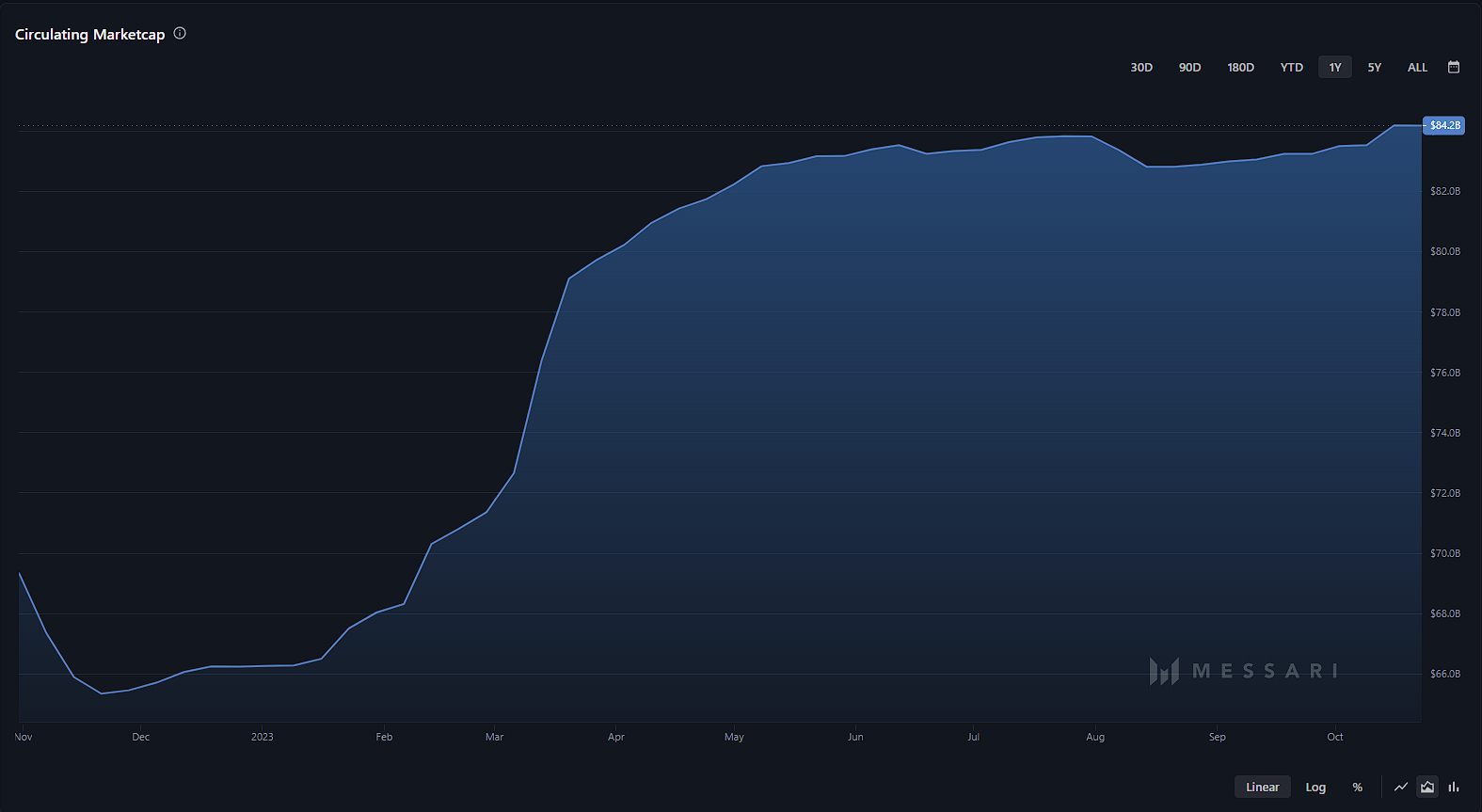

Tether’s USDT supply reached $84 billion in the middle of the market

Tether's stablecoin USDT hit an all-time high on October 21, surpassing the $84 billion supply mark. Data from Masari indicates a $1 billion increase over the week, in line with the current market rally – fueled by positive sentiment over the adoption of the 2023 Bitcoin Spot Currency Fund (ETF).

Resilience amid market challenges

Tether's market capitalization dropped to $66 billion last year amid a challenging climate that saw the collapse of crypto firms such as FTX and Three Arrows Capital. Doubts also arose over the stability of the reserves.

Despite these setbacks, Tether has shown resilience. Thanks to the favorable market conditions and the struggles of its rivals such as Binance USD (BUSD) and USD Coin (USDC), it has managed to increase its token supply by $18 billion this year alone.

Earlier this year, regulatory actions against its competitors further strengthened Tether's position in the market. New York's Department of Financial Services ordered BUSD provider Paxos to stop further innovation.

Subsequently, the US Securities and Exchange Commission classified BUSD as a security. These events have resulted in a significant drop in BUSD supply, falling from a peak of $22 billion in November 2022 to $2 billion currently.

Market dominance is reinforced by external factors.

Another competitor, USDC, ran into problems when it was revealed that it was exposed to a failed crypto-friendly Silicon Valley bank. Although the stablecoin has briefly recovered, circulation has steadily declined despite the improving market. Such factors have contributed to Tether's continued dominance of growth, with DeFillama data showing that it now commands about 70% of market capitalization.

Tether CEO Paolo Arduino celebrated this achievement with an “84B $USDt” post on social media platform X.

With widespread cryptocurrency investment and market stability, Tether USDT reaching $84 billion in supply is more than a milestone. Investor confidence in statcoin serves as a safe harbor indicator, especially when competing alternatives face regulatory and financial hurdles. This development may reflect broader market sentiment, which is leaning toward optimism.