The Bitcoin ETF has cleared $541 million, the second largest one-day inflow since its launch.

Key receivers

US spot Bitcoin ETFs saw one of their biggest one-day flows on November 4. The price of Bitcoin fell below $70,000.

Share this article

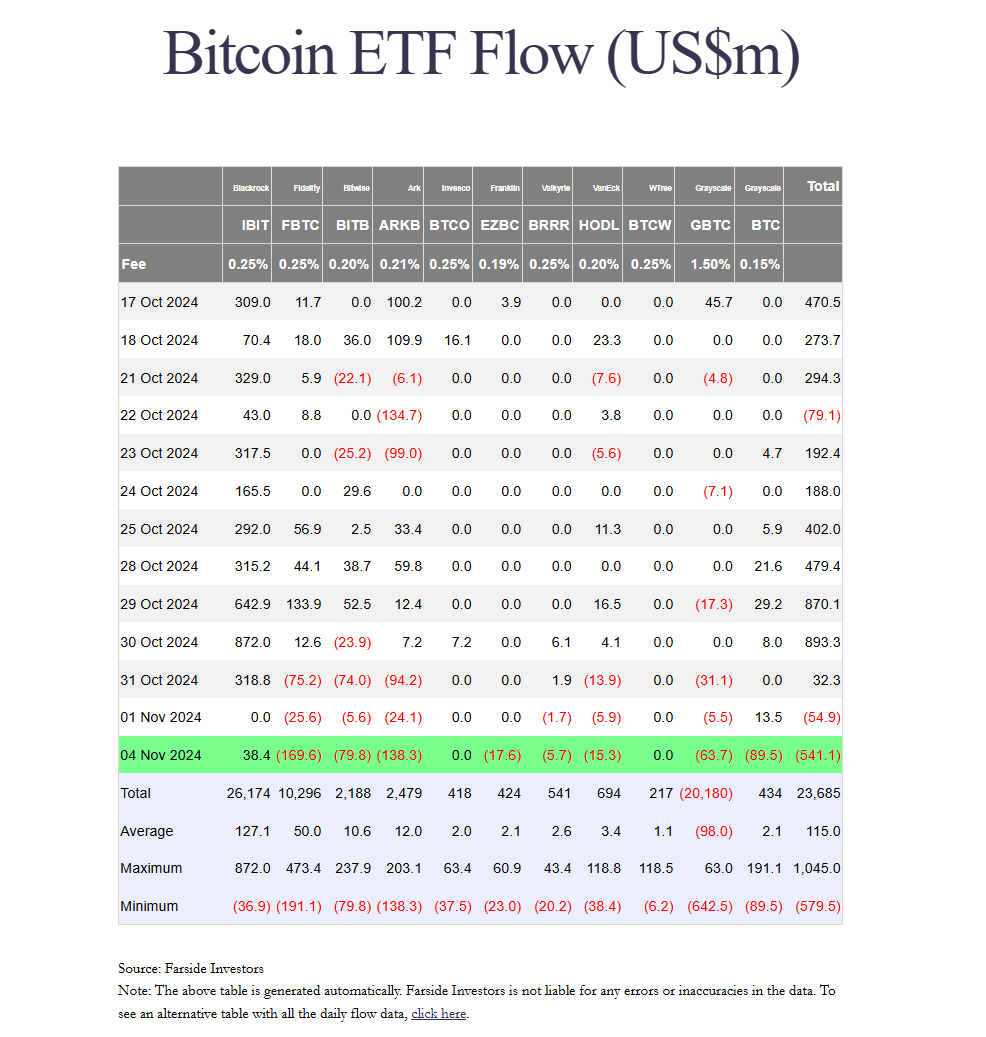

US spot Bitcoin ETFs experienced their second-biggest one-day outflow since their inception, with investors pulling out $541 million on Nov. 4, according to data from Farside Investors.

The selloff fell just short of the $563 million record set on May 1, with Fidelity's FBTC experiencing a $170 million withdrawal on Monday, the second-largest daily outflow to date.

Ark Invest's ARKB and Bitwise's BITB posted their worst performances since inception, costing $138 million and $80 million respectively. Greyscale BTC withdrawals saw $89 million, while the GBTC fund lost $64 million.

Franklin Templeton, VanEyck and Valkyrie funds have collectively recorded more than $38 million in outflows.

In contrast, BlackRock's IBIT reported net inflows of $38 million, while WisdomTree's BTCW and Invesco's BTCO reported no inflows.

Spot bitcoin ETFs extended their seven-day winning streak last Friday as bitcoin fell below $70,000 after trading to record highs earlier that week, according to CoinGecko.

The biggest crypto asset extended its slide over the weekend, falling to a low of $67,300. However, the US Federation of It is still holding on to gains after a 50 basis-point cut on September 18.

Markets support volatility ahead of election day and the FOMC meeting

All eyes are on tomorrow's presidential election and Wednesday's scheduled federal policy decision. Crypto markets favor volatility ahead of these key events.

Analysts predict high volatility in Bitcoin as the election approaches. This could trigger a “sell-on-the-news” reaction similar to past events where market participants reacted strongly to major news, leading to price increases.

Bitcoin is currently trading at around $67,800, down 2% in the last 24 hours, CoinGecko data shows. Total crypto market value fell 3% to $2.3 trillion.

When Bitcoin sneezes, the broader crypto market catches the flu. Ethereum and Solana are up more than 3% each, while Toncoin and Chainlink are down 5% respectively.

Historically, Bitcoin has experienced significant price increases following US elections. For example, after the 2012, 2016, and 2020 elections, the price of Bitcoin made significant gains in the year following each election cycle. This trend shows Bitcoin's potential to rally post-election, regardless of which candidate wins.

However, short-term price action may depend on who wins the election. Bernstein analysts suggest that a Trump victory could push the price of Bitcoin to $90,000. Conversely, if Harris wins, Bitcoin could fall to $50,000.

Share this article