Strategy can be eliminated by finding a program that is fragmented with asset displacements

key atways

The lack of strategic market premium is now widening the risk of cutting the company from the main equity indicators. Analysts at JapanMona said MSCI could cost them as much as $2.8 billion if it bans billions of shares in other index-linked funds.

Share this article

If the strategy is dead, it affects the risk of execution of fair indicators. According to Bloomberg, Japanese stocks have warned that the company may lose its position in the mirror, such as MSCI America and Nasdaq 100.

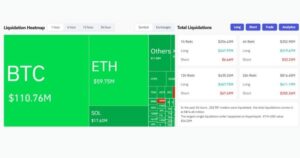

MSCI estimated that if companies with digital assets accounted for more than half of their total assets, they could be replaced at a rate of more than $2.8 billion if applied to the strategy.

The integrated mass bubble driver is more accurate than the integrated balance sheet of the integrated bidirectional balance sheet.

As the pressure shifts to select stocks, the sustainability of the model once seen in market play and bitcoin appreciation is being questioned.

After completing market consultations on digital asset exclusion policies, MSCI expects to announce its intentions.