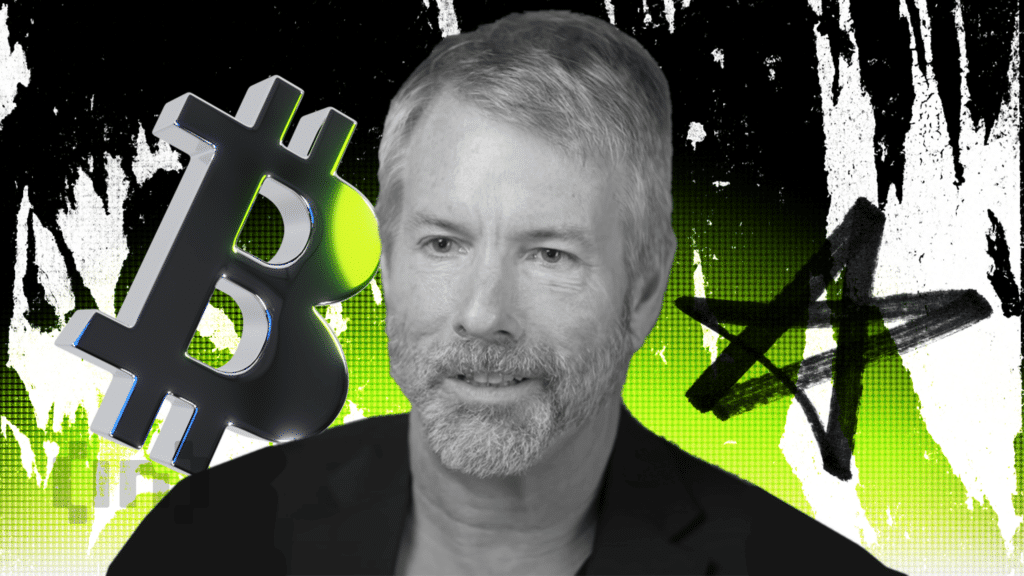

That’s why Saylor’s micro strategy was to buy more bitcoins

MicroStrategy Chairman Michael Saylor announced that his company bought another 5,262 bitcoins. This purchase cost $561 million and continued the plan to acquire permanent BTC.

However, rumors are circulating that the company may put these acquisitions on hold in January, as the company has been added to the NASDAQ-100.

Saylor buys more Bitcoin

A recent purchase, this marks MicroStrategy's third bitcoin purchase in December alone. Just last week, the company bought $1.5 billion worth of BTC at an average price of $100,386. Under Saylor's leadership, the firm has become one of the world's largest bitcoin holders and shows no signs of stopping.

“MicroStrategy bought 5,262 BTC for ~$561 million at ~$106,662 per bitcoin, and BTC gained 47.4% QTD and 73.7% YTD. Since 12/22/2024, we have acquired 444,262 BTC for ~$27.7 billion at ~$62,257 per bitcoin,” Salor said.

Since the general crypto bull run in November, Saylor has shown interest in buying large amounts of Bitcoin. So far, the property has been yielding high yields as the value of the property continues to rise. Recently, he also teased a big BTC buy to signal MicroStrategy's inclusion in the NASDAQ-100.

However, rumors are circulating that MicroStrategy may be putting a pause on these BTC purchases since January. Since the company was added to the NASDAQ-100 and quarterly earnings reports are coming early next. Annually, Saylor may implement a self-imposed blackout period that prohibits any purchase of Bitcoin.

The company's recent moves have resulted in higher production, but they may present a double-edged sword to itself and the wider market. Saylor has materially contributed to “decentralization” in the Bitcoin economy, and his company has surpassed Bitcoin's exponential growth rate.

Therefore, BTC volatility may have an excessive impact on MSTR's stock market performance. In the past week alone, Bitcoin is down nearly 12%, and MSTR's stock price is down more than 15%.

But for now, this BTC buying pattern seems to be stable. Whether or not Saylor approves the rumored pause in January, more high-profile acquisitions in the final week of December are still plausible.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.