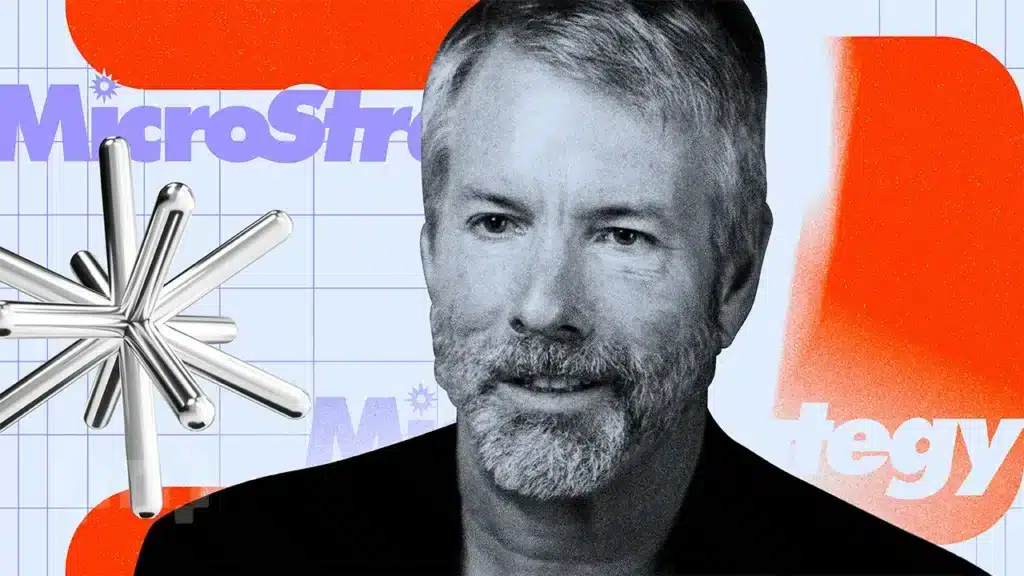

Surprising $ 46 billion?

Micro strategic, software company has been associated with Bitcode Jaggeon, and the unexpected tax controversy is getting an unexpected tax controversy. The $ 47 billion of $ 18 billion dollars – as $ 18 billion dollars – just put the Camt of the US Corporate option in the node of the US Corporate option.

The tax company may force the tax company to pay the federal income tax on paper profits in the 2022 inflation rate of inflation.

Micro strategy suffer for Crypto

Typically, they do not be punished until the profit of investment are sold. However, Camt, companies are implemented by the revenues of 15% tax rate, which is designed to avoid revenue by the tax revenue.

Microstone in January said that the cost of bitcoin cost is calm, since 2026, since 2026, it has been billions of debt. If IRS free taxes such as Berkshire Hathhaway, it did not extend to me the same insertion with Crypter Code.

According to Robert Wils, Robert Wils, the Cryptic Dinemarkics may play a technical.

“Freedom of Baden's administration will be no reality,” says Wall Street Journalns.

Micro strategy focuses on a powerful assignment of the Business model focuses on a powerful assignment of the company, which has earned $ 92 billion market. However, this strategy has made the marketing structure and vulnerable to control. If the Microstigger is forced to pay taxes on non-profit extension, Microtigi may need to sell some of the Bitcoin South by wearing the main style.

Such a situation will make a microstrarty of a microstrarty that you find Bitcoin exposure. The company planned $ 2 billion stock, but it is dismissed assumptions for a pause of Bitcoin purchases during my speech.

Math changes include complexity

New rules of the FASB is complicated by the FASB. Since this year, companies must report on their records of confidential currencies. Micro strategy reports that this change increases up to 128 billion dollars and $ 4 billion to $ 4 billion.

This shifter is affected by a microstiginal bitscoon bitscoon. Such results are more vulnerable to control control and variables.

Micro strategy is both blessing and curse. On the one hand, it has imported the company to Nastadar -100, which strengthen the name of the gaurry in the corporate clippie investment. On the other hand, it has exposed the organization to unexpected accidents, which may be a tix account that can destroy a profit or force the property of property.

Tax dirt is not a concern only. IRS has been prepared to start tracking tracking corplical translations, which shows a wide range of control testimony.

Micro structure Fatless Amond Recognition Speed - Lately 1.1 billion of $ 1.1 billion and stock supplies. Some view it careless, others view it as a long-term place on the superiority of bitcoin. The company has recently purchased $ 243 million in January this year, even a matter of danger.

When IRS prepares the regulations of the CAMT application, Microstig is trying to be free for Crypto content for Crypto. If IRS offers such a relief, the company can avoid the bill. However, the results may be difficult if the betcoin cost cannot be realized or discharged.

The Bitcoin approach will stop being $ 46 billion courage for the market, micro strategy. The corporate strategy, an arpograph strategy, can re-spell it again.

Missing

By complying with the guidance of acestry, beincrypto is committed to reporting a clear, clear reporting. This news report is important to provide accurate and up-to-date information. However, readers will be individually and recommend facts individually before making any decisions on this content. Please note that our terms and circumstances, privacy policy and responsibility is made.