Stellar (XLM) price outlook for November 2025

Stellar (XMM) entered the fiscal year on a near flat note at $0.30 on October 5. Last month there were witches, prices were up 17%, but Stellar was more stable than most of its peers – it was able to block weekly losses of more than 6%.

On paper, November was historically a strong month for Sclaulrrry. But this time things seem less convincing. Charts and chain data show mixed signals – weak, large trends, but signs of short-term regrouping to form the bottom.

Sponsored Sponsored

The previous No Noves seems to have broken Stelalr's setup

Historically, November to November cannot be predicted. The certificate of appreciation is + 58%, which looks like + 47%, like + 470% in 2024 and + in 2020.

But the average return tells the real story – (-5.6.67%), they are very meaningful.

Want more gratitude insights like these? Sign up for editorial news from editor Chu Girish.

That non-freezing system can also be seen on the short-term XLM price chart. In the year October 31, 2007

Meanwhile, the Relative Strength Index (RSI) – a measure that measures the balance between buying and selling strength – has opened higher at the same time.

The inconsistency between price and RSI is known as hidden chart divergence. He often said that even though Everlor's prices were stable, they fell forward.

Sponsored Sponsored

Unless Stellar is a strong pacemaker, this broken setup can last into early November.

Short-term cash flows show hope, but big investors are still silent

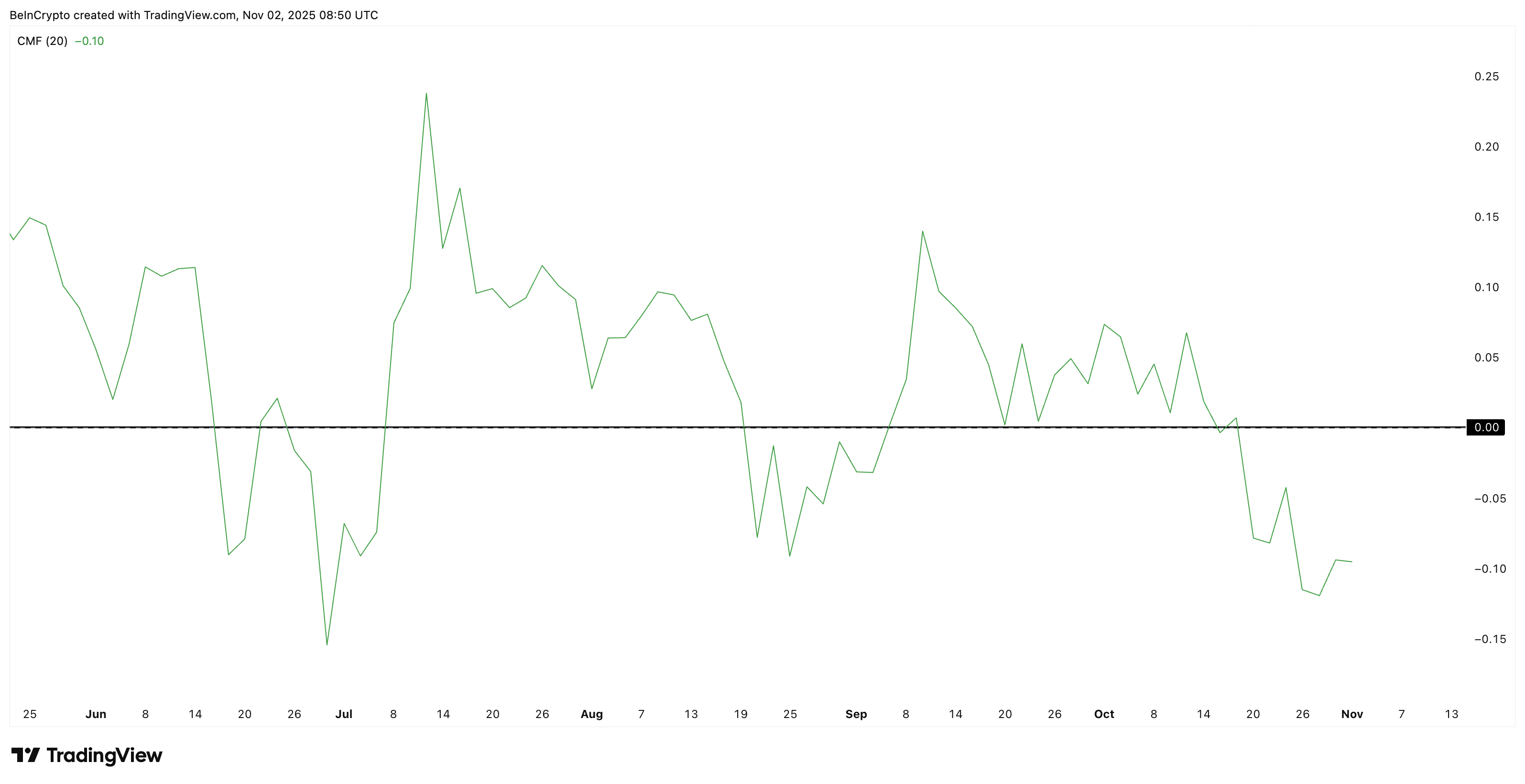

A positive sign is seen in the cash flow data. Chaikin Money Flow (CMF) – an indicator that includes whether money is going out or leaving the market – currently around +0.04.

A positive CMF means more money is moving out of it into lexlore, short-term whales may be pulling back. This does not guarantee the restoration of the trend, but usually the pressure is to buy some of it as slowly as it can sell. Moreover, the short-term CMF The price is right when it's busy.

Sponsored Sponsored

However, when you visit the two-day chart of the CMEF, the CAMA.P.10 is still sitting nearby, indicating that the broader stocks have not yet returned strongly.

Although this will be a short-term flow until there is no recovery, the recovery will probably be short-lived.

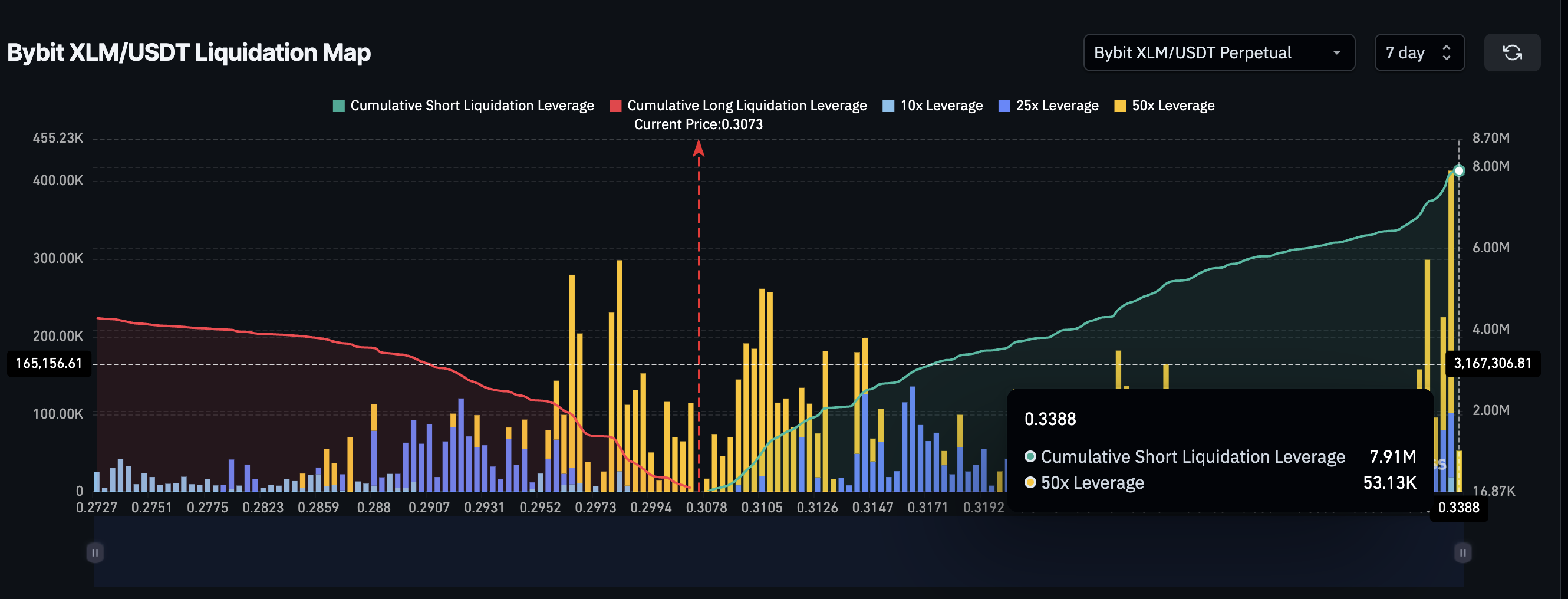

Another thing that adds to the tension is the 7-day baseline data from Betbit. It shows approximately 7.9 million dollars in the short distance compared to 4.3 million dollars below – about 84% of them.

This imbalance indicates that a short snack may occur if the drink comes out a little. That forces short traders to buy back to buy and short to increase the use of work.

Sponsored Sponsored

But for now, that leveraged consolidation is entirely based on short-term cash flow — and it doesn't change the bigger picture.

The Stellar price chart shows a tight range and key levels

In the 2-day chart, in the 2-day chart, in the technical triangle, the structure reflects when buyers and sellers move in balance, but never dominate. Prices remained in the range of $0.27 to $0.35 for days to show maturity.

If Stellar is below $0.27, if below $0.27, the lower trend line of this triangle is opening the way to $0.21 and possibly $0.19. This proves that the weakness of October is still dominant.

If the price of XLM stays above $0.35 and closes the previous $0.37, the upper part can be re-estimated and try to reach $0.47. Any further strength could push it to $0.52. However, the short-term ASSASS indicates that there is still a limited period of time to support such activity.

In general, in November, the direction of the price of svilella is consistent with the first trend, which crop. Weak Rsi-Lo breeding moment is low, at least for now.