Strong earnings from Nivesia from $ 100 per kg.

Key controls

Q1 2025 Fracture and the market conditions of Orvistors can combine from $98,000 to $100,000 to $100,000 to $100,000 before implementation.

A bearish price forecast could prompt an analyst to suggest that a war collapse could open the door to a deep correction.

Bitcoin (BTC) fears of a bullish earnings bubble after a better-than-expected earnings outlook from Nvidia, but the sentiment was quickly overturned as shares traded above the 700-point rally.

Why do markets crash? Explanation of our logic

There is only one subject that is even partially structured for such a sudden market collapse.

In the year At 11:20 E et et, the US Department of Labor said that the “November and October employment agreement” will leave school … pic.totter.com/zubenqStrite.com/zubnqStdd5l

— Kobester Letter (@koberisterter) No. November 20, 2025

Bitcoin fell to a new monthly low of $86,400, and data points to further downside on the way.

Bitcoin mirrors Q1 QURARESIRLER breakout-analyzer

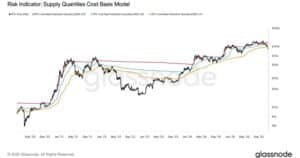

Bitcoin's latest pull is run by the same GRALESE investment officer Abibe, which opened in Q1 2025.

At that time B.C.C. The rate of loss increased during the period of punishment, before breaking out of the upper support level and the multi-week stock range, from the time when the stock market broke out of the head high.

The Abel chart below shows that in the recent months, the analysis will enter dynamically with the recent months, “3 to 4 weeks to $100,000 at $8,000” can compile from $100,000 to $100,000.

Most importantly, both corrections are prescribed in a broad macro.

In Q1 2025, the wire was canceled by the US tariff war. At this point, the catalyst is that worries about technology bubbles have been brutally filled with worries about technology stocks before the emerging markets have become reflective of the emerging markets.

By the end of the year, Bitcoin will grow to a resistance of 100,000 USD.

Analysis of creatinine in the urine (channel) and growth-stimulating conditions, despite the fact that the conditions of picone descent are more ordered, the analysis supports the applied adult view.

During the initial corrections, the repeated accumulation zone, the repeated accumulation area BACC rotated near the border of this multi-week low.

In addition, Bitcoin's weekly relative strength index (RSI) has entered the initial range for the first time in months.

Related $90K Bitcoin Price ‘Close Your Eyes and Bid Chance: Analysis

Taken together, these symptoms are possible symptoms of possible symptoms

Slashing spin interest $30,000 BTC price target lama

Analyzing Alexandrobacti took a very sheltered position, saying that it was officially prescribed from the big high marriage plan that he would get in many months.

In the technical analysis of the kinematics, the risk of loss of the Stright that is worried usually indicates a significant decline in the measured activity with the measured content.

In this case, Alejandrobak argues for a long-term buying project near the $30,000 level, which is a level that corresponds to several historical support zones on the weekly chart.

This article does not contain investment advice or recommendations. Every investment and business activity involves risk, and readers should do their own research when making a decision.