Telegram Linked Toncoin (TON) Set For 50% Rally, Why?

So far, Telegram-linked Toncoin (TON) has not benefited from Donald Trump's presidential victory, unlike other cryptocurrencies over the past few days. However, the tone has started to change, and the property is ready for the popular rally that has been missed in recent days.

Why is the price of TonCoin increasing?

This positive hypothesis is driven not only by the overall bullish market sentiment and Trump's presidential victory, but also by strong price action and significant participation by investors and traders over the past 24 hours.

Toncoin (Ton) technical analysis and upcoming levels

According to CoinPedia's technical analysis, TON has broken out of the downtrend and horizontal resistance levels it has been facing since July 2024 and early September 2024. Based on Ton's daily chart, this level has historically served as a selling pressure area with significant price declines.

However, with the recent conflict in Tons, there seem to be no significant obstacles preventing the asset from rising in the coming days. Based on the recent price action, if Ton closes the daily candle above the $5.45 level, there is a good chance that it could rise by 50% to reach the $8.25 level in the near term.

Currently, the asset is trading above the 50 Simple Moving Average (SMA) and below the 200 SMA on a daily basis, indicating a downtrend.

Bullish On-Chain Indicators

Along with technical analysis, metrics across the chain further support Toon's bullish view. According to Chain Analysis Koingles, Ton's long/short ratio currently stands at 1.05, indicating strong bullish sentiment among traders.

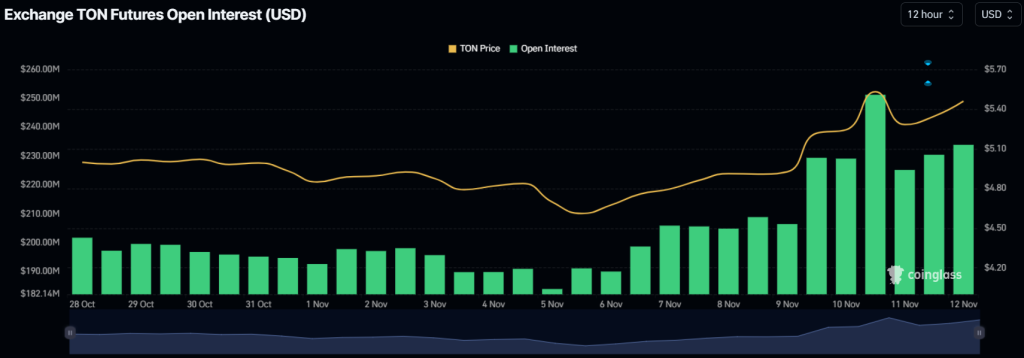

In addition, traders have started to participate in Toncoin following the bullish crash. Data shows that open interest in Tons has increased by 8.4% in the last 24 hours and by 6.35% in the last four hours, indicating an increase in vacancies compared to the previous day.

Current price momentum

As of now, Ton is trading at the $5.50 level and has seen a price increase of over 4.90% in the last 24 hours. During the same period, the transaction volume decreased by 4.5 percent and increased by 2.5 percent.