Act, the country's first legal framework for newspapers.

The startup has been valued at approximately $930,000, which is $10 trillion ($66 billion).

Certificates of appreciation are coordinated to operate as a tenant from the wall networks and are supported by bank deposits and jubs.

JPCO plans to sell 80% of Strackcoins in government bonds to STEDCON

The founder and CEO of Oubed, after several years of disastrous financial planning, bought the bond issuers to the buyers of the wallet.

“By buying bonds, stretccoin issuers could emerge as one of the biggest joggers in the next few years,” she said.

He added that the authorities can influence the duration of the bond period, but he added that controlling the total dates can be a challenge.

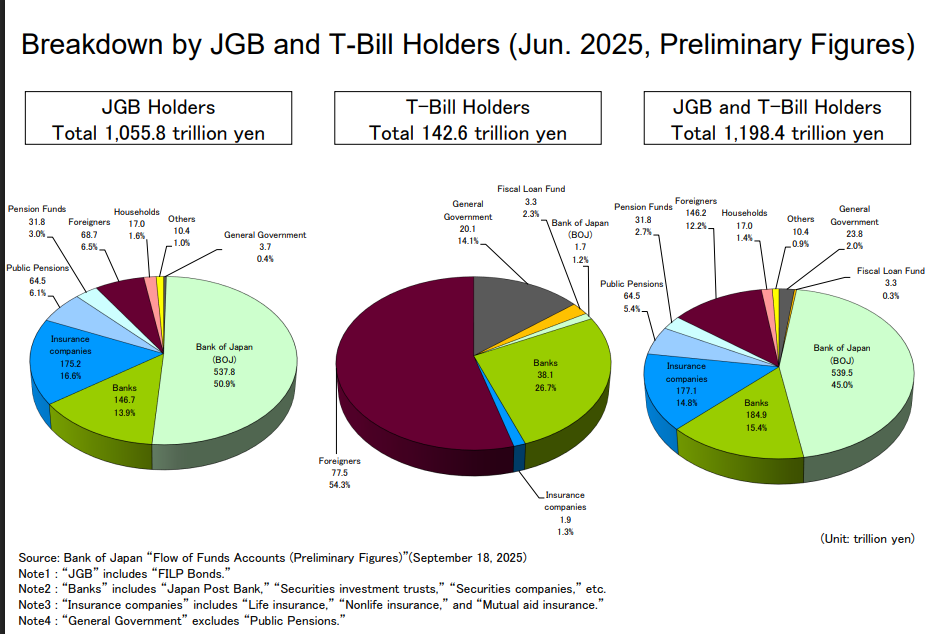

Japan's mortgage market currently accounts for 50% of the $1,055-trillion market, followed by insurance companies and domestic banks. Foreign investors and public pension accounts for small shares.

When reducing the budgets, there is certainty that the transport facilities that were cut during the ultrasound guidance palace will take the new supply, especially since the government will charge more debt to receive the spending plans.

The Oakbed chain has been able to fill this gap by spending 80% in jugs and 20% in jugs and 20% in Artbek.

Japan's cashless payments will rise to 42.8% by 2024, down from 13.2% of GPS digital finance, according to Japik's launch.

Financial Services Agency (FAA)

In the year On November 7th, Japanese banks, Mittishi Ufino Finance, and Aptoho Finance Group officially supported the payment program.

The pilot aims to develop sanctions that are baked in to relieve mutual customers who target Dorking customers in the future.

Japan aims to increase its role in digital finance through digital finance

Globally, boosters represent more than 99% of the market.

Okbed said the dollar seal will increase transaction and transaction costs for Japanese companies, while Japan's role in global digital finance could provide domestic options.

JPC offers fee-free transactions primarily to earn income. This approach is to attract real-world adoption and test an established digital NN.

As South Korea and Hong Kong as South Korea and Hong Kong, established local chains and products are regulated.

Japan's main banks are also moving towards settlement. The three megabucks, with FSA support, corporate settlement infrastructure, and USDC. They plan to execute the two tails that were killed to establish salary chains that can transfer their safety.

Japanese authorities remain cautious. Policy makers have warned that the regulated killers will weaken the role played by foreign betting systems and commercial banks.

Anyone who comes out of compliance is expected to conduct a close investigation regarding the support of the property, the rights of the purchase rights and the ability to control the cosmetics.

Closing news news analysed, cryptographic predictions