Supply compression and parabolic bull run

Supply and demand volatility has set the stage for a parabolic bull run as the cryptocurrency market nears its expected Bitcoin halving on April 25, 2024.

Unlike previous cycles, this year marks the beginning of a bigger picture for Bitcoin, with institutional adoption growing and use cases expanding.

Why Bitcoin exchange positions in a parabolic bull run

The approval and success of Bitcoin exchange-traded funds (ETFs) marked a historic milestone in the crypto journey. Since its inception, Bitcoin has experienced a whopping 60% price growth, with transaction volumes reaching unprecedented highs.

The influx of institutional interest in Bitcoin ETFs has attracted more than $30 billion in assets under management in just two months. This surge in demand is reflected in the record-breaking $1 billion revenue in one day. Meanwhile, net flows exceed $10 billion, and daily revenues triple daily supply.

This situation is set to intensify post-halving, with ETFs holding more than 467,000 BTC, excluding Grayscale, far exceeding Bitcoin's annual supply of 164,000 BTC.

Current demand for BTC has taken about 4.5% of its available supply. Therefore, the rising number of Bitcoin ETFs could create a supply glut.

According to the roughly $114 trillion investment advisers in the U.S. are mandated to wait 90 days before launching a new product, allocating just 1% to Bitcoin could double its current market value and cause a supply glut. process,” 21Shares analysts wrote.

Read more: Bitcoin Half Cycles and Investment Strategies: What You Need to Know

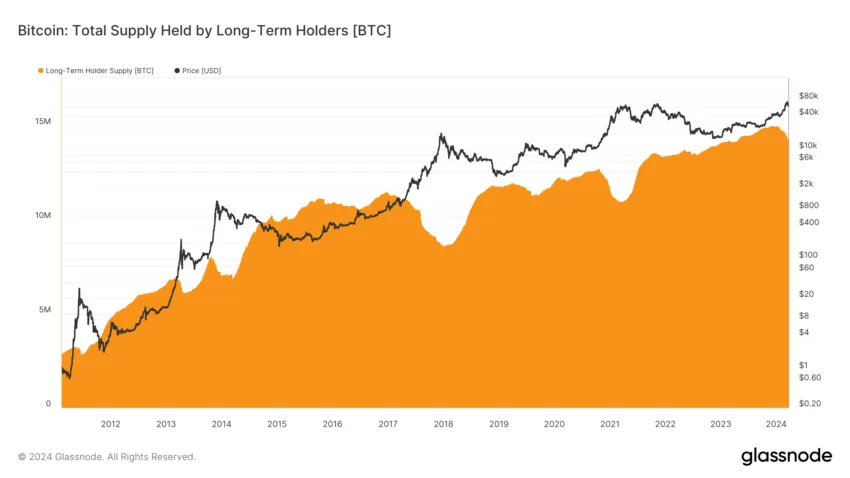

The steadfast belief of long-term Bitcoin holders also shows unwavering faith in Bitcoin's value proposition despite market volatility. The supply held by these long-term investors remains at 70 percent of the total circulating supply.

Meanwhile, the supply held by short-term suppliers has grown by more than 33%, limiting supply and hinting at an impending price hike.

According to 21Shares analysts, Bitcoin's upcoming halving on April 25, 2024, coupled with this backdrop, suggests that the cryptocurrency market may be on a unique and unprecedented bullish cycle. With ETFs drawing in a new wave of traditional investing and the unshakable confidence of long- and short-term holders, Bitcoin's supply limits are becoming ever-increasing.

“If this trend continues, Bitcoin's supply side will continue to shrink, laying the groundwork for supply congestion and the start of a parabolic bull run,” 21Shares analysts said.

Read more: Bitcoin price prediction for 2024/2025/2030

Acknowledging Bitcoin's inherent volatility as the 2024 halving approaches, the current environment looks set for a major upside. This cycle may differ from previous ones and usher in a new era of institutional adoption and financial recognition.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.