Tera Blockchain is stopped

Key receivers

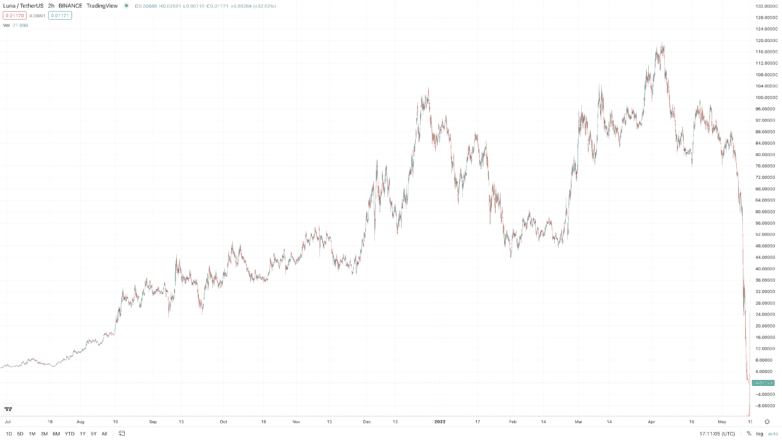

In response to the ongoing LUNA and UST crisis, Terra validators have suspended the blockchain. With UST losing its peg on the dollar, LUNA is in a death spiral. It broke below a penny today. According to Terra, the network will restart when 2/3 of the voting power comes online. However, the future of the project is up in the air after this week.

Share this article

The growth follows LUNA's death spiral and decline of less than one percent.

Terra Blockchain on hiatus

The Terra blockchain has stopped.

The Terra blockchain has officially stopped at the height of 7603700.

Following severe $LUNA inflation and a drastic reduction in attack costs, Terra validators have decided to shut down the Terra chain to prevent administrative attacks.

— Terra (UST) 🌍 Powered by LUNA 🌕 (@terra_money) May 12, 2022

Terraform Labs, the development firm behind the ill-fated network, confirmed that the blockchain had stalled at a block height of 7603700 in a late Thursday update.

Their Twitter account reads:

“Terra's verifiers have decided to stop the Terra chain to prevent serious administrative attacks $LUNA Inflation and the cost of violence are greatly reduced.

Terraform Labs later shared a patch to disable additional delegation before validators restarted the network. He added that the network will restart when 2/3 voting power comes online.

The update comes as the Terra UST stablecoin continues to struggle to maintain its peg against the dollar. The algorithmically stable coin first fell below its target price on Saturday and failed to return to the peg this week. At runtime, Terra incorporates a design mechanism that uses LUNA to stabilize the UST value. Arbitrageurs can burn LUNA worth 1 UST to $1 when the UST price trades above $1 USD and when the UST price falls below the peg. However, UST experienced intense selling pressure this week amid adverse market conditions. As a result, the UST owners rushed to leave their positions, and LUNA collapsed and went into a death spiral. As more and more UST holders began producing more LUNA, the supply increased exponentially, breaking over 25 billion tokens today. LUNA broke below a penny this afternoon. Just a week ago it was trading around $80.

The cost of attacking the network is greatly reduced as the cost of LUNA is now effectively zero. The market value of the blockchain is now more than 400 million dollars. When LUNA cost $80, the value of the network was around $30 billion.

This week's loss has been described as the most unprecedented in crypto history. While many algorithmic stablecoin projects have failed in the past, including the Basis Cash project that Terraform Labs CEO Do Kwon is said to have created, none have had as high a rise and fall as Terra. Once one of the world's largest Layer 1 blockchains alongside the likes of Solana, Avalanche and Ethereum, in a matter of weeks Terra has become one of crypto's most spectacular failures.

Update: Today around 18:00 UTC, Terra blockchain resumed block production.

Disclosure: At the time of writing, the author of this article owns ETH and several other cryptocurrencies.

Share this article

The information on or included in this website is obtained from independent sources that we believe to be accurate and reliable, but we make no representations or warranties as to the timeliness, completeness or accuracy of any information on or accessible from this website. . Decentralized Media, Inc. Not an investment advisor. We do not provide personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may be out of date, or may be incomplete or incorrect. We may, but are not obligated to, update any outdated, incomplete or inaccurate information.

You should not make an investment decision in an ICO, IEO or other investment based on the information on this website and you should never interpret or rely on any information on this website as investment advice. If you are seeking investment advice on an ICO, IEO or other investment, we strongly recommend that you consult a licensed investment advisor or other qualified financial professional. We do not receive compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities or commodities.

See full terms and conditions.