The B.C. Rovivers Rocks Specs Priced at $93k at $93k: What’s Next?

Bitcoin (BTC) tried to close above the resistance zone last week when it hovered above $93,300. However, on Monday, the price below $85,000 was BTC.

Key controls

Bitcoin's failure to close above $9300 has improved to a fixed trend line with $93,000.

Without hot spot demand, Bitcoin can reach between $80,600 and $96,000 until one of the other levels declines.

The place buyers have a sense of security

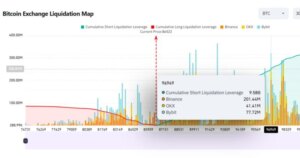

Thin spot liquidity and weak order book depth are the main faults in BACC when trying to move above $93,000. Although the dense cost – $14,000 is placed in this region, there are more than 400,000 BTS in “400,000 bits” Ochatin floor.

Despite the strong historical stock, no active pressure was found between $84,000 and $90,000. Meanwhile, many short-term bearers have the market in the low liquidity zone from $104,600 compared to their comparison.

From 2018 “From 2018” From 2018 “From 2018” From 2018 Historically, such a very dangerous table with young people have major risks.

Although the need for space is weak, the prescribed excessive diving person's copy of the driving force is manual, but currently sitting idle.

Related BTC Price Analysis: Bitcoin Could Eat Another 50%

Bitcoin can travel in front of the next form

Bitcoin is now at $96,000 (recently (the top of the immediate range)) and $80,600-$84,000 (based on Onochinat cost) floor. Liquidity continues on both sides, which means that the breakout in both directions is stimulating the mechanism.

In terms of background, near the lower band from $ 80,600 to 84,000. $84,000 can be touched again. That can build up before re-adding, so that liquid rains on the bottomless road.

On the contrary, risk access below $93,000 – $93,000 – $96,000 can be re-entered as teas, which can lead to further correction in line with the wider range.

Given the current Botaroptop, the chance of consolidation of the side streets will occur on December 9-10 ahead of the upcoming Federal Reserve (FAMC). With US interest-rate policies, traders can stay abducted instead of chasing volatility with markets that hold signals rather than chasing signals.

Related BTC Prices Below $84K for 2025 Candlestick for Bitcoin's ‘Crucial' Week

This article does not contain investment advice or recommendations. Every investment and business activity involves risk, and readers should do their own research when making a decision.