Starccoin Serverer Tater is an actor to manage rival banks in the commodity trading lender

The leading issuer, Ater, is itself to compete with the banks after it has invested approximately $1.5 billion in the market.

Pea peo po ero eradoinoin was revealed on November 14. The company is involved in everything from oil and cotton to wheat and various agricultural products.

The company arranges US dollar loans and US dollar loans backed by US Treasury bills and precious metals such as gold.

Compared to the most active banks in commodities, a minor player compared to the $200 billion billion billion billion billion dollar, it is the company's main fire protection.

Last October Ortpins covered totter pea covered spot pea covered flower tours with many companies with interesting companies first.

At the time, Anardono said: “We cannot publicly share specific investment strategies for successful trading. Our methodology is still evolving.”

He emphasized that the future prospects are “huge” with Mr. to pursue various opportunities in commodity markets.

The current product credit model

Commodity business loans are the products, merchants, traders and buyers who manage the hours and costs associated with buying, transporting and selling physical goods.

Banks have historically filled this role by bridging the gaps in the flow of money between merchants and customers' suppliers and downstream stockholders.

However, the process documents – difficult and time-consuming, but how banks have been for decades, regulatory frameworks and long-term partnerships with major business companies.

How does Tate's approach differ?

Teter merchandise. Instead of applying only to bank wires or letters of credit, it saves US dollars or USDT directly to secondary commodity traders.

Because the U.S.D.C. Transitional borders are placed immediately around the transition, especially in areas where shaving is used more in the future.

A boat can be built quickly for working capital when businessmen often need it.

In addition, peat is the opposite of rival funds and is a place where liquidity exists in markets where the asset is slow or expensive.

Traders who could incur money through the hours to process a loan in the bank or to adjust documents could get money in ASDT, enabling them to move cargo or to wait for cargo before changing the price.

Attor's push for commodity finance was followed by several high-profile failures and fraud allegations.

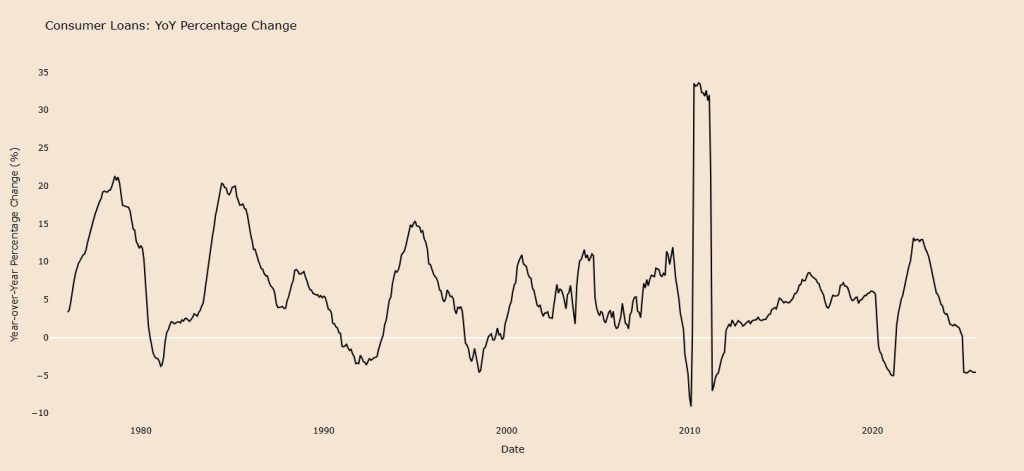

This has led to the private credit market to increase personal loans in areas where banks are willing to lend.

For Taita and other private lenders, frequent and frequent and constant interest payments in the form of frequent and frequent cycles of credit facilities are also attractive to Ormel and other private lenders.

Tenet's financial position

This year, to generate approximately $ 15 billion dollars, the largest historical issuer will not be seen without stopping at the beginning.

Earth's chief investment officer, Matt Hogwart, can beat Saudi Arabia.

Compared to the previous year, it was 183.8 billion dollars, compared to 183 billion dollars, compared to 50% in 2018.

Although the boat has kept strong raw materials, it is suggested that the company may need 20 bits for new capital from the 3 percent of proprietary wood.

Such a transaction would set Netflix and Samsung at an estimated value of close to $500 billion, putting Netflix and Samsung on par with businesses like MasterCard.

At the same time, the company holds precious metals, the gold reserves are more than 12 billion dollars.

In order to support this expansion, we have recently signed an agreement with HBCL. Board leadership in steel regions from HBC. It was attached to a metal frame.

Closing news news analysed, cryptographic predictions